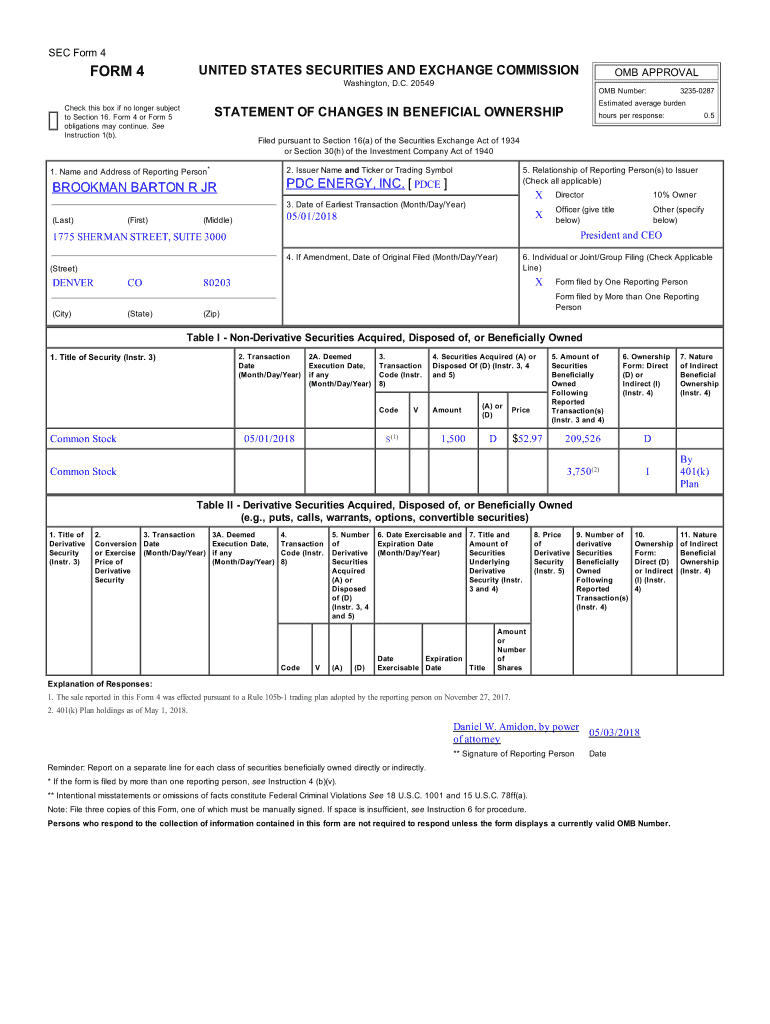

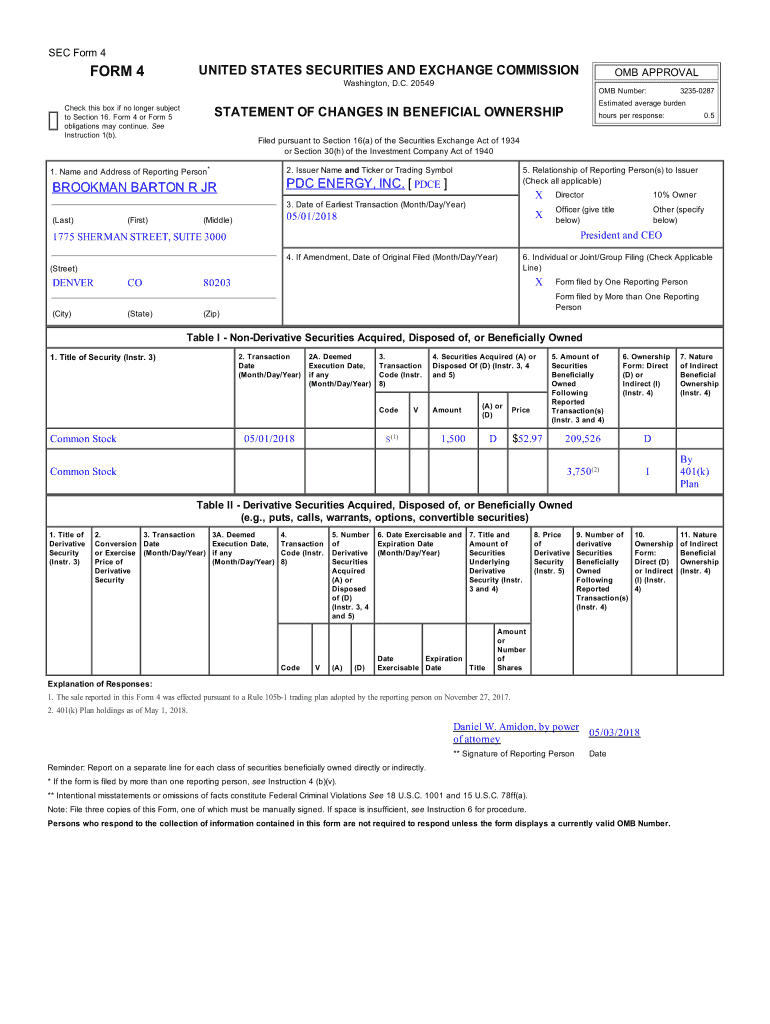

Get the free 401(k) Plan holdings as of May 1, 2018

Show details

SEC Form 4UNITED STATES SECURITIES AND EXCHANGE COMMISSIONER 4 Check this box if no longer subject to Section 16. Form 4 or Form 5 obligations may continue. See Instruction 1(b).OMB Number: hours

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 401k plan holdings as

Edit your 401k plan holdings as form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 401k plan holdings as form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 401k plan holdings as online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit 401k plan holdings as. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 401k plan holdings as

How to fill out 401k plan holdings as

01

To fill out 401k plan holdings, follow these steps:

02

Begin by gathering all the necessary documents and information, including your 401k plan details, investment options, and personal financial goals.

03

Review the available investment options provided by your 401k plan administrator.

04

Assess your risk tolerance and determine your investment strategy. This can be done by understanding your financial goals, time horizon, and willingness to take on risk.

05

Choose the specific investment options you want to allocate your 401k plan holdings to. This can include various asset classes such as stocks, bonds, mutual funds, and ETFs.

06

Consider diversifying your holdings to spread out risk by investing in different asset classes and sectors.

07

Determine the allocation percentages for each investment option based on your risk tolerance and investment strategy.

08

Fill out the necessary forms provided by your 401k plan administrator to make the desired changes to your holdings.

09

Double-check all the information entered before submitting the forms.

10

Monitor your 401k plan holdings periodically and make adjustments as needed to align with your changing financial goals and market conditions.

Who needs 401k plan holdings as?

01

Anyone who wants to save for retirement can benefit from having 401k plan holdings.

02

Specifically, individuals who are employed and have access to an employer-sponsored 401k plan can utilize 401k plan holdings.

03

Employers often offer matching contributions to employees' 401k plans, which can provide additional incentives for individuals to participate.

04

Having 401k plan holdings allows individuals to save for retirement on a tax-advantaged basis, meaning contributions are deducted from taxable income and investment earnings grow tax-free until withdrawals are made in retirement.

