Get the free Puerto Rico Tax Incentives: the Ultimate Guide to Act 20 and ...

Show details

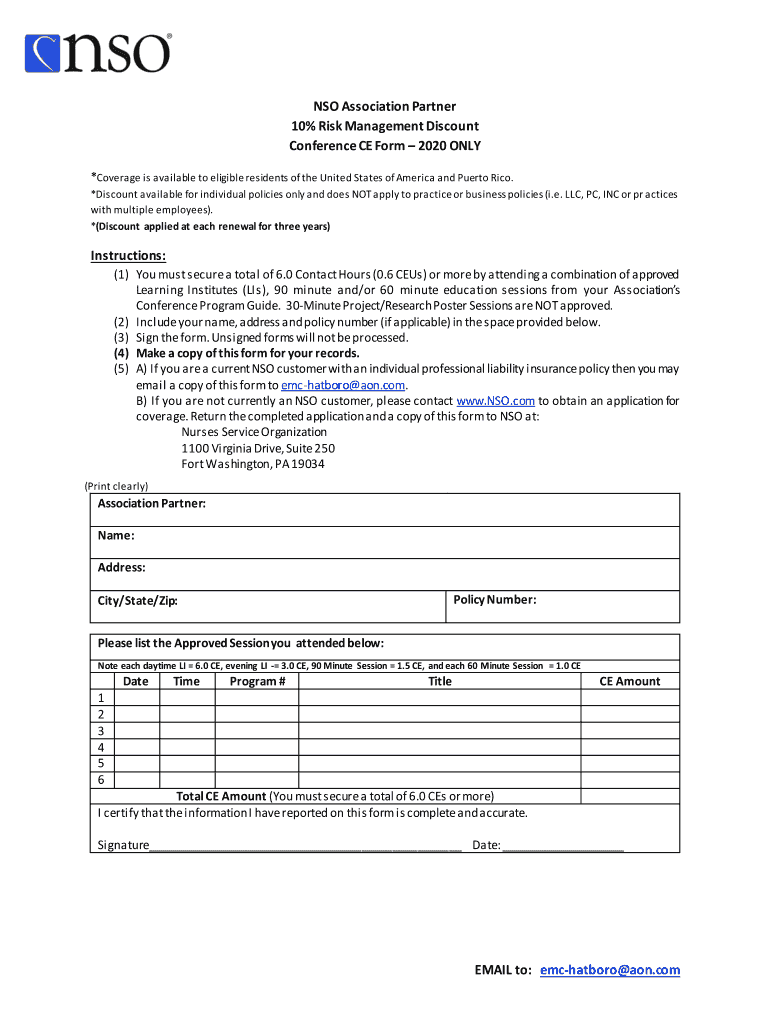

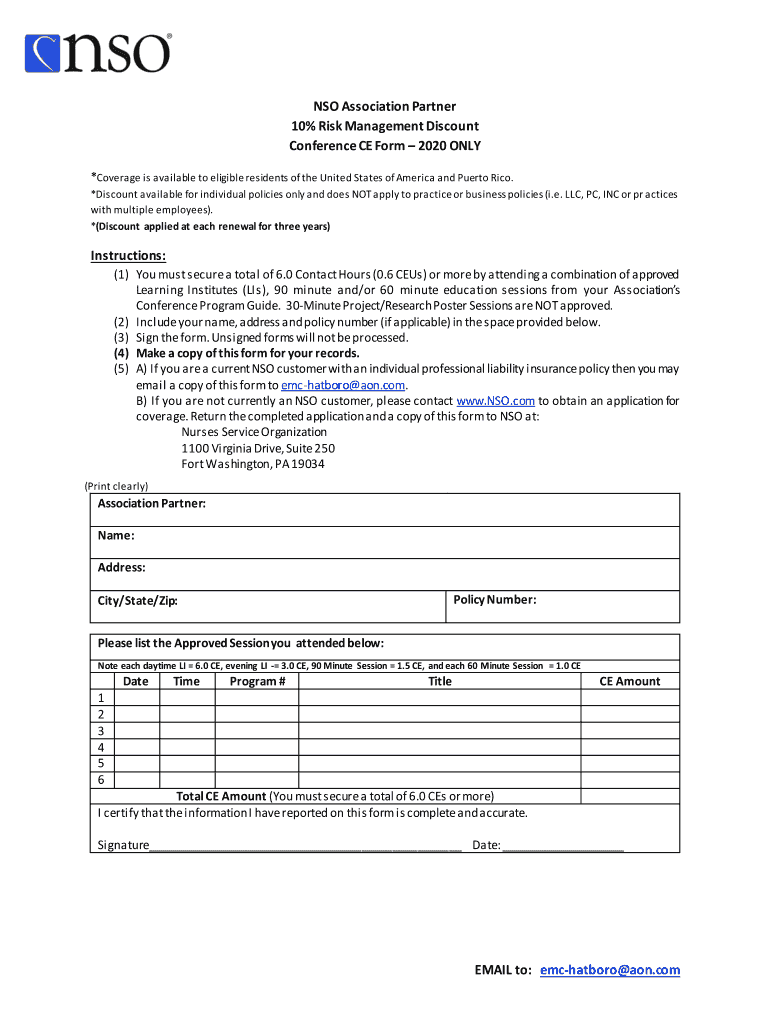

NO Association Partner 10% Risk Management Discount Conference CE Form 2020 ONLY *Coverage is available to eligible residents of the United States of America and Puerto Rico. *Discount available for

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign puerto rico tax incentives

Edit your puerto rico tax incentives form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your puerto rico tax incentives form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing puerto rico tax incentives online

Follow the steps below to benefit from the PDF editor's expertise:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit puerto rico tax incentives. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out puerto rico tax incentives

How to fill out puerto rico tax incentives

01

Begin by gathering all necessary documentation, including tax forms, receipts, and financial statements.

02

Research and familiarize yourself with the specific tax incentives available in Puerto Rico, such as Act 20 and Act 22.

03

Consult with a tax professional or accountant who is knowledgeable about Puerto Rico tax laws and incentives.

04

Determine your eligibility for the tax incentives based on criteria such as residency, business activities, and investment requirements.

05

Carefully fill out the required tax forms, ensuring that all information is accurate and complete.

06

Attach any supporting documentation or evidence required for each tax incentive you are applying for.

07

Review and double-check your completed tax forms, ensuring that all relevant sections have been filled out correctly.

08

Submit your Puerto Rico tax incentives application and forms to the appropriate government department or agency.

09

Follow up on your application status and provide any additional information or documentation if requested.

10

Keep copies of all submitted forms and documentation for your records.

Who needs puerto rico tax incentives?

01

Individuals or businesses who are looking to reduce their tax liabilities and take advantage of favorable tax benefits.

02

Entrepreneurs and investors who want to establish or expand their business operations in Puerto Rico.

03

