Get the free Transfer of Shares to IEPFShareholders' ServiceInvestors

Show details

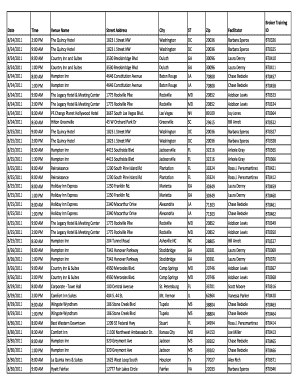

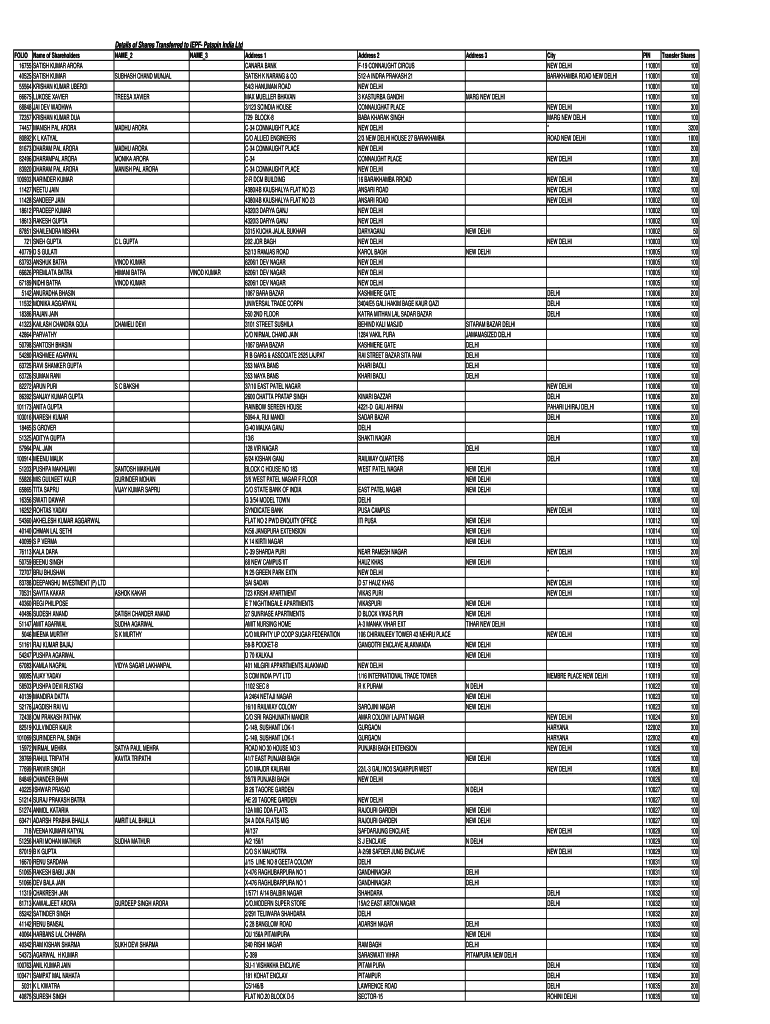

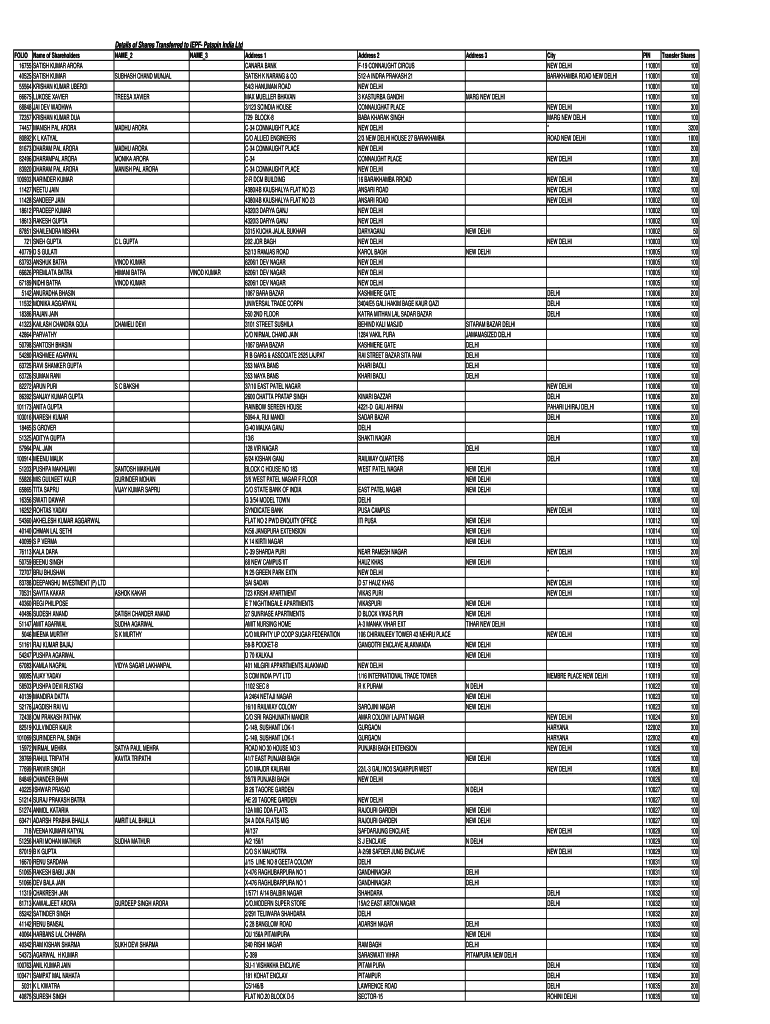

Details of Shares Transferred to IEP Pat spin India Ltd

FOLIO

16755

40525

55564

66675

68848

72357

74457

80892

81673

82496

83920

100933

11427

11428

18612

18613

87851

721

40779

63793

66626

67189

5142

11532

18386

41323

42864

50798

54280

63725

63726

82272

86392

101173

103016

18465

51325

57964

100914

51203

55826

65865

16356

16252

54360

40140

40099

76113

50759

72707

83788

70531

40360

40486

51147

5046

51161

54247

67083

90085

58503

40139

52176

72438

82519

101069

15972

39769

77699

84849

40225

51214...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign transfer of shares to

Edit your transfer of shares to form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your transfer of shares to form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit transfer of shares to online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit transfer of shares to. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out transfer of shares to

How to fill out transfer of shares to

01

To fill out a transfer of shares, follow these steps:

02

Begin by gathering all necessary documents, including the share transfer form, stock certificates, and any supporting agreements or contracts.

03

Fill out the share transfer form with the required information, such as the names and addresses of the transferor (current shareholder) and the transferee (new shareholder), the number of shares being transferred, and the share certificate numbers.

04

Provide any additional details or special instructions, if required.

05

Ensure all parties involved sign the transfer form, including any witnesses as required by law.

06

Submit the completed transfer form, along with any accompanying documents, to the relevant authority or the company's registrar.

07

Pay any applicable fees or taxes associated with the share transfer.

08

Wait for the completion of the transfer process and receive confirmation or new share certificates, if applicable.

Who needs transfer of shares to?

01

Transfer of shares is needed by individuals or entities who wish to buy or sell shares in a company. This can include existing shareholders looking to sell their shares, new investors purchasing shares, or corporate entities involved in mergers, acquisitions, or restructuring. Additionally, lawyers, financial advisors, and regulatory authorities may also require transfer of shares documentation for legal and compliance purposes.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find transfer of shares to?

