Get the free Tax Rolls by Owner Name

Show details

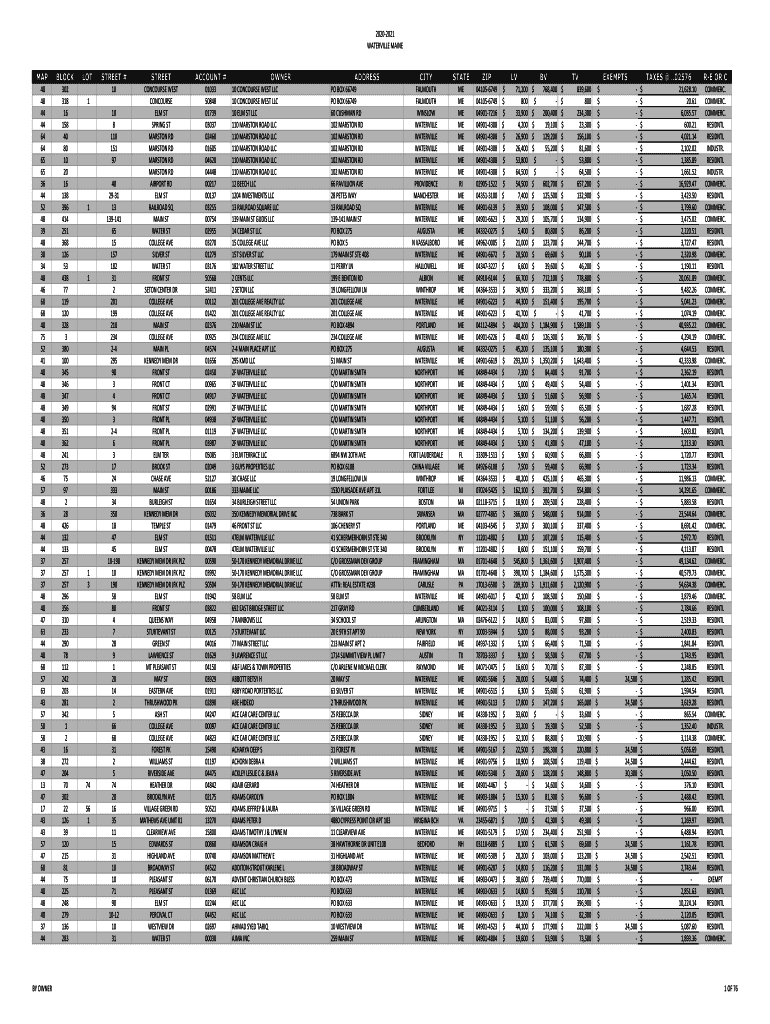

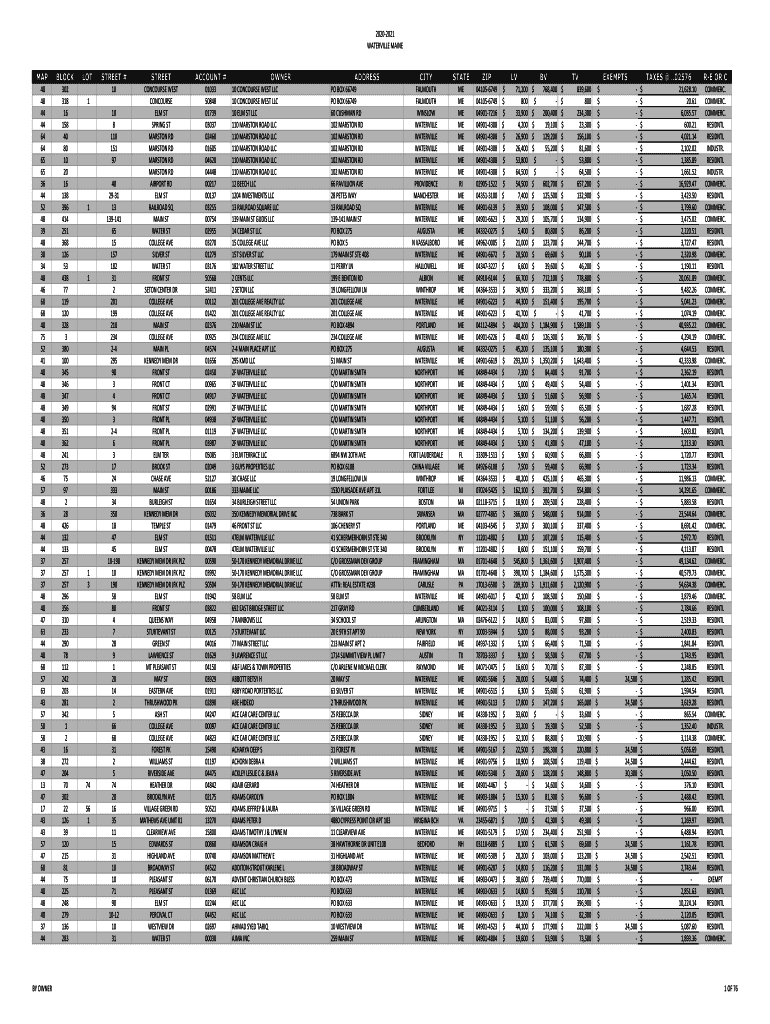

20202021

WATERVILLE MAINEMAPBLOCK48

48

44

44

64

64

65

65

36

44

52

48

39

48

38

34

48

46

68

68

48

75

52

41

48

48

48

48

48

48

48

48

52

46

57

48

36

48

44

44

37

37

37

48

48

47

63

44

48

68

57

63

43

57

58

58

43

38

47

13

47

17

43

43

57

47

68

44

48

48

48

37

44302

318

16

158

40

80

10

20

16

138

396

414

251

368

126

53

438

77

119

120

328

3

380

100

345

346

347

349

350

351

362

241

273

75

97

2

28

426

132

133

257

257

257

296

356

310

233

290

78

112

242

203

281

342

1

2

16

272

204

70

302

22

126

39

120

215

81

75...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tax rolls by owner

Edit your tax rolls by owner form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tax rolls by owner form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit tax rolls by owner online

Follow the steps down below to use a professional PDF editor:

1

Log in to account. Click on Start Free Trial and sign up a profile if you don't have one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit tax rolls by owner. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out tax rolls by owner

How to fill out tax rolls by owner

01

Gather all necessary documents such as property ownership records, income statements, expense receipts, and any other relevant financial information.

02

Determine the correct tax roll form that needs to be filled out. This can vary depending on the jurisdiction and type of property.

03

Fill in the owner's personal information, including name, address, and contact details.

04

Provide details about the property, such as its address, size, and any improvements or changes made during the year.

05

Calculate the property's assessed value based on the applicable tax rules and regulations.

06

Report any income generated from the property, including rent, lease payments, or any other form of revenue.

07

Deduct eligible expenses related to the property, such as maintenance costs, repairs, and property taxes paid.

08

Double-check all the information provided and make sure all calculations are accurate.

09

Sign and date the tax roll form.

10

Submit the completed tax roll form to the appropriate tax authority within the given deadline.

Who needs tax rolls by owner?

01

Various individuals and entities may need tax rolls by owner, including:

02