High net worth individuals seeking to minimize their personal income tax obligations.

04

Companies involved in specific industries targeted by Puerto Rico tax incentives, such as manufacturing, export services, or tourism.

05

Qualified individuals or businesses who meet the residency and investment requirements outlined in Act 20 (Export Services Act) and Act 22 (Individual Investors Act).

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit puerto rico tax incentives from Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your puerto rico tax incentives into a dynamic fillable form that you can manage and eSign from anywhere.

How do I complete puerto rico tax incentives online?

pdfFiller has made it easy to fill out and sign puerto rico tax incentives. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

How do I fill out puerto rico tax incentives using my mobile device?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign puerto rico tax incentives and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

What is puerto rico tax incentives?

Puerto Rico tax incentives are a set of tax benefits designed to attract businesses and individuals to the island, aiming to stimulate economic development and attract investments.

Who is required to file puerto rico tax incentives?

Individuals and businesses that benefit from the tax incentives program in Puerto Rico are required to file for these incentives, usually including eligible corporations, investors, and individuals.

How to fill out puerto rico tax incentives?

To fill out Puerto Rico tax incentives, applicants must complete the specific forms provided by the Puerto Rico Department of Treasury, include necessary documentation, and ensure they meet eligibility criteria.

What is the purpose of puerto rico tax incentives?

The purpose of Puerto Rico tax incentives is to promote economic growth, encourage job creation, attract foreign investment, and stimulate development in various sectors.

What information must be reported on puerto rico tax incentives?

Information that must be reported includes the nature of the business, income generated, eligibility criteria for incentives, and any other relevant financial data as required by the authorities.

Fill out your puerto rico tax incentives online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Puerto Rico Tax Incentives is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.