Get the free Recent legislation requires tax exempt organizations to e-file ...

Show details

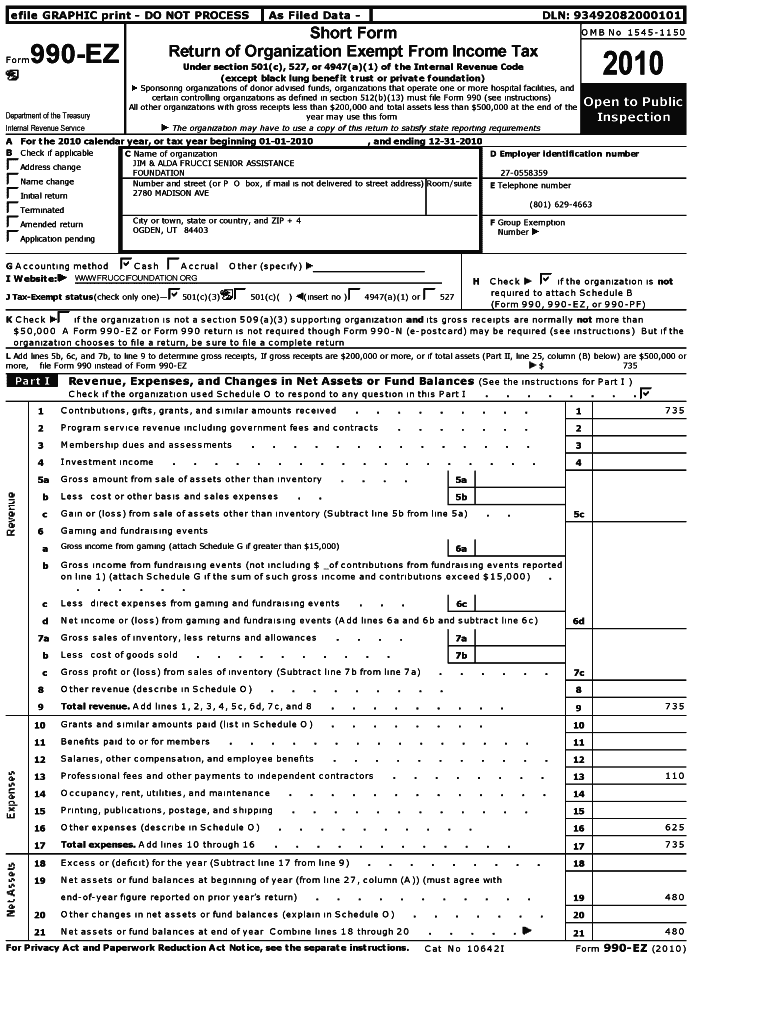

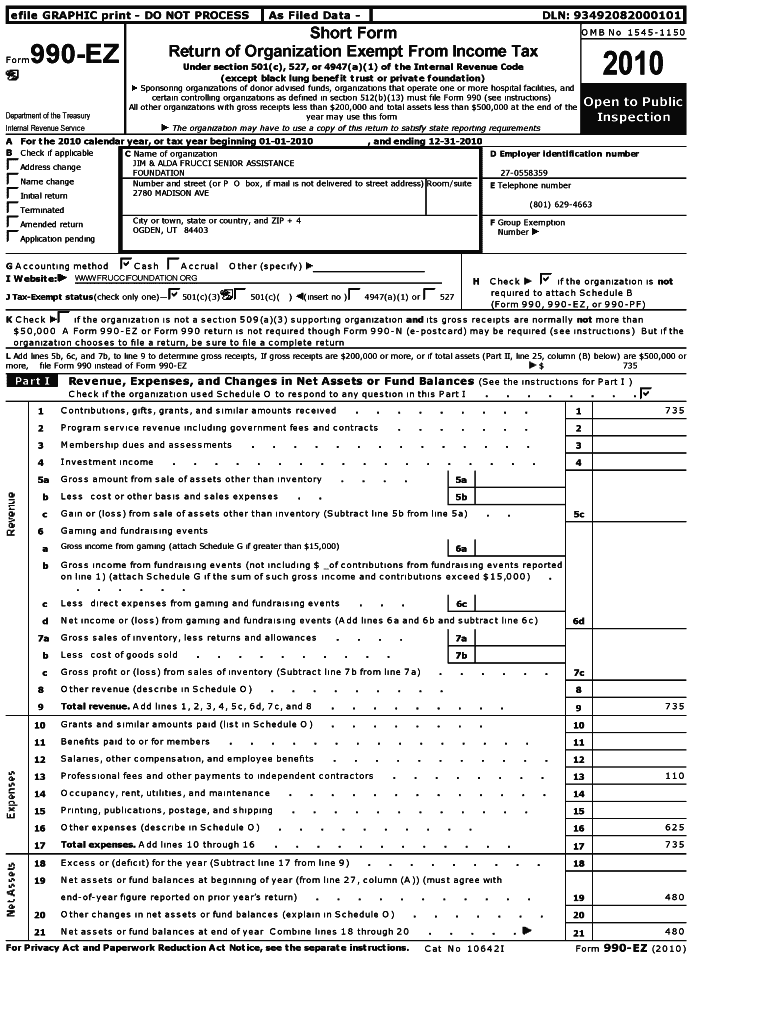

File GRAPHIC forming DO NOT Process Filed Data DAN: 9 3492082000101Short Form Return of Organization Exempt From Income Tax990.EZ OMB No154511502010Under section 501 (c), 527, or 4947(a)(1) of the

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign recent legislation requires tax

Edit your recent legislation requires tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your recent legislation requires tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit recent legislation requires tax online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit recent legislation requires tax. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you could have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out recent legislation requires tax

How to fill out recent legislation requires tax

01

Collect all the necessary tax forms, such as Form 1040 or Form 1099, as required by the recent legislation.

02

Gather all relevant financial documents, including W-2 forms, receipts, and records of charitable contributions.

03

Review the recent legislation to understand any specific requirements or changes to the tax filing process.

04

Use tax preparation software or consult a tax professional to ensure accurate and up-to-date information is included in the tax return.

05

Fill out the required tax forms accurately, providing all necessary information and supporting documentation.

06

Double-check all entries and calculations before submitting the tax return to avoid errors or discrepancies.

07

File the completed tax return by the designated deadline, either electronically or through mail, as specified by the recent legislation.

08

Keep copies of all filed tax documents, including proof of submission and payment, for future reference or in case of audits or inquiries.

Who needs recent legislation requires tax?

01

Individuals and businesses who are required by law to pay taxes and file tax returns must adhere to the recent legislation that mandates tax compliance.

02

Taxpayers of various income levels, including employees, self-employed individuals, freelancers, and investors, may be obligated to fulfill the requirements set forth by recent legislation.

03

