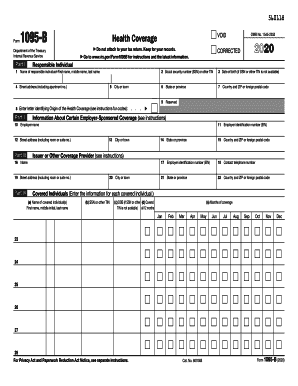

Who needs Form 1094-B?

This form is used by all individuals who file Form 1095-B. Its main purpose is informative.

What is the purpose of Form 1094-B?

The Transmittal of Health Coverage Information Returns is sent to the IRS to inform the total amount of all submitted Forms 1095-B, Health Coverage. The Health Coverage Form serves as proof that a taxpayer was covered by the minimum essential coverage. According to US law every individual must have minimum essential coverage for each month.

What documents must accompany Form 1094-B?

This form should be sent together with Form 1095-B. A separate submission is not needed.

How long does it take to fill the form out?

This is a one-page form, and it takes up to five minutes to complete it.

What information should be provided in Form 1094-B?

The person who fills out the form has to provide the following details:

- First name

- Employer Identification Number

- Name and telephone number of the contact person

- Address (street, city, state, country and ZIP)

- Total number of submitted Forms 1095-B

- The preparer also has to sign the form, indicate their title and date it.

- The information provided in Form 1094-B must fully correspond to the data in Form 1095-B.

What do I do with the form after its completion?

The completed Form 1094-B is forwarded to the appropriate IRS office.