- Property owners who are required to report their property's assessed value and financial information for tax purposes.

03

- Tax authorities who use these rolls to determine the appropriate property taxes to be paid by the owners.

04

- Real estate agents or brokers who need this information to assist clients in buying or selling properties.

05

- Legal professionals who may require tax rolls as part of legal proceedings involving property.

06

- Potential buyers or investors who want to evaluate the financial aspects and tax obligations associated with a property.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit tax rolls by owner from Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your tax rolls by owner into a dynamic fillable form that you can manage and eSign from any internet-connected device.

Where do I find tax rolls by owner?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific tax rolls by owner and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

Can I sign the tax rolls by owner electronically in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your tax rolls by owner in minutes.

What is tax rolls by owner?

Tax rolls by owner refer to the official records that list property ownership and the associated taxes that are levied on those properties. These rolls provide a detailed account of all taxable properties and their owners within a jurisdiction.

Who is required to file tax rolls by owner?

Property owners, including individuals, businesses, and organizations that own taxable property, are typically required to file tax rolls by owner. The specific requirements may vary by jurisdiction.

How to fill out tax rolls by owner?

To fill out tax rolls by owner, a property owner must provide their personal information, property details, and any other required data on the forms provided by the local government. It may also require information on property value, assessments, and previous tax payments.

What is the purpose of tax rolls by owner?

The purpose of tax rolls by owner is to maintain accurate records of property ownership and ensure that property taxes are correctly assessed, collected, and used to fund public services and infrastructure.

What information must be reported on tax rolls by owner?

The information that must be reported on tax rolls by owner typically includes the owner's name, property address, property identification number, assessed value, and any exemptions that may apply.

Fill out your tax rolls by owner online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tax Rolls By Owner is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.