Get the free Trust Costs Go Up; Get Ready to NegotiateBarron's

Show details

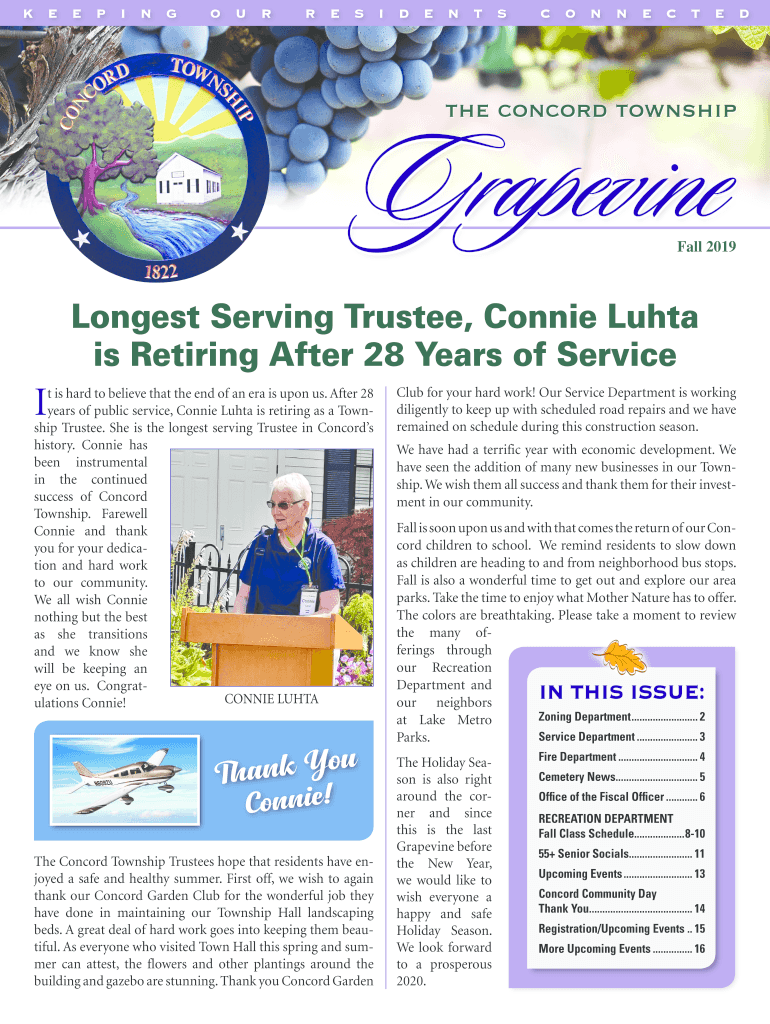

K E E P I N GO U RR E S I D E N T SC O N N E C T E DFall 2019Longest Serving Trustee, Connie Junta

is Retiring After 28 Years of Service It is hard to believe that the end of an era is upon us. After

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign trust costs go up

Edit your trust costs go up form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your trust costs go up form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit trust costs go up online

In order to make advantage of the professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit trust costs go up. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out trust costs go up

How to fill out trust costs go up

01

To fill out trust costs go up, you can follow these points:

02

Identify the purpose of the trust: Determine the reason for creating the trust, such as asset protection or estate planning.

03

Evaluate the assets: Assess the value and nature of the assets that will be placed into the trust.

04

Understand the legal requirements: Familiarize yourself with the laws and regulations governing trusts, including any specific documentation or forms that need to be filled out.

05

Consult a professional: Seek advice from an attorney or financial advisor who specializes in trusts to ensure that you fully understand the process and comply with legal requirements.

06

Gather necessary information: Collect all the relevant information, such as personal details, asset details, and beneficiary information.

07

Fill out the trust documents: Complete the required forms or legal documents, providing accurate and detailed information as requested.

08

Review and revise: Carefully review the filled-out trust documents, making sure all information is correct and that the documents reflect your intentions.

09

Sign and notarize: Sign the trust documents in the presence of a notary public, who will verify your identity and witness your signature.

10

Store and distribute copies: Keep copies of the filled-out trust documents in a safe place, and provide copies to relevant parties, such as the trustee and beneficiaries.

11

Update as needed: Periodically review and update the trust documents to accommodate any changes in circumstances or preferences.

Who needs trust costs go up?

01

Trust costs going up can be relevant for various individuals and entities, such as:

02

- Individuals with substantial assets who want to protect their wealth and ensure proper distribution to beneficiaries.

03

- Estate planners who aim to minimize estate taxes and simplify the transfer of assets upon their death.

04

- Individuals seeking to provide for minor children or family members with special needs.

05

- Business owners who wish to protect their business assets or plan for business succession.

06

- Non-profit organizations or charities that rely on trust funds for ongoing operations or specific projects.

07

- Individuals involved in complex financial arrangements or international investments that require efficient and secure asset management.

08

- High net worth individuals with significant real estate holdings or diverse investment portfolios.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify trust costs go up without leaving Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including trust costs go up, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

How can I send trust costs go up for eSignature?

When your trust costs go up is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

How do I edit trust costs go up on an Android device?

Yes, you can. With the pdfFiller mobile app for Android, you can edit, sign, and share trust costs go up on your mobile device from any location; only an internet connection is needed. Get the app and start to streamline your document workflow from anywhere.

What is trust costs go up?

Trust costs go up refers to the increasing expenses associated with managing and administering a trust, such as legal fees, accounting fees, and other operational costs.

Who is required to file trust costs go up?

Typically, the trustee or the individual responsible for managing the trust is required to file trust costs go up.

How to fill out trust costs go up?

To fill out the trust costs go up, gather all relevant financial documents, complete the designated forms, and provide detailed information on all costs associated with the trust.

What is the purpose of trust costs go up?

The purpose of trust costs go up is to provide a clear accounting of the expenses involved in the management of the trust, ensuring transparency and compliance with legal requirements.

What information must be reported on trust costs go up?

Information that must be reported includes detailed expenses like management fees, legal fees, taxes, and any other costs incurred in the administration of the trust.

Fill out your trust costs go up online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Trust Costs Go Up is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.