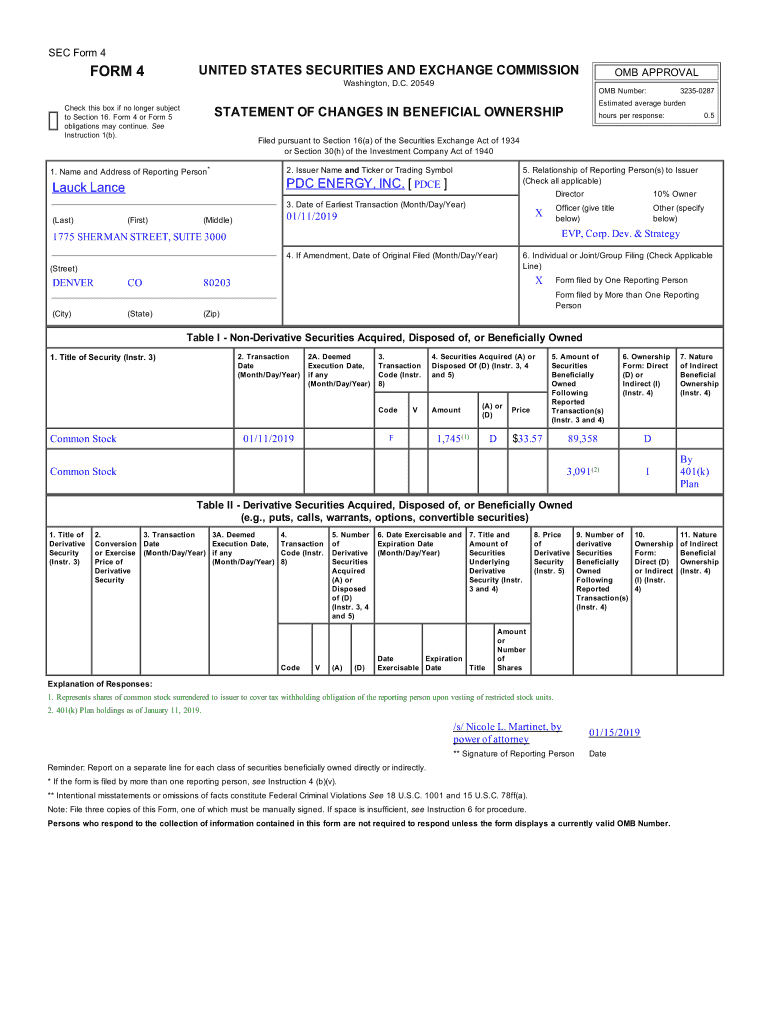

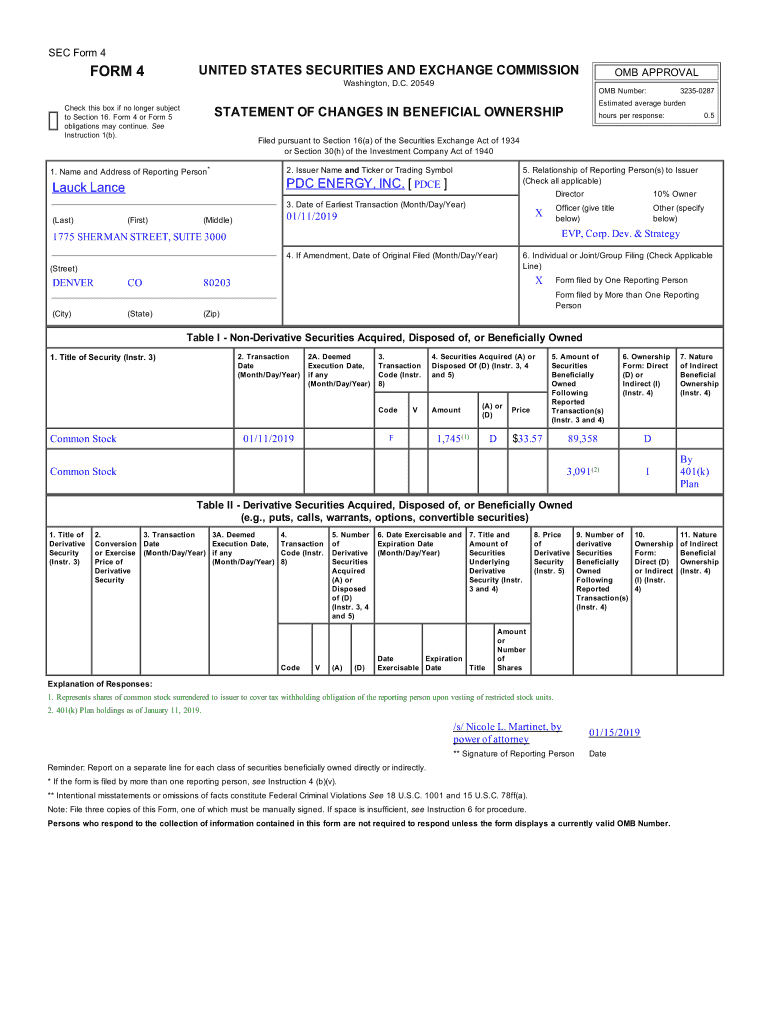

Get the free 401(k) Plan holdings as of January 11, 2019

Show details

SEC Form 4FORM 4UNITED STATES SECURITIES AND EXCHANGE COMMISSIONCheck this box if no longer subject to Section 16. Form 4 or Form 5 obligations may continue. See Instruction 1(b).OMB Number:2. Issuer

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 401k plan holdings as

Edit your 401k plan holdings as form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 401k plan holdings as form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 401k plan holdings as online

Use the instructions below to start using our professional PDF editor:

1

Log in to account. Click Start Free Trial and sign up a profile if you don't have one yet.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit 401k plan holdings as. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 401k plan holdings as

How to fill out 401k plan holdings as

01

Gather all relevant information such as your current 401k plan statement, investment options, and any restrictions or limitations on changing holdings.

02

Review the investment options available in your 401k plan. These may include different types of mutual funds, target-date funds, index funds, or company stock.

03

Consider your investment goals, risk tolerance, and time horizon. This will help you determine which holdings are most suitable for you.

04

Assess the performance and expense ratios of the available investment options. Look for funds with a strong track record and low fees.

05

Diversify your holdings by allocating your contributions across different asset classes, such as stocks, bonds, and cash equivalents. This helps spread risk and potentially increase returns.

06

Rebalance your holdings periodically to ensure they align with your investment strategy. This involves adjusting the allocation of funds based on market conditions or changes in your financial situation.

07

Monitor the performance of your holdings and make adjustments as needed. Stay informed about any changes to the investment options in your 401k plan and take advantage of educational resources provided by your plan provider.

08

Consult with a financial advisor if you need personalized guidance or have specific investment questions.

Who needs 401k plan holdings as?

01

Anyone who is eligible for a 401k plan and wants to save for retirement can benefit from having 401k plan holdings.

02