05

Additionally, 401k plan holdings provide individuals with the flexibility to choose from a variety of investment options to grow their retirement savings.

06

Overall, 401k plan holdings are essential for individuals who want to secure their financial future and have a comfortable retirement.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify 401k plan holdings as without leaving Google Drive?

pdfFiller and Google Docs can be used together to make your documents easier to work with and to make fillable forms right in your Google Drive. The integration will let you make, change, and sign documents, like 401k plan holdings as, without leaving Google Drive. Add pdfFiller's features to Google Drive, and you'll be able to do more with your paperwork on any internet-connected device.

Can I create an electronic signature for the 401k plan holdings as in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your 401k plan holdings as in minutes.

How do I edit 401k plan holdings as on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share 401k plan holdings as from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.

What is 401k plan holdings as?

401k plan holdings refer to the assets that are held within an individual's 401k retirement savings account, which can include various investments such as stocks, bonds, and mutual funds.

Who is required to file 401k plan holdings as?

Employers who sponsor a 401k plan are required to file 401k plan holdings as part of their reporting obligations to the IRS and the Department of Labor.

How to fill out 401k plan holdings as?

To fill out 401k plan holdings, employers must collect information about the plan's investments, participant account balances, and any changes in holdings over the reporting period, and report that data on relevant forms such as Form 5500.

What is the purpose of 401k plan holdings as?

The purpose of 401k plan holdings is to provide a clear overview of the assets owned by the retirement plan, ensuring transparency and compliance with federal regulations.

What information must be reported on 401k plan holdings as?

Information that must be reported includes the types of investments, the value of the assets held, participant contributions, and distributions made during the reporting period.

Fill out your 401k plan holdings as online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

401k Plan Holdings As is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.