Get the free JOINT ACCOUNT AGREEMENT - Univest Securities

Show details

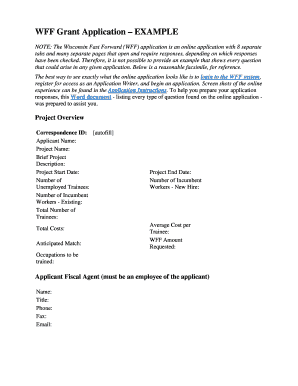

JOINT ACCOUNT AGREEMENT Univ est Securities, Inc. 330 West 38th Street, Suite 238 New York, NY 10018 Phone: (212) 343-8888 Email: info univestsecurities.com ACCOUNT NUMBER In consideration of your

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign joint account agreement

Edit your joint account agreement form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your joint account agreement form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit joint account agreement online

Use the instructions below to start using our professional PDF editor:

1

Sign into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit joint account agreement. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out joint account agreement

How to fill out a joint account agreement:

01

Ensure that all account holders have a clear understanding of the purpose and terms of the joint account. This agreement serves as a legal document outlining the responsibilities and rights of each party involved.

02

Begin by stating the basic information of all account holders, including their full names, addresses, contact details, and social security numbers or identification numbers.

03

Specify the type of joint account being established, such as a joint checking account or a joint savings account. Include the account number, bank or financial institution name, and branch details.

04

Define the purpose of the joint account, whether it is for personal, business, or specific shared expenses. Be as specific as possible to avoid any future misunderstandings.

05

Outline the financial contributions and obligations of each account holder. Include how funds will be deposited, withdrawn, and managed. Clarify if one or all account holders have the authority to make transactions on behalf of the joint account.

06

Include any limitations or restrictions on account transactions, such as withdrawal limits, authorization requirements for large transfers, or specific purposes for which funds should not be used.

07

Specify the consequences or penalties for any breaches of the joint account agreement, such as unauthorized withdrawals or mismanagement of funds. This helps protect everyone involved and encourages responsible account management.

08

Consider including provisions for resolving disputes or disagreements that may arise in the future. This may involve mediation, arbitration, or any alternative methods deemed appropriate by the account holders.

09

Sign and date the joint account agreement, ensuring all account holders have reviewed and understood its contents. It is advisable to have the agreement witnessed or notarized to increase its legal validity.

10

Keep a copy of the joint account agreement for each account holder's records and provide a copy to the bank or financial institution where the joint account is established.

Who needs a joint account agreement?

01

Couples or partners who are living together or in a committed relationship may need a joint account agreement to outline their shared financial responsibilities and prevent disputes over money matters.

02

Business partners who open a joint account may require a joint account agreement to establish the financial rules and obligations between them, ensuring smooth operation of the business and avoiding potential conflicts.

03

Family members, such as parents and children, who share a joint account for managing expenses or centralized banking may benefit from having a joint account agreement that clearly defines each individual's role and rights.

04

Close friends or roommates who decide to open a joint account to split bills or share expenses may find it helpful to have a joint account agreement. This document can prevent misunderstandings and provide a clear framework for managing shared finances.

05

Any group or organization that establishes a joint account, such as clubs, societies, or nonprofit organizations, should consider having a joint account agreement to outline the financial operations and responsibilities of its members. This ensures transparency and accountability within the group.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is joint account agreement?

Joint account agreement is a contract between two or more parties who agree to share ownership of a single account, such as a bank account or investment account.

Who is required to file joint account agreement?

All parties involved in the joint account are required to file the agreement.

How to fill out joint account agreement?

To fill out a joint account agreement, all parties must provide their personal information, agree on the terms of ownership and responsibilities, and sign the document.

What is the purpose of joint account agreement?

The purpose of a joint account agreement is to establish clear ownership and responsibilities for all parties involved in the shared account.

What information must be reported on joint account agreement?

The joint account agreement must include the names and contact information of all parties, the account details, and the terms of ownership.

How can I manage my joint account agreement directly from Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign joint account agreement and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

How do I edit joint account agreement in Chrome?

Add pdfFiller Google Chrome Extension to your web browser to start editing joint account agreement and other documents directly from a Google search page. The service allows you to make changes in your documents when viewing them in Chrome. Create fillable documents and edit existing PDFs from any internet-connected device with pdfFiller.

How do I fill out joint account agreement using my mobile device?

Use the pdfFiller mobile app to fill out and sign joint account agreement. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, their features, and how to get started.

Fill out your joint account agreement online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Joint Account Agreement is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.