Get the free form 941 rev july 2020

Show details

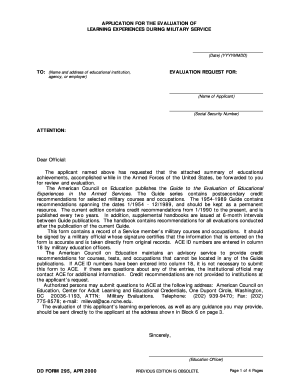

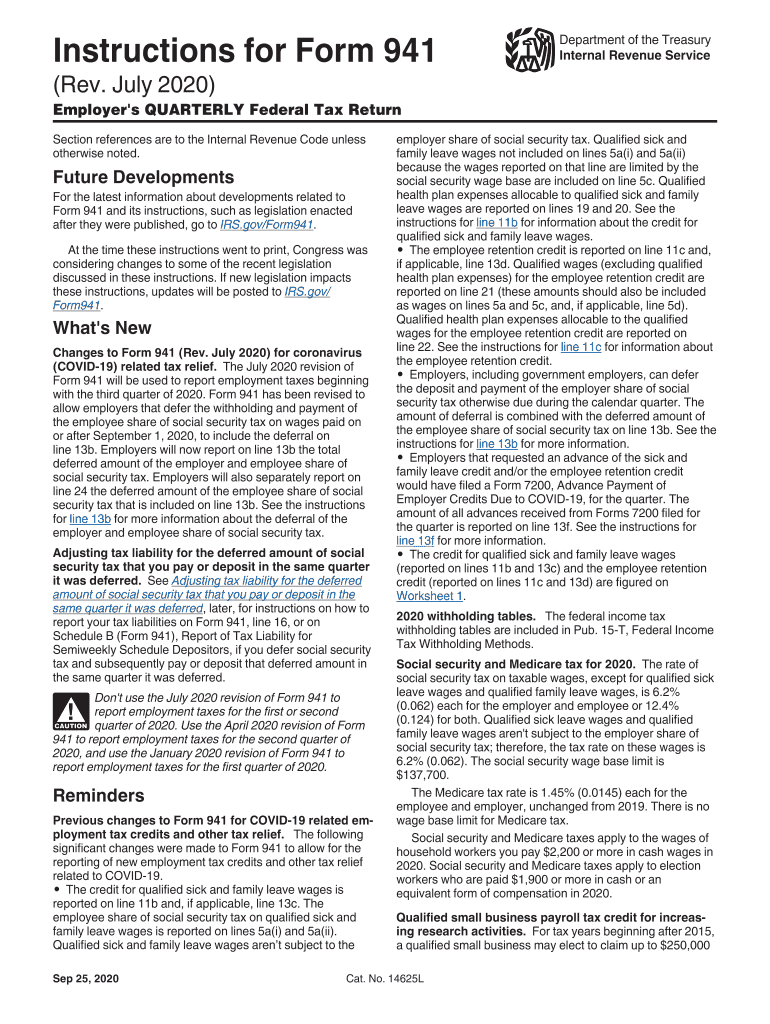

Instructions for Form 941Department of the Treasury

Internal Revenue Service(Rev. July 2020)Employer\'s QUARTERLY Federal Tax Return

Section references are to the Internal Revenue Code unless

otherwise

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form 941 rev july

Edit your form 941 rev july form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 941 rev july form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit form 941 rev july online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit form 941 rev july. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form 941 rev july

How to fill out form 941 rev july

01

To fill out form 941 rev July, follow these steps:

02

Provide your business information, such as your Employer Identification Number (EIN), legal name, and trade name (if applicable).

03

Indicate the accounting method you use (cash, accrual, or other) and the business type (corporation, partnership, etc.).

04

Report the wages, tips, and other compensation paid to your employees during the quarter, including any taxable fringe benefits.

05

Calculate the federal income tax withholding and social security and Medicare taxes withheld from your employees' wages.

06

Determine the amount of your share of social security and Medicare taxes as an employer.

07

Report any adjustments or corrections to previously reported wages, taxes, or tips.

08

Calculate your total tax liability for the quarter, including additional Medicare tax if applicable.

09

Enter any deposits or payments made during the quarter, and apply any available tax credits.

10

Subtract the total deposits and credits from your total tax liability to calculate the balance due or overpayment.

11

Sign and date the form, and provide your contact information for any inquiries.

12

Retain a copy of the completed form for your records.

Who needs form 941 rev july?

01

Form 941 rev July is needed by any employer who pays wages to employees and is required to withhold federal income tax, social security tax, or Medicare tax from those wages.

02

It is used to report quarterly tax information to the Internal Revenue Service (IRS), including details of employee wages, taxes withheld, and the employer's share of social security and Medicare taxes.

03

In general, employers who have employees on payroll are required to file this form. However, certain exceptions may apply, such as if the employer only pays household employees or if the employer is exempt from social security and Medicare taxes.

Fill

form

: Try Risk Free

People Also Ask about

Is there a new form 941 for 3rd Quarter 2020?

This August, the IRS released the draft of Form 941 with the expected changes. Following that, the IRS has finalized the Form 941 for the 3rd and 4th quarters and released it on September 30. Therefore, employers can begin to e-file Form 941 for the 3rd quarter of 2020 as the deadline is on November 2, 2020.

Is there a revised form 941 for 2020?

(COVID-19) related tax relief. Form 941 has been revised to allow employers that defer the withholding and payment of the employee share of social security tax on wages paid on or after September 1, 2020, to include the deferral on line 13b.

How do I get a copy of my form 941?

How do I get copies of prior years' 941 reports Go to Taxes, then Payroll Tax. Select the Filings tab. View your current tax forms in the ACTION NEEDED or COMING UP section. Or select Resources, then Archived forms and filings for past forms. If the form is available, select Preview to view forms not yet filed.

How do I amend my 941 for ERC 2020?

You'll then use Form 941-X to amend the original filing. This amendment form can also be used to claim credits retroactively if you are eligible but failed to claim it for the applicable quarter. You may still qualify for the Employee Retention Credit (ERC), which has been around since the start of the pandemic.

What is the 941 for October 2020?

The October 2020 revision of Form 941-X updates Form 941-X to allow it to be used to make corrections to the deferred amount of the employee share of social security tax for the third and fourth quarters of 2020. (COVID-19) related tax relief.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute form 941 rev july online?

Easy online form 941 rev july completion using pdfFiller. Also, it allows you to legally eSign your form and change original PDF material. Create a free account and manage documents online.

How can I edit form 941 rev july on a smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing form 941 rev july.

How do I fill out form 941 rev july using my mobile device?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign form 941 rev july and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

What is form 941 rev july?

Form 941, Rev. July, is a quarterly tax return that employers in the United States use to report income taxes, Social Security tax, and Medicare tax withheld from employee paychecks.

Who is required to file form 941 rev july?

Employers who pay wages to employees and are required to withhold federal income tax, Social Security tax, and Medicare tax must file Form 941.

How to fill out form 941 rev july?

To fill out Form 941, employers must provide information regarding their business, total wages paid, the amount of taxes withheld, and any adjustments or credits. Detailed instructions are available on the IRS website.

What is the purpose of form 941 rev july?

The purpose of Form 941 is to report the employer's quarterly payroll taxes and to ensure compliance with federal tax obligations related to employee wages.

What information must be reported on form 941 rev july?

Form 941 requires reporting of total wages paid, the number of employees, total federal income tax withheld, Social Security and Medicare taxes, and any adjustments to these amounts.

Fill out your form 941 rev july online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form 941 Rev July is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.