Get the free General Obligation Refunding Bond Issuance

Show details

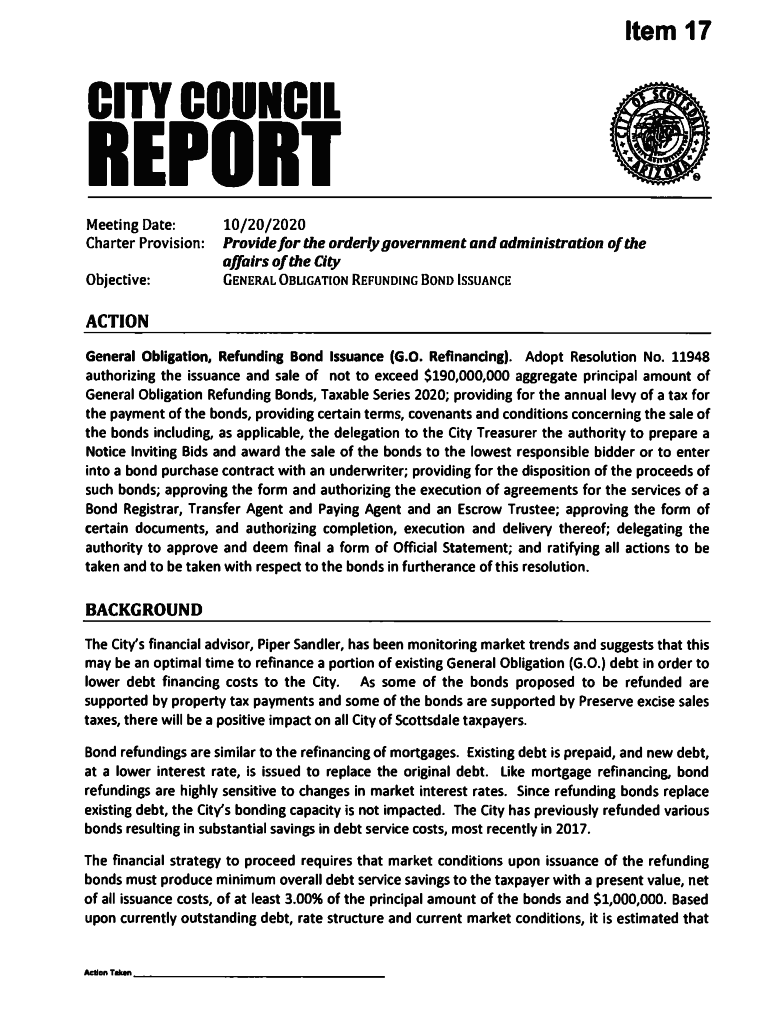

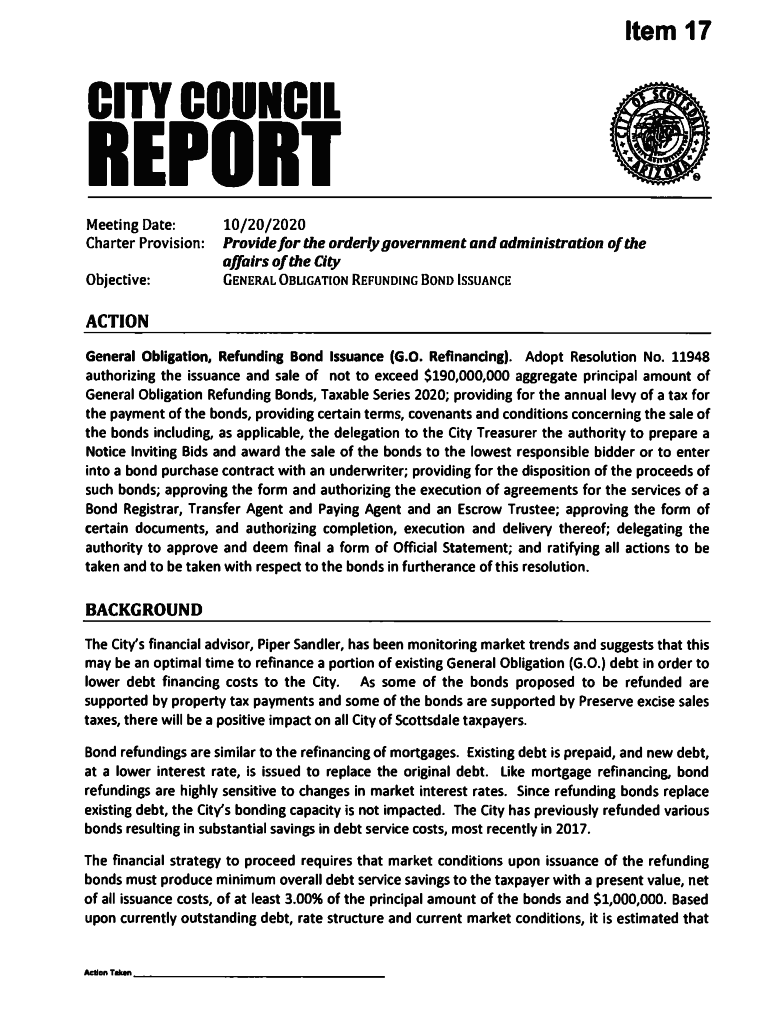

Item 17CITY COUNNlREPORT

Meeting Date:

Charter Provision:Objective:mm10/20/2020

Provide for the orderly government and administration of the

affairs of the City

General Obligation Refunding Bond IssuanceACTION

General

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign general obligation refunding bond

Edit your general obligation refunding bond form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your general obligation refunding bond form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit general obligation refunding bond online

To use the services of a skilled PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit general obligation refunding bond. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out general obligation refunding bond

How to fill out general obligation refunding bond

01

Gather all necessary documents such as the original bond agreement, any amendments or extensions, and the refunding bond application.

02

Review the terms and conditions of the original bond agreement to understand the obligations and restrictions associated with the refunding process.

03

Prepare a detailed analysis of the financial benefits and risks associated with refunding the general obligation bond. This analysis should consider factors such as interest rate differentials, cost savings, and potential credit rating impacts.

04

Contact the legal counsel and financial advisors involved in the original bond issuance to discuss the refunding process and any legal or regulatory requirements.

05

Complete the refunding bond application, providing all necessary information and supporting documentation as requested.

06

Submit the refunding bond application to the appropriate authority or governing body overseeing the issuance of general obligation bonds.

07

Await approval from the governing body, which may involve a review process or public hearing.

08

If approved, work with legal counsel and financial advisors to prepare the necessary legal documents, including the refunding bond agreement.

09

Arrange for the sale of the refunding bonds to investors, ensuring compliance with applicable securities laws and regulations.

10

Use the proceeds from the refunding bonds to repay the existing general obligation bond, effectively refinancing the debt and achieving the desired cost savings.

11

Monitor and manage the ongoing obligations associated with the refunding bond, including making timely payments of principal and interest.

12

Periodically review the financial performance and market conditions to assess the potential for additional refunding opportunities.

Who needs general obligation refunding bond?

01

