Get the free 529 College Savings Plan Beneficiary Change Form - Fidelity ...

Show details

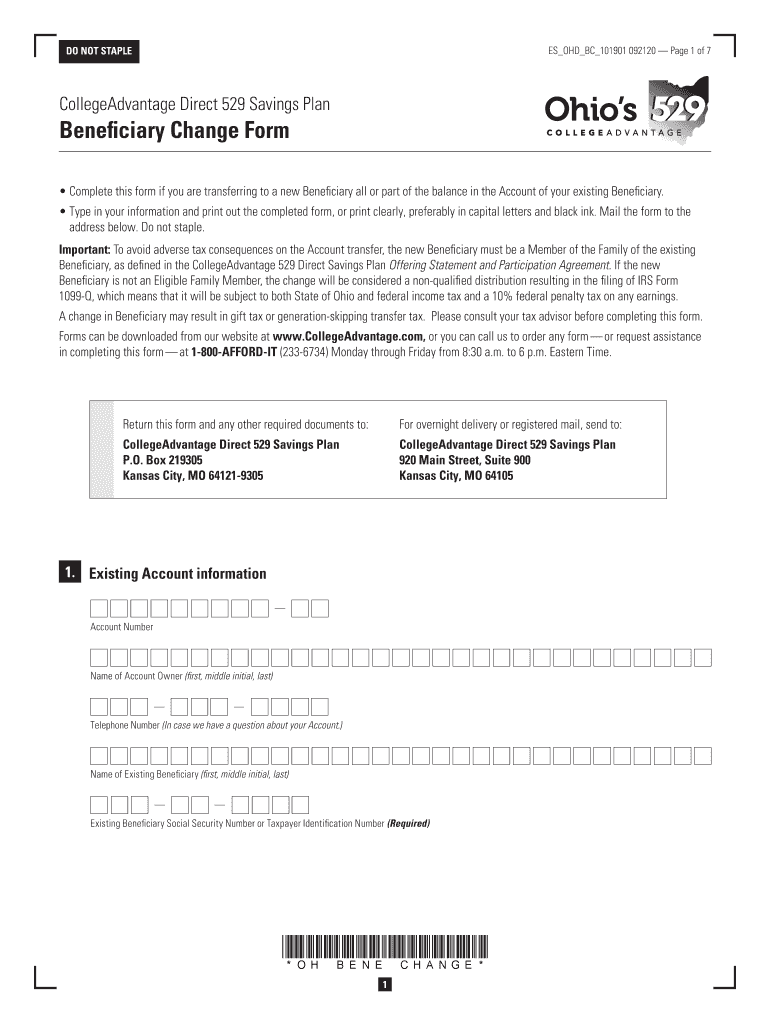

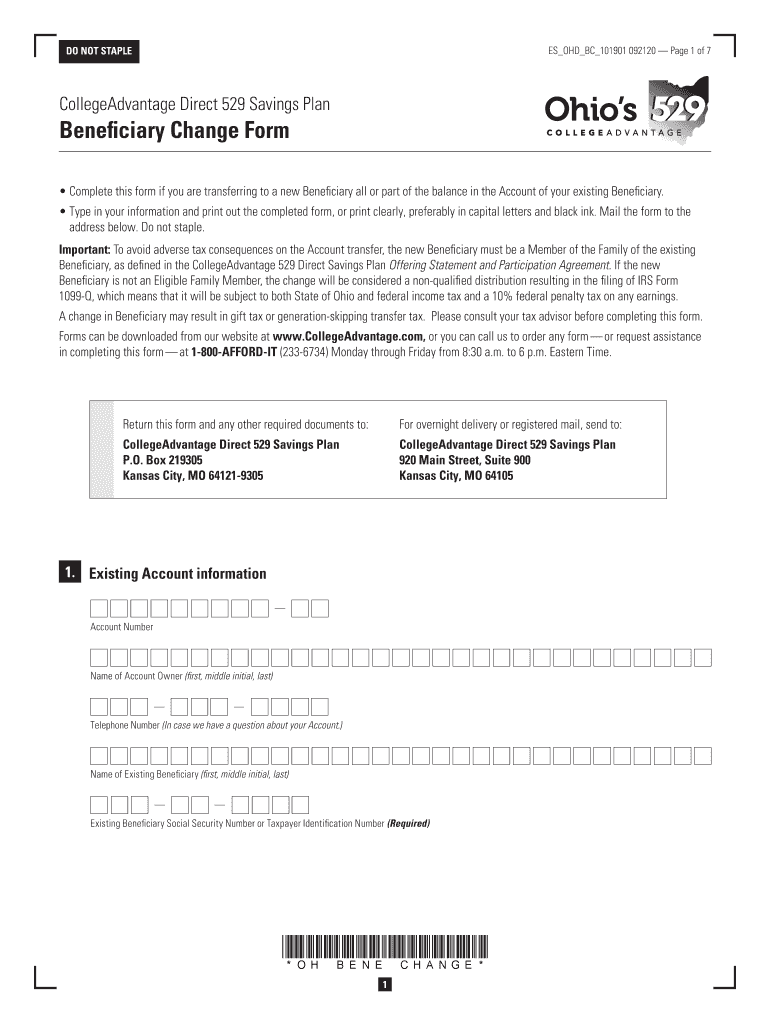

ES OH DBC 101901 092120-Page 1 of 7DO NOT STAPLECollegeAdvantage Direct 529 Savings PlanBeneficiary Change Form Complete this form if you are transferring to a new Beneficiary all or part of the balance

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 529 college savings plan

Edit your 529 college savings plan form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 529 college savings plan form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 529 college savings plan online

To use the professional PDF editor, follow these steps below:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one yet.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit 529 college savings plan. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 529 college savings plan

How to fill out 529 college savings plan

01

Step 1: Research and choose a 529 college savings plan that best suits your needs. You can compare different plans based on factors like investment options, fees, and state tax benefits.

02

Step 2: Gather the necessary documents and information, such as your social security number, the beneficiary's social security number, and personal identification details.

03

Step 3: Open a 529 college savings plan account either online or through a paper application. Follow the instructions provided by the plan provider.

04

Step 4: Fill out the application form with accurate and complete information. Provide details about the beneficiary, account owner, investment options, contribution amounts, and beneficiary's age or expected enrollment date for college.

05

Step 5: Review the terms and conditions of the plan and make sure you understand them.

06

Step 6: Determine how you will fund the account. You can make regular contributions or make lump sum payments at your convenience.

07

Step 7: Set up automatic contributions if desired to simplify the process of saving for college.

08

Step 8: Monitor and manage your 529 college savings plan regularly. Review the performance of your investments, adjust contribution amounts if needed, and stay informed about any updates or changes to the plan.

09

Step 9: Maximize the benefits of a 529 college savings plan by taking advantage of state tax deductions, if available, and utilizing the funds for qualified educational expenses when the beneficiary attends college.

10

Step 10: Keep track of any necessary paperwork and documentation related to the plan for tax purposes and future reference.

Who needs 529 college savings plan?

01

Anyone who wants to save and invest for a child's or their own higher education expenses can benefit from a 529 college savings plan.

02