Employees who want to take advantage of tax advantages offered by 401k plans, such as tax-deferred growth and potential employer matching contributions, should consider having 401k plan holdings.

03

Individuals who want to have control over their retirement savings and the ability to choose from a variety of investment options may find 401k plan holdings beneficial.

04

People who want to take an active role in planning and managing their retirement funds can utilize 401k plan holdings to build a diversified investment portfolio.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in 401k plan holdings as?

With pdfFiller, you may not only alter the content but also rearrange the pages. Upload your 401k plan holdings as and modify it with a few clicks. The editor lets you add photos, sticky notes, text boxes, and more to PDFs.

How can I edit 401k plan holdings as on a smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing 401k plan holdings as, you need to install and log in to the app.

How do I edit 401k plan holdings as on an Android device?

You can make any changes to PDF files, such as 401k plan holdings as, with the help of the pdfFiller mobile app for Android. Edit, sign, and send documents right from your mobile device. Install the app and streamline your document management wherever you are.

What is 401k plan holdings as?

401k plan holdings refer to the assets and investments that are part of an employee's 401k retirement savings plan.

Who is required to file 401k plan holdings as?

Plan sponsors and administrators of 401k retirement plans are required to file 401k plan holdings.

How to fill out 401k plan holdings as?

To fill out 401k plan holdings, one must gather the necessary financial information, complete the required forms as per the guidelines provided by the IRS or plan custodian, and submit them within the stipulated deadlines.

What is the purpose of 401k plan holdings as?

The purpose of 401k plan holdings is to provide a clear view of the investments in a retirement plan, ensuring transparency and compliance with federal regulations.

What information must be reported on 401k plan holdings as?

Information that must be reported includes the type of investments, current value of the holdings, fees associated with the investments, and any transactions that occurred during the reporting period.

Fill out your 401k plan holdings as online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

401k Plan Holdings As is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.