Get the free international fuel tax agreement application department of ...

Show details

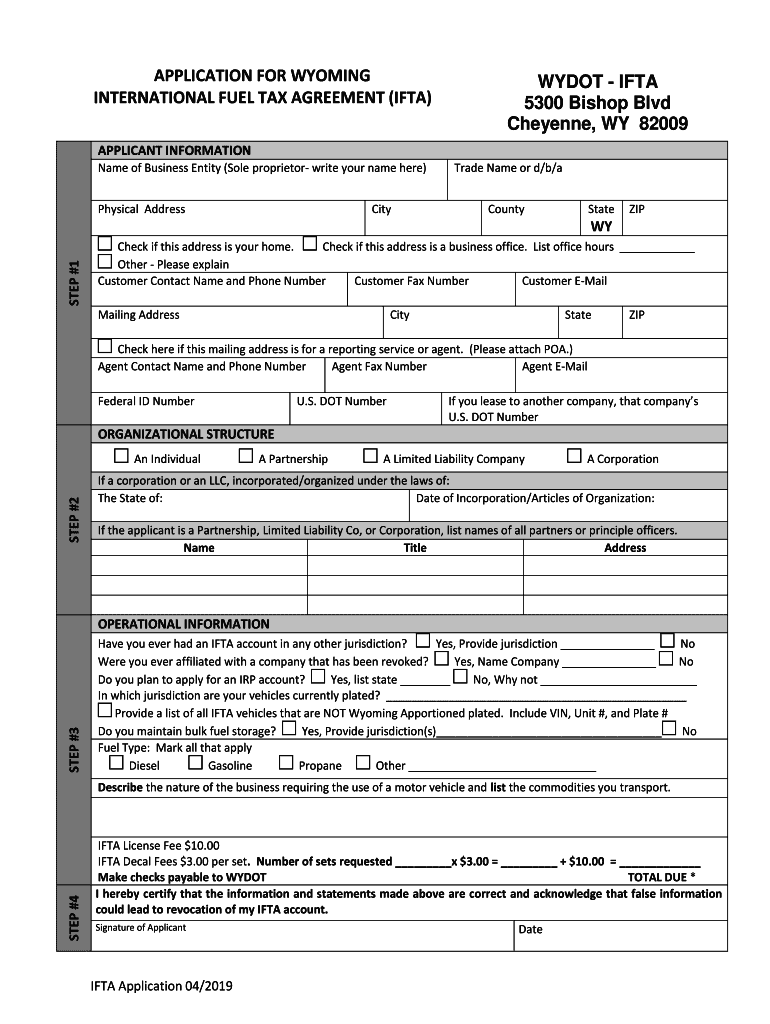

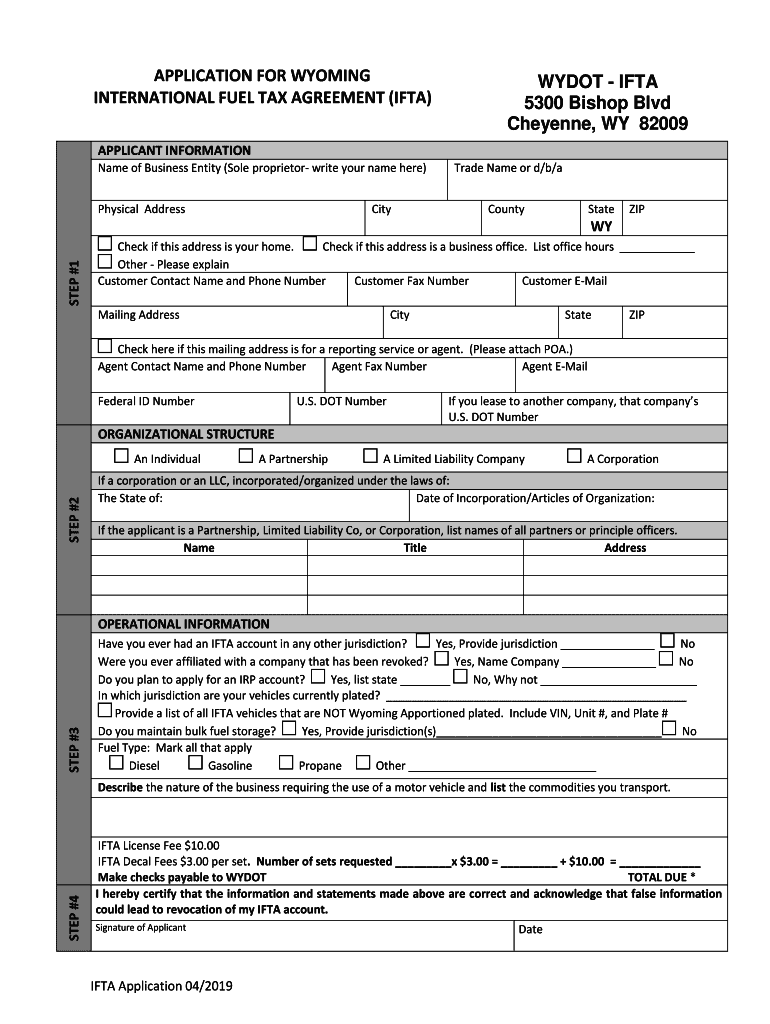

APPLICATION FOR WYOMING INTERNATIONAL FUEL TAX AGREEMENT (IFTA)WY DOT IFTA 5300 Bishop Blvd Cheyenne, WY 82009APPLICANT INFORMATION Name of Business Entity (Sole proprietor write your name here) Physical

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign international fuel tax agreement

Edit your international fuel tax agreement form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your international fuel tax agreement form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit international fuel tax agreement online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit international fuel tax agreement. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Dealing with documents is always simple with pdfFiller. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out international fuel tax agreement

How to fill out international fuel tax agreement

01

Obtain an International Fuel Tax Agreement (IFTA) application form from the appropriate state agency.

02

Fill out the application form with accurate and complete information about your business, including your business name, contact information, and vehicle details.

03

Provide the required supporting documents, such as copies of vehicle registrations, proof of insurance, and any other necessary documentation.

04

Calculate the total miles traveled and fuel consumed in each member jurisdiction for each vehicle in your fleet.

05

Use the provided IFTA tax rate table to determine the amount of fuel tax due for each member jurisdiction.

06

Fill out the IFTA tax return form, which includes reporting the total miles traveled and fuel consumed in each jurisdiction, as well as the corresponding tax amounts.

07

Submit the completed IFTA application form, along with the supporting documents and tax payment, to the appropriate state agency by the required deadline.

08

Keep accurate records of all fuel purchases, mileage, and tax payments for auditing purposes.

09

Renew your IFTA agreement annually and update any changes in your vehicle fleet or business information.

10

Comply with any additional reporting requirements or tax audits by the state agency as necessary.

Who needs international fuel tax agreement?

01

Motor carriers and interstate motor carriers who operate qualified motor vehicles in multiple member jurisdictions.

02

Businesses or individuals who transport goods or passengers across the borders of different member jurisdictions.

03

Any company or individual that regularly engages in interstate transportation of taxable fuel.