General obligation refunding bonds are typically needed by government entities or municipalities that have existing general obligation bonds with higher interest rates.

02

By issuing refunding bonds, these entities can take advantage of lower interest rates and achieve cost savings by refinancing the existing debt.

03

This can be beneficial for entities facing budget constraints or looking to free up funds for other projects or initiatives.

04

Additionally, entities with improved credit ratings or financial profiles may also pursue refunding bonds to lower borrowing costs and improve overall debt management.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify general obligation refunding bond without leaving Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your general obligation refunding bond into a dynamic fillable form that can be managed and signed using any internet-connected device.

Where do I find general obligation refunding bond?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific general obligation refunding bond and other forms. Find the template you need and change it using powerful tools.

Can I edit general obligation refunding bond on an Android device?

Yes, you can. With the pdfFiller mobile app for Android, you can edit, sign, and share general obligation refunding bond on your mobile device from any location; only an internet connection is needed. Get the app and start to streamline your document workflow from anywhere.

What is general obligation refunding bond?

A general obligation refunding bond is a type of municipal bond issued to refinance existing debt obligations, lowering interest rates or extending the duration of the debt.

Who is required to file general obligation refunding bond?

Municipal entities, such as state or local governments, that issue general obligation bonds are required to file general obligation refunding bonds when they seek to refinance existing debt.

How to fill out general obligation refunding bond?

To fill out a general obligation refunding bond, the issuing authority must provide details such as the bond amount, the purpose of the refunding, the maturity dates, the interest rate, and any applicable legal language.

What is the purpose of general obligation refunding bond?

The purpose of a general obligation refunding bond is to reduce interest costs, create budgetary savings, and improve cash flow by replacing older, higher-interest debt with new, lower-interest debt.

What information must be reported on general obligation refunding bond?

Information that must be reported includes the bond's face value, interest rates, payment schedules, the intended use of proceeds, and any obligations being refinanced.

Fill out your general obligation refunding bond online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

General Obligation Refunding Bond is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.