Get the free Business Income TaxDepartment of Revenue - Colorado.gov

Show details

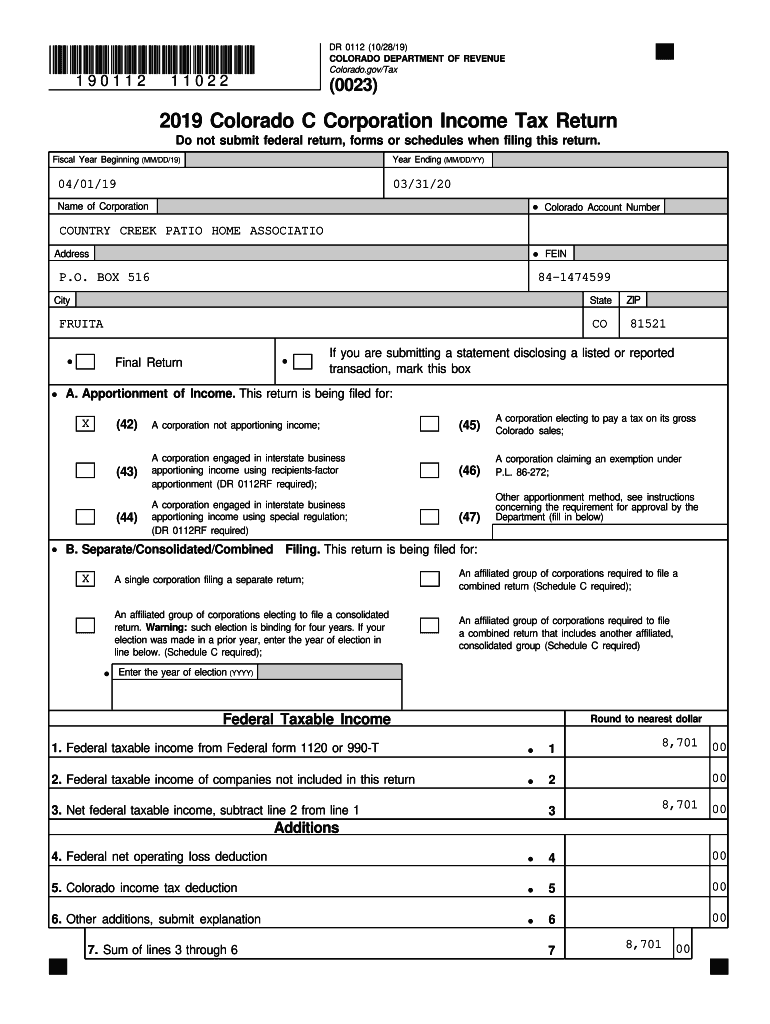

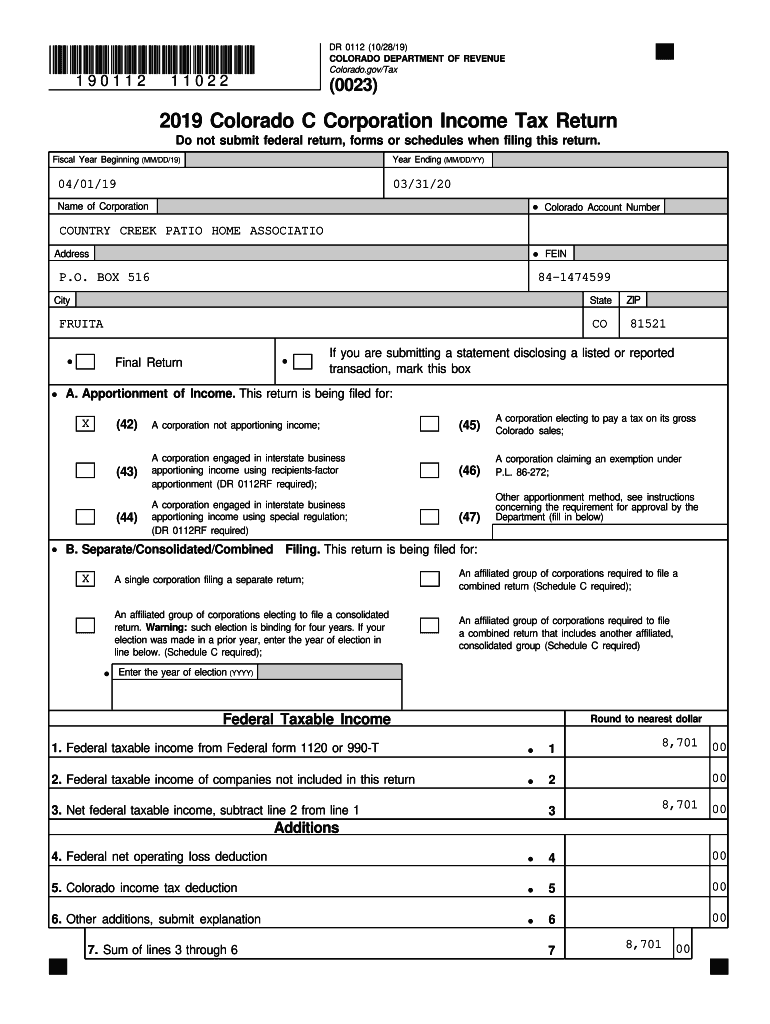

DR 0112 (10/28/19)

COLORADO DEPARTMENT OF REVENUE

Colorado.gov/Tax19011211022(0023)2019 Colorado C Corporation Income Tax Return

Do not submit federal return, forms or schedules when filing this return.

Fiscal

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign business income taxdepartment of

Edit your business income taxdepartment of form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your business income taxdepartment of form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit business income taxdepartment of online

In order to make advantage of the professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit business income taxdepartment of. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

The use of pdfFiller makes dealing with documents straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out business income taxdepartment of

How to fill out business income taxdepartment of

01

Collect all relevant financial documents including income statements, balance sheets, and expense records.

02

Determine your business income by subtracting your business expenses from your total revenue.

03

Fill out the necessary tax forms, such as Schedule C or Form 1120, depending on your business structure.

04

Report your business income accurately and honestly, ensuring that all deductions and credits are properly documented.

05

Review your completed tax return for any errors or omissions.

06

File your business income tax return by the specified deadline, either electronically or by mail.

07

Make any necessary tax payments or request a refund if applicable.

08

Keep copies of your tax return and supporting documents for future reference.

Who needs business income taxdepartment of?

01

Any individual or entity that operates a business and generates income from it needs to file a business income tax return.

02

This includes self-employed individuals, sole proprietors, partnerships, limited liability companies (LLCs), and corporations.

03

Different tax forms are required depending on the business structure, annual income, and other factors.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get business income taxdepartment of?

