Get the free LLCs vs. sole proprietorships vs. other business entities - upload wikimedia

Show details

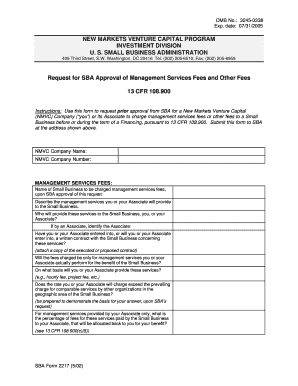

To be completed by other legal entity (solo proprietor)176721269499104765157Registration number Activity code Name: Wikimedia Serbia Registered office: Belgrade (Star Grad), Dean ska 4TINBALANCE SHEET

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign llcs vs sole proprietorships

Edit your llcs vs sole proprietorships form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your llcs vs sole proprietorships form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit llcs vs sole proprietorships online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit llcs vs sole proprietorships. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to deal with documents. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out llcs vs sole proprietorships

How to fill out llcs vs sole proprietorships

01

To fill out an LLC:

02

Choose a name for your LLC that complies with your state's regulations.

03

File the necessary paperwork with your state's Secretary of State office.

04

Pay the required filing fee.

05

Draft an LLC operating agreement that outlines the ownership and management structure of the LLC.

06

Obtain any necessary licenses or permits for your LLC's specific business activities.

07

Obtain an Employer Identification Number (EIN) from the IRS, if necessary.

08

Register your LLC for state and local taxes.

09

To fill out a sole proprietorship:

10

Choose a name for your sole proprietorship.

11

Obtain any necessary licenses or permits for your business activities.

12

Obtain an Employer Identification Number (EIN) from the IRS, if necessary.

13

Register for state and local taxes.

14

Follow any specific regulations or requirements for your particular industry.

15

Keep detailed records of your income, expenses, and business transactions.

16

File your personal income tax return, reporting your business's income and expenses.

17

Pay any self-employment taxes owed.

18

Consider getting liability insurance to protect your personal assets.

Who needs llcs vs sole proprietorships?

01

LLCs are ideal for:

02

- Small businesses or startups with multiple owners.

03

- Businesses that want legal protection for personal assets.

04

- Companies looking to attract investors or obtain financing.

05

Sole proprietorships are suitable for:

06

- Individuals starting a small business on their own.

07

- Freelancers or independent contractors.

08

- Businesses with low risk or liability.

09

- Owners who want full control and simplicity in management.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit llcs vs sole proprietorships from Google Drive?

pdfFiller and Google Docs can be used together to make your documents easier to work with and to make fillable forms right in your Google Drive. The integration will let you make, change, and sign documents, like llcs vs sole proprietorships, without leaving Google Drive. Add pdfFiller's features to Google Drive, and you'll be able to do more with your paperwork on any internet-connected device.

How can I send llcs vs sole proprietorships to be eSigned by others?

When you're ready to share your llcs vs sole proprietorships, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

How do I make edits in llcs vs sole proprietorships without leaving Chrome?

Download and install the pdfFiller Google Chrome Extension to your browser to edit, fill out, and eSign your llcs vs sole proprietorships, which you can open in the editor with a single click from a Google search page. Fillable documents may be executed from any internet-connected device without leaving Chrome.

What is llcs vs sole proprietorships?

LLCs (Limited Liability Companies) are business structures that provide personal liability protection to their owners, while sole proprietorships are unincorporated businesses owned by a single individual without legal distinction from the owner.

Who is required to file llcs vs sole proprietorships?

Generally, all LLCs must file with the state to be recognized as a separate legal entity, whereas sole proprietorships do not require a formal filing, but may need to register a business name or get permits depending on the jurisdiction.

How to fill out llcs vs sole proprietorships?

To form an LLC, you need to fill out and submit Articles of Organization to your state's Secretary of State office. For a sole proprietorship, you may need to fill out a business name registration form if you are using a name other than your own, along with any applicable permits.

What is the purpose of llcs vs sole proprietorships?

The primary purpose of forming an LLC is to protect personal assets from business liabilities, while a sole proprietorship allows for simpler operation and taxation as the owner reports business income on personal tax returns.

What information must be reported on llcs vs sole proprietorships?

LLCs must report their structure, ownership, and operating agreement, while sole proprietorships typically report income and expenses through personal tax returns, disclosing business income on Schedule C.

Fill out your llcs vs sole proprietorships online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Llcs Vs Sole Proprietorships is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.