IRS 9465 Instructions 2020 free printable template

Show details

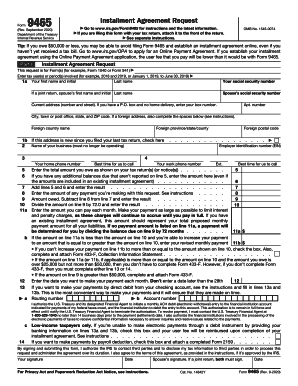

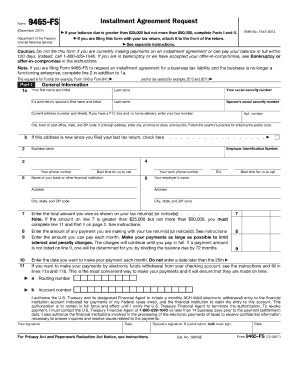

Instructions for Form 9465Department of the Treasury

Internal Revenue Service(Rev. October 2020)Installment Agreement Request

(For use with Form 9465 (Rev. September 2020))

Section references are

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign IRS 9465 Instructions

Edit your IRS 9465 Instructions form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IRS 9465 Instructions form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing IRS 9465 Instructions online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit IRS 9465 Instructions. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IRS 9465 Instructions Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IRS 9465 Instructions

How to fill out IRS 9465 Instructions

01

Obtain IRS Form 9465 from the IRS website or your tax preparer.

02

Fill in your name, address, and Social Security number at the top of the form.

03

Provide the tax year for which you owe payment.

04

Specify the amount you owe on the form.

05

Select the type of payment plan you are requesting (short-term or long-term).

06

Provide your estimated monthly payment amount and the date you prefer to start your payment plan.

07

Sign and date the form to certify that the information provided is accurate.

08

Submit the completed Form 9465 along with your tax return or separately if you have already filed.

Who needs IRS 9465 Instructions?

01

Individuals who owe taxes but cannot afford to pay the full amount by the due date.

02

Taxpayers seeking to set up a payment plan with the IRS for their outstanding tax liabilities.

03

Anyone who needs to request installment payments for their tax obligations.

Fill

form

: Try Risk Free

People Also Ask about

In which situation should an individual not use form 9465 to file?

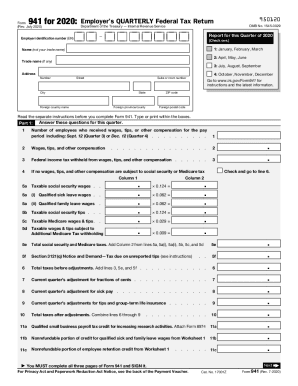

Do not use Form 9465 if: You can pay the full amount you owe within 120 days (see Can you pay in full within 120 days?), You want to request an online payment agreement (see Applying online for a payment agreement), or. Your business is still operating and owes employment or unemployment taxes.

When should I file form 9465?

Taxpayers who owe taxes but can't pay them all at once can file Form 9465 to set up an installment plan if they meet certain conditions. This helps taxpayers who cannot come up with a lump sum payment. In general, installment plans must be completed within 72 months or less, depending on how much you owe.

Who can use form 9465?

Use Form 9465 to request a monthly installment plan if you cannot pay the full amount you owe shown on your tax return (or on a notice we sent you).

Can I file IRS form 9465 electronically?

Electronic filing of Form 9465 isn't available if the amount you owe is greater than $50,000. If you don't agree to make your payments by direct debit or payroll deduction, complete Form 433-F, Collection Information Statement, and file it with this form.

What is IRS form 9465 used for?

Use Form 9465 to request a monthly installment plan if you cannot pay the full amount you owe shown on your tax return (or on a notice we sent you).

Do I need to fill out form 9465?

Taxpayers who owe taxes but can't pay them all at once can file Form 9465 to set up an installment plan if they meet certain conditions. This helps taxpayers who cannot come up with a lump sum payment. In general, installment plans must be completed within 72 months or less, depending on how much you owe.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get IRS 9465 Instructions?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific IRS 9465 Instructions and other forms. Find the template you need and change it using powerful tools.

How do I edit IRS 9465 Instructions in Chrome?

Install the pdfFiller Google Chrome Extension in your web browser to begin editing IRS 9465 Instructions and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.

Can I sign the IRS 9465 Instructions electronically in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your IRS 9465 Instructions in seconds.

What is IRS 9465 Instructions?

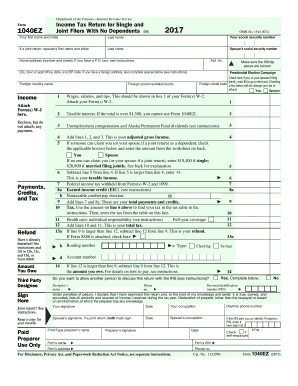

IRS 9465 Instructions provide guidelines for taxpayers on how to request a payment plan for any federal income tax owed.

Who is required to file IRS 9465 Instructions?

Taxpayers who are unable to pay their tax bill in full by the due date and wish to establish a monthly payment plan are required to file IRS 9465 Instructions.

How to fill out IRS 9465 Instructions?

To fill out IRS 9465 Instructions, taxpayers should provide their personal information, the amount owed, and details about their requested payment plan, including the proposed monthly payment amount.

What is the purpose of IRS 9465 Instructions?

The purpose of IRS 9465 Instructions is to help taxpayers understand the process of applying for a payment plan to settle their tax liabilities over time.

What information must be reported on IRS 9465 Instructions?

The information that must be reported on IRS 9465 Instructions includes the taxpayer's name, address, Social Security number, tax information, the total amount owed, and the proposed monthly payment.

Fill out your IRS 9465 Instructions online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IRS 9465 Instructions is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.