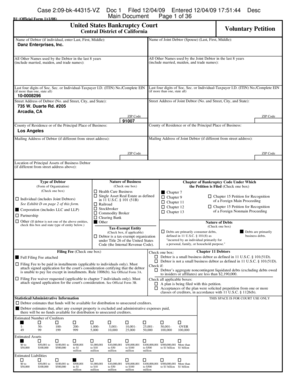

CA DE 903 2018 free printable template

Show details

If there is more than one uncashed check or unclaimed electronic benefit payment please list the others here. 7 Provide mailing address. 9 Identify the type of Employment Development Department benefit payment i.e. Unemployment Insurance 10 Indicate whether this claim is for an Employment Development Department benefit payment check that was never cashed. 11 Provide the exact name on the check. Signature of Claimant or Representative Date Please see page 2 for instructions on completing the...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign CA DE 903

Edit your CA DE 903 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your CA DE 903 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit CA DE 903 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit CA DE 903. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CA DE 903 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out CA DE 903

How to fill out CA DE 903

01

Obtain a copy of the CA DE 903 form from the California Employment Development Department (EDD) website or your local EDD office.

02

Fill out the personal information section, including your name, Social Security number, and address.

03

Provide details about your employment, including the name and address of your employer, and your job title.

04

Indicate the dates of your unemployment, including the last day worked and the beginning date of your unemployment.

05

Complete the section regarding your reason for unemployment, selecting the most appropriate option.

06

Review the form for accuracy, ensuring all required fields are completed.

07

Sign and date the form to certify that the information provided is true and complete.

08

Submit the completed form to the appropriate EDD office either by mail or in person.

Who needs CA DE 903?

01

Individuals who have become unemployed and are seeking unemployment benefits in California need to fill out the CA DE 903 form.

Fill

form

: Try Risk Free

People Also Ask about

Is there a deadline for unclaimed property in California?

California Unclaimed Property Law requires businesses to notify property owners by mail if they have property that will become reportable within 6-12 months. Consult our Guide to Due Diligence for guidance on this process. The Controller's Office has created sample letters to assist the property owner outreach process.

What is the law on unclaimed funds in California?

California's Unclaimed Property Law requires banks, insurance companies, corporations, and certain other entities to report and submit their customers' property to the State Controller's Office when there has been no activity for a period of time (generally three years).

How long does it take to receive unclaimed money from California?

Unclaimed Property Claims Property owner claims that only involve cash may be processed in as little as 30 to 60 days. More complex claims, such as those filed by heirs, those involving multiple owners, or those involving businesses are generally processed within the 180 day period.

How do I contact California unclaimed property?

Use this form for inquiries regarding unclaimed property. If you need an immediate response, contact our call center (800) 992-4647 (Nationwide) or (916) 323-2827 (Outside of U.S.). We are available 8 a.m. to 5 p.m, Pacific Time, Monday through Friday excluding State Holidays.

Where can I claim unclaimed money in California?

To access the unclaimed property database by telephone, contact the State Controller's Customer Service Unit. California residents can call toll-free, at 800-992-4647 between the hours of 8:00 AM and 5:00 PM, Monday through Friday (except holidays). Those outside California may call (916) 323-2827.

How long does unclaimed property stay with the state California?

Unclaimed property is generally defined as any financial asset left inactive by its owner for a period of time, typically three years. California unclaimed property law does not include real estate.

How do I claim unclaimed money from California?

To access the unclaimed property database by telephone, contact the State Controller's Customer Service Unit. California residents can call toll-free, at 800-992-4647 between the hours of 8:00 AM and 5:00 PM, Monday through Friday (except holidays). Those outside California may call (916) 323-2827.

Does unclaimed property expire in California?

Unclaimed property is generally defined as any financial asset left inactive by its owner for a period of time, typically three years. California unclaimed property law does not include real estate.

How long does the state of California hold unclaimed funds?

There is no time limit for claiming your property from the state.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send CA DE 903 to be eSigned by others?

Once your CA DE 903 is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

How do I edit CA DE 903 on an iOS device?

Create, edit, and share CA DE 903 from your iOS smartphone with the pdfFiller mobile app. Installing it from the Apple Store takes only a few seconds. You may take advantage of a free trial and select a subscription that meets your needs.

How do I edit CA DE 903 on an Android device?

With the pdfFiller mobile app for Android, you may make modifications to PDF files such as CA DE 903. Documents may be edited, signed, and sent directly from your mobile device. Install the app and you'll be able to manage your documents from anywhere.

What is CA DE 903?

CA DE 903 is a form used by the California Employment Development Department to report wages and employment information for employees in the state.

Who is required to file CA DE 903?

Employers in California who pay wages to employees are required to file CA DE 903.

How to fill out CA DE 903?

To fill out CA DE 903, employers need to provide information such as the employer's account number, employee details, total wages paid, and any applicable deductions.

What is the purpose of CA DE 903?

The purpose of CA DE 903 is to ensure that employers report accurate employment and wage information, which is used for unemployment insurance and tax purposes.

What information must be reported on CA DE 903?

The information that must be reported on CA DE 903 includes the employer's details, employee names, Social Security numbers, total wages paid during the reporting period, and any deductions.

Fill out your CA DE 903 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

CA DE 903 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.