PR Form 480.20(U) 2019-2026 free printable template

Show details

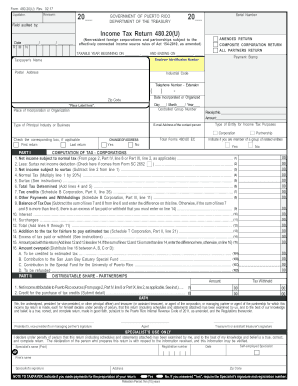

Form 480.20(U) Rev. 06.1920__Reviewer:Liquidator:Field audited by:20__GOVERNMENT OF PUERTO RICO DEPARTMENT OF THE TREASURYSerial NumberIncome Tax Return 480.20(U) Date ___/ ___/ ___ R MN AMENDED RETURN(Nonresident

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign PR Form 48020U

Edit your PR Form 48020U form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your PR Form 48020U form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit PR Form 48020U online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit PR Form 48020U. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

PR Form 480.20(U) Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out PR Form 48020U

How to fill out PR Form 480.20(U)

01

Gather all necessary personal information, including name, address, and contact details.

02

Write your social security number in the designated field.

03

Provide information about your residency status.

04

Indicate the purpose for which you are completing the form.

05

Include details about your employment or financial situation.

06

Review all entries for accuracy and completeness.

07

Sign and date the form where required.

08

Submit the form to the relevant authority as instructed.

Who needs PR Form 480.20(U)?

01

Individuals applying for certain government benefits or services.

02

Residents seeking to update their personal information with a government agency.

03

Applicants needing to verify their residency or income for assistance programs.

Fill

form

: Try Risk Free

People Also Ask about

What is form 480.6 C Puerto Rico withholding?

480.6C - Form 480.6C is intended for non-residents of Puerto Rico. It covers investment income that has been subject to Puerto Rico source withholding. 480.6D - Form 480.6D is intended for residents of Puerto Rico. It covers exempt income and income subject to the Puerto Rico Alternate Basic Tax (ABT).

What is a Puerto Rico Form 480?

What is a 480 form? Form 480 is a document that summarizes payments that have not been subject to withholding, payments generated to a supplier for services, distributions, among others, to declare statements before the Department of the Treasury of Puerto Rico.

Does Puerto Rico have withholding tax?

Corporations not engaged in a trade or business in Puerto Rico are subject to a 29% WHT at source on certain gross income items (considered fixed or determinable, annual or periodical [FDAP]) from Puerto Rico sources.

What is a 480 form used for?

Form 480 Rural Call Completion Data Filing This information concerned the delivery of calls to Rural Local Exchange Carriers and is used to identify possible areas for further inquiry. For purposes of these requirements, a covered provider may be: a local exchange carrier as defined in 47 C.F.R.

What is the income tax rate for non-residents in Puerto Rico?

Puerto Rican employees who are non-residents are subject to a flat 29% withholding in the case of foreign nationals and to a 20% withholding in the case of US citizens.

What is tax form 480.6 D?

480.6C - Form 480.6C is intended for non-residents of Puerto Rico. It covers investment income that has been subject to Puerto Rico source withholding. 480.6D - Form 480.6D is intended for residents of Puerto Rico. It covers exempt income and income subject to the Puerto Rico Alternate Basic Tax (ABT).

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit PR Form 48020U from Google Drive?

People who need to keep track of documents and fill out forms quickly can connect PDF Filler to their Google Docs account. This means that they can make, edit, and sign documents right from their Google Drive. Make your PR Form 48020U into a fillable form that you can manage and sign from any internet-connected device with this add-on.

How do I edit PR Form 48020U in Chrome?

Adding the pdfFiller Google Chrome Extension to your web browser will allow you to start editing PR Form 48020U and other documents right away when you search for them on a Google page. People who use Chrome can use the service to make changes to their files while they are on the Chrome browser. pdfFiller lets you make fillable documents and make changes to existing PDFs from any internet-connected device.

Can I edit PR Form 48020U on an Android device?

With the pdfFiller Android app, you can edit, sign, and share PR Form 48020U on your mobile device from any place. All you need is an internet connection to do this. Keep your documents in order from anywhere with the help of the app!

What is PR Form 480.20(U)?

PR Form 480.20(U) is a tax form used in Puerto Rico to report the income and taxation of various entities, specifically designed for partnerships and certain other entities.

Who is required to file PR Form 480.20(U)?

Entities classified as partnerships, joint ventures, and certain other pass-through entities operating in Puerto Rico are required to file PR Form 480.20(U).

How to fill out PR Form 480.20(U)?

To fill out PR Form 480.20(U), taxpayers must provide details regarding the entity's income, deductions, credits, and other financial information as outlined in the form's instructions.

What is the purpose of PR Form 480.20(U)?

The purpose of PR Form 480.20(U) is to ensure that income earned by partnerships or similar entities in Puerto Rico is accurately reported for tax purposes, facilitating the assessment of tax liabilities.

What information must be reported on PR Form 480.20(U)?

The information that must be reported on PR Form 480.20(U) includes the entity's total income, allowable deductions, credits claimed, distributions to partners, and any applicable tax liabilities.

Fill out your PR Form 48020U online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

PR Form 48020u is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.