04

Carriers who operate vehicles with a gross vehicle weight or combined weight of more than 26,000 pounds, or vehicles designed to transport more than 15 passengers.

05

Companies or individuals who want to simplify their fuel tax reporting and payment process by consolidating multiple tax jurisdictions into a single agreement.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute international fuel tax agreement online?

Filling out and eSigning international fuel tax agreement is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

How do I edit international fuel tax agreement in Chrome?

Get and add pdfFiller Google Chrome Extension to your browser to edit, fill out and eSign your international fuel tax agreement, which you can open in the editor directly from a Google search page in just one click. Execute your fillable documents from any internet-connected device without leaving Chrome.

How do I fill out international fuel tax agreement on an Android device?

Complete international fuel tax agreement and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.

What is international fuel tax agreement?

The International Fuel Tax Agreement (IFTA) is an agreement among the lower 48 United States and Canadian provinces to simplify the reporting of fuel use by interjurisdictional commercial carriers.

Who is required to file international fuel tax agreement?

Motor carriers that operate a qualified motor vehicle in multiple jurisdictions are required to file IFTA, specifically those who operate vehicles with a gross vehicle weight of over 26,000 pounds or have three or more axles.

How to fill out international fuel tax agreement?

To fill out the IFTA, a carrier must gather fuel purchase records, total distance traveled in each jurisdiction, and prepare an IFTA tax return, ensuring to report in accordance with the guidelines provided by their home jurisdiction.

What is the purpose of international fuel tax agreement?

The purpose of IFTA is to establish a fair and equitable fuel tax collection system that reduces the administrative burden on carriers and allows them to pay fuel taxes based on the miles traveled in each participating jurisdiction.

What information must be reported on international fuel tax agreement?

Carriers must report the total miles traveled in each jurisdiction, the amount of fuel purchased in each jurisdiction, and the fuel tax owed or refundable for each jurisdiction.

Fill out your international fuel tax agreement online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

International Fuel Tax Agreement is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.