The premium subscription for pdfFiller provides you with access to an extensive library of fillable forms (over 25M fillable templates) that you can download, fill out, print, and sign. You won’t have any trouble finding state-specific business income taxdepartment of and other forms in the library. Find the template you need and customize it using advanced editing functionalities.

How do I make changes in business income taxdepartment of?

pdfFiller allows you to edit not only the content of your files, but also the quantity and sequence of the pages. Upload your business income taxdepartment of to the editor and make adjustments in a matter of seconds. Text in PDFs may be blacked out, typed in, and erased using the editor. You may also include photos, sticky notes, and text boxes, among other things.

How do I fill out business income taxdepartment of using my mobile device?

Use the pdfFiller mobile app to fill out and sign business income taxdepartment of on your phone or tablet. Visit our website to learn more about our mobile apps, how they work, and how to get started.

What is business income tax department of?

The business income tax department is responsible for administering, collecting, and processing taxes levied on the profits earned by businesses within a jurisdiction.

Who is required to file business income tax department of?

Businesses that operate for profit, including corporations, partnerships, and sole proprietorships, are generally required to file with the business income tax department.

How to fill out business income tax department of?

To fill out the business income tax form, businesses must provide financial information including income, expenses, and deductions as per the guidelines set by the tax department. Proper documentation must accompany the form.

What is the purpose of business income tax department of?

The purpose of the business income tax department is to ensure compliance with tax regulations, collect revenues for government services, and provide a framework for tax assessment and reporting.

What information must be reported on business income tax department of?

Businesses must report total income, deductible expenses, net profit or loss, and any relevant tax credits. Additional information may include business structure, ownership details, and specific industry-related data.

Fill out your business income taxdepartment of online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Business Income Taxdepartment Of is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.