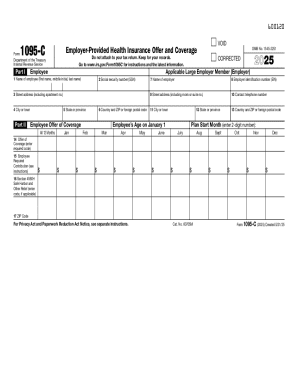

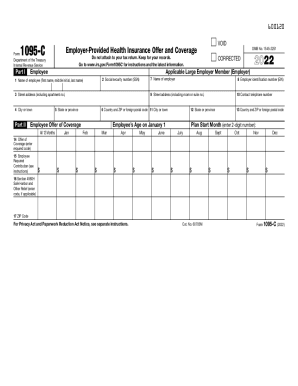

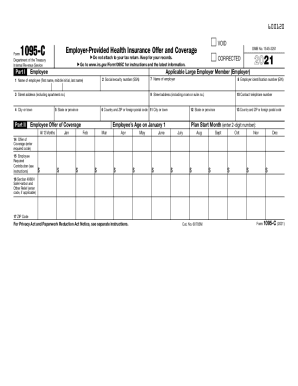

IRS 1095-C 2020 free printable template

Instructions and Help about IRS 1095-C

How to edit IRS 1095-C

How to fill out IRS 1095-C

About IRS 1095-C 2020 previous version

What is IRS 1095-C?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS 1095-C

What should I do if I need to correct an IRS 1095-C after submission?

If you realize there's an error in your IRS 1095-C after sending it, you can submit a corrected form. Ensure you clearly indicate it's a correction and follow IRS guidelines for amendments. This helps in keeping your tax records accurate and avoiding potential discrepancies.

How can I track the status of my IRS 1095-C submission?

To verify the receipt and processing of your IRS 1095-C, use the IRS e-Services or contact them directly. Common e-file rejection codes can guide you on issues needing resolution. Regularly checking your submission status helps in ensuring it was correctly processed.

What privacy measures should I consider when handling IRS 1095-C information?

When managing IRS 1095-C forms, prioritize data security by using secure methods for storing and sharing sensitive information. Implementing encryption and limiting access to those who need it ensures compliance and protects privacy.

What common errors should I be aware of when filing the IRS 1095-C?

Common mistakes include incorrect employee information and failing to check required box options correctly. Being aware of these errors allows you to prepare and file the IRS 1095-C accurately, minimizing the chances of rejection.

See what our users say