Get the free MANDATORY PROVIDENT FUND SCHEMES AUTHORITY IV.7 ...

Show details

Guidelines IV.3 MANDATORY PROVIDENT FUND SCHEMES AUTHORITY IV.3 Guidelines on Election for Transfer of Accrued Benefits INTRODUCTION Sections 145, 146, 147, 148, 148A, 148B, 149, 150 and 150A of the

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign mandatory provident fund schemes

Edit your mandatory provident fund schemes form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your mandatory provident fund schemes form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit mandatory provident fund schemes online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit mandatory provident fund schemes. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

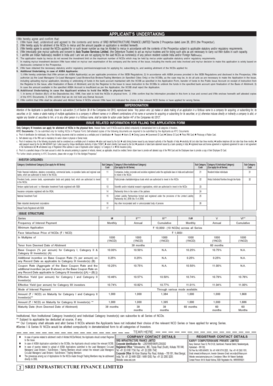

How to fill out mandatory provident fund schemes

How to fill out mandatory provident fund schemes:

01

Gather relevant documents: Start by collecting all the necessary documents required for filling out the mandatory provident fund scheme. This may include your identification documents, employment contract, and any other supporting paperwork.

02

Understand the application process: Familiarize yourself with the application process of the mandatory provident fund scheme. Read through the guidelines or instructions provided by the relevant authority to ensure you are following the correct procedure.

03

Complete the application form: Fill out the application form provided by the mandatory provident fund scheme. Make sure to provide accurate and up-to-date information about yourself, such as your name, address, and employment details.

04

Nominate beneficiaries: Some mandatory provident fund schemes allow you to nominate beneficiaries who will receive the benefits in case of your untimely demise. If applicable, carefully select and include the details of your chosen beneficiaries in the application form.

05

Submit the application: Once you have filled out the mandatory provident fund scheme application form, double-check all the information for accuracy. Ensure that you have included all the necessary supporting documents. Then, submit the completed application form either online or through the designated submission channels.

Who needs mandatory provident fund schemes:

01

Employees in Hong Kong: The mandatory provident fund scheme is primarily designed for employees working in Hong Kong. It is compulsory for both full-time and part-time employees. If you are employed in Hong Kong, you will need to participate in a mandatory provident fund scheme.

02

Self-employed individuals: Self-employed individuals who do not have any employees are also eligible to join a mandatory provident fund scheme. It provides an opportunity for self-employed individuals to save for retirement and enjoy the benefits provided by the scheme.

03

Foreign employees: Foreign employees working in Hong Kong are also required to participate in a mandatory provident fund scheme. It ensures that all employees, regardless of their nationality, receive retirement benefits and financial security for their future.

04

Individuals changing jobs: If you are changing jobs in Hong Kong, you may need to switch your mandatory provident fund scheme. It is important to understand the process of transferring your accumulated funds from one scheme to another as per the rules and regulations.

05

Individuals looking for retirement savings: Even if participation in a mandatory provident fund scheme is not obligatory for some individuals, it can still be beneficial for those who wish to save for their retirement. It provides a structured and regulated savings plan, ensuring a secure financial future.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get mandatory provident fund schemes?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the mandatory provident fund schemes. Open it immediately and start altering it with sophisticated capabilities.

How do I edit mandatory provident fund schemes in Chrome?

mandatory provident fund schemes can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

Can I edit mandatory provident fund schemes on an Android device?

With the pdfFiller mobile app for Android, you may make modifications to PDF files such as mandatory provident fund schemes. Documents may be edited, signed, and sent directly from your mobile device. Install the app and you'll be able to manage your documents from anywhere.

What is mandatory provident fund schemes?

Mandatory Provident Fund (MPF) schemes are retirement savings schemes established by the Hong Kong government to help employees save for their retirement.

Who is required to file mandatory provident fund schemes?

Employers in Hong Kong are required to enroll their eligible employees in an MPF scheme and make contributions on their behalf.

How to fill out mandatory provident fund schemes?

Employers need to collect their employees' personal and employment information, contributions, and submit it to the MPF trustees regularly.

What is the purpose of mandatory provident fund schemes?

The purpose of MPF schemes is to provide retirement protection for employees in Hong Kong and ensure they have savings for their retirement years.

What information must be reported on mandatory provident fund schemes?

Employers must report their employees' personal details, contributions made, and any changes in employment status.

Fill out your mandatory provident fund schemes online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Mandatory Provident Fund Schemes is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.