Business entities, such as corporations, partnerships, and sole proprietorships, also need to comply with the recent legislation's tax obligations.

04

Non-profit organizations, trusts, and estates may have specific tax obligations as determined by the recent legislation.

05

It is advised to consult the specific provisions of the recent legislation or seek professional assistance to determine if any entity or individual falls under the scope of those who need to comply with the tax requirements.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get recent legislation requires tax?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific recent legislation requires tax and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

How do I complete recent legislation requires tax online?

pdfFiller has made it easy to fill out and sign recent legislation requires tax. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

Can I create an eSignature for the recent legislation requires tax in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your recent legislation requires tax right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

What is recent legislation requires tax?

The recent legislation refers to the specific tax law or regulation enacted that mandates certain tax requirements, such as the Inflation Reduction Act.

Who is required to file recent legislation requires tax?

Individuals and businesses affected by the recent legislation who meet certain income thresholds or criteria are required to file.

How to fill out recent legislation requires tax?

To fill out the recent legislation requires tax, taxpayers should obtain the relevant forms from the IRS website, gather necessary financial documents, and follow the provided instructions to complete the forms accurately.

What is the purpose of recent legislation requires tax?

The purpose of the recent legislation is to address specific economic goals, generate revenue, or promote certain activities, such as green energy investments.

What information must be reported on recent legislation requires tax?

Taxpayers must report their income, deductions, credits, and any other relevant financial information as specified in the recent legislation.

Fill out your recent legislation requires tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Recent Legislation Requires Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.