Affidavit of Disclaimer of Interest by Heir of Tanadgusix Corporation free printable template

Get, Create, Make and Sign dd beneficiary blank form

Editing dd beneficiary blank form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out dd beneficiary blank form

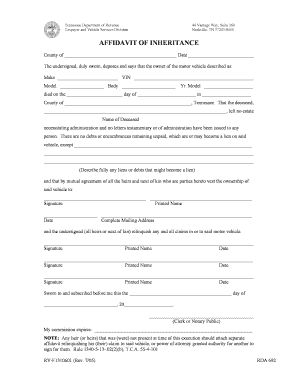

How to fill out Affidavit of Disclaimer of Interest by Heir of Tanadgusix Corporation Shareholder

Who needs Affidavit of Disclaimer of Interest by Heir of Tanadgusix Corporation Shareholder?

Video instructions and help with filling out and completing dd beneficiary blank

Instructions and Help about dd beneficiary blank form

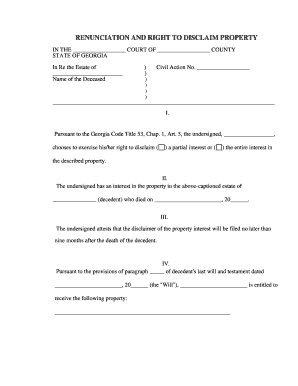

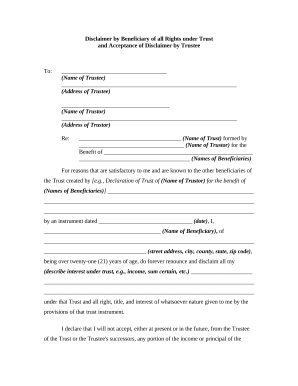

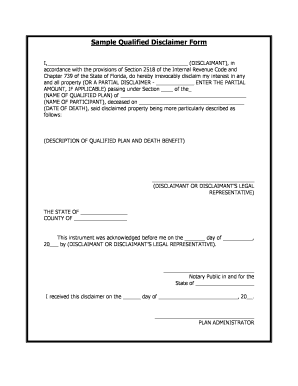

So a very similar option to the separate trusts but with a minor adjustment so same pictures you saw before but this time we allow the surviving spouse to decide what assets go in the shelter trust after your death something you're the first to die so what this does are it ensures the spouse can analyze the assets at the time of your death can decide how much do I need in my name how much does a shelter trust provide based on the facts at that time determine what can be allocated to the shelter trust typically the is called a disclaimer, and it's made within nine months after the spouses death and then the balance of those assets end up in the marital trust which we talked about before and the pros and cons are very similar you get the creditor protection with the shelter trust you get to provide for the surviving spouse if necessary you have more flexibility on the division of assets because if the surviving spouse get to decide what goes into the shelter trust they have a lot more flexibility at the time to determine their needs going forward the drawback so the decision of death you are hoping that the surviving spouse will make the right decision he or she may allocate too much they may not allocate enough that is a risk involved and that is one of the drawbacks similar to the separate trusts before there's still the medicaid look-back issue because a disclaimer is also deemed a transfer and the marital trust is still exposed

People Also Ask about

Why would someone disclaim an inheritance?

When should you disclaim an inheritance?

What does disclaimer of inheritance mean?

Why would you disclaim an inheritance?

How does a disclaimer work with an estate?

How do I write an inheritance disclaimer letter?

What are the reasons for disclaiming an inheritance?

Our user reviews speak for themselves

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my dd beneficiary blank form in Gmail?

How do I edit dd beneficiary blank form straight from my smartphone?

How do I complete dd beneficiary blank form on an Android device?

What is Affidavit of Disclaimer of Interest by Heir of Tanadgusix Corporation Shareholder?

Who is required to file Affidavit of Disclaimer of Interest by Heir of Tanadgusix Corporation Shareholder?

How to fill out Affidavit of Disclaimer of Interest by Heir of Tanadgusix Corporation Shareholder?

What is the purpose of Affidavit of Disclaimer of Interest by Heir of Tanadgusix Corporation Shareholder?

What information must be reported on Affidavit of Disclaimer of Interest by Heir of Tanadgusix Corporation Shareholder?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.