The premium subscription for pdfFiller provides you with access to an extensive library of fillable forms (over 25M fillable templates) that you can download, fill out, print, and sign. You won’t have any trouble finding state-specific transfer of shares to and other forms in the library. Find the template you need and customize it using advanced editing functionalities.

Can I create an electronic signature for the transfer of shares to in Chrome?

As a PDF editor and form builder, pdfFiller has a lot of features. It also has a powerful e-signature tool that you can add to your Chrome browser. With our extension, you can type, draw, or take a picture of your signature with your webcam to make your legally-binding eSignature. Choose how you want to sign your transfer of shares to and you'll be done in minutes.

How do I complete transfer of shares to on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your transfer of shares to. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is transfer of shares to?

Transfer of shares refers to the process by which an individual or entity gives ownership of shares in a company from one party to another, involving a legal document known as a share transfer form.

Who is required to file transfer of shares to?

Typically, the seller or transferor of the shares is required to file the transfer of shares, along with the buyer or transferee, depending on the jurisdiction and company policies.

How to fill out transfer of shares to?

To fill out a transfer of shares, you need to provide the names and addresses of the transferor and transferee, the number of shares being transferred, the consideration received for the shares, and the date of the transfer, all documented in the share transfer form.

What is the purpose of transfer of shares to?

The purpose of transferring shares is to change the ownership of the shares, allowing the new owner to have the rights associated with those shares, such as voting rights and dividends.

What information must be reported on transfer of shares to?

Information that must be reported includes the names and addresses of the transferor and transferee, the quantity of shares transferred, the price or value of the shares, and the date of transfer.

Fill out your transfer of shares to online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Transfer Of Shares To is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.