Parents and grandparents can open accounts for their children or grandchildren respectively.

03

Guardians, relatives, and even friends can also open accounts for a designated beneficiary.

04

Adults planning to pursue further education can also open a 529 plan for themselves to save and invest for their own educational expenses.

05

Those who desire tax advantages and flexibility in saving for college should consider a 529 college savings plan.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my 529 college savings plan in Gmail?

Using pdfFiller's Gmail add-on, you can edit, fill out, and sign your 529 college savings plan and other papers directly in your email. You may get it through Google Workspace Marketplace. Make better use of your time by handling your papers and eSignatures.

Can I sign the 529 college savings plan electronically in Chrome?

Yes. By adding the solution to your Chrome browser, you may use pdfFiller to eSign documents while also enjoying all of the PDF editor's capabilities in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a photo of your handwritten signature using the extension. Whatever option you select, you'll be able to eSign your 529 college savings plan in seconds.

How do I fill out 529 college savings plan using my mobile device?

On your mobile device, use the pdfFiller mobile app to complete and sign 529 college savings plan. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to discover more about our mobile applications, the features you'll have access to, and how to get started.

What is 529 college savings plan?

A 529 college savings plan is a tax-advantaged savings plan designed to encourage saving for future educational expenses, primarily for college tuition and related costs.

Who is required to file 529 college savings plan?

Individuals who wish to open or contribute to a 529 college savings plan must file relevant forms, typically including the account owner and the beneficiary information.

How to fill out 529 college savings plan?

To fill out a 529 college savings plan, you need to provide personal information for the account owner and beneficiary, select an investment option, and specify contribution amounts.

What is the purpose of 529 college savings plan?

The purpose of a 529 college savings plan is to provide a tax-efficient way to save for educational expenses, thus helping families prepare financially for college.

What information must be reported on 529 college savings plan?

Information that must be reported on a 529 college savings plan includes the account owner’s details, beneficiary’s information, contributions made, and earnings.

Fill out your 529 college savings plan online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

529 College Savings Plan is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.