Get the free Payments to Individuals Who are Non‐Employees of NSHE - unr

Show details

This document outlines the procedures and forms required for making payments to individuals who are not employees of the Nevada System of Higher Education (NSHE), including guidelines for various

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign payments to individuals who

Edit your payments to individuals who form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your payments to individuals who form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit payments to individuals who online

To use the services of a skilled PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit payments to individuals who. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

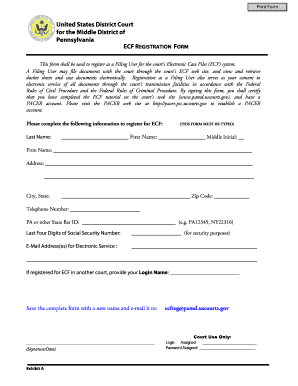

How to fill out payments to individuals who

How to fill out Payments to Individuals Who are Non‐Employees of NSHE

01

Gather necessary documentation including the individual's name, address, and social security number.

02

Determine the purpose of the payment and ensure it qualifies as a non-employee payment.

03

Complete the appropriate payment request form, ensuring all required fields are filled out correctly.

04

Attach any relevant documentation or receipts supporting the payment request.

05

Submit the completed form and attachments to the designated department or financial office for processing.

06

Keep a copy of the submitted form and all documentation for your records.

Who needs Payments to Individuals Who are Non‐Employees of NSHE?

01

Individuals providing services or performing work for NSHE who are not classified as employees.

02

Contractors, consultants, or speakers who require compensation for their services.

03

Anyone receiving payments for services rendered that do not fall under an employee-employer relationship.

Fill

form

: Try Risk Free

People Also Ask about

What is an alternative defined contribution plan?

An alternative DC plan means a DC plan that exists at any time between the date of a 401(k) plan termination and 12 months after distribution of all assets from the terminated plan. Hence, the rule under 1.401(k)-1(d)(4) is referred to sometimes as the “12-month rule.”

How do you pay non employees?

How is an independent contractor paid? Obtain the independent contractor's Form W-9, Request for Taxpayer Identification Number and Certification. Provide compensation for work performed. Remit backup withholding payments to the IRS, if necessary. Complete Form 1099-NEC, Nonemployee Compensation.

What is a 401(a) fica alternative plan?

The FICA Alternative Plan is a defined contribution retirement plan authorized under Section 401(a) of the Internal Revenue Code. It allows certain employees in temporary positions to participate, providing an alternative to earning Social Security credits.

What is the difference between a defined contribution plan and a retirement plan?

As the names imply, a defined-benefit plan—also commonly known as a traditional pension plan—provides a specified payment amount in retirement. A defined-contribution plan allows employees to contribute and invest in funds and other securities over time to save for retirement.

What is the FICA alternative retirement plan?

What is a 457(b) FICA Alternative Retirement Plan? A 457(b) FICA Alternative Retirement Plan is a qualified retirement plan which takes the place of Social Security for government entities such as school districts, cities, etc.

What is the NSHE defined contribution retirement plan alternative?

The NSHE Defined Contribution Retirement Plan Alternative is mandatory for NSHE professional and faculty employees3. You contribute 17.5% of your salary4,5 on a pretax basis. NSHE also contributes 17.5% of your pretax salary. You are immediately vested 100% in both the NSHE contributions and your contributions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Payments to Individuals Who are Non‐Employees of NSHE?

Payments to Individuals Who are Non‐Employees of NSHE refers to the financial compensation provided to individuals who perform services for the Nevada System of Higher Education (NSHE) but are not classified as employees. This could include contractors, consultants, or speakers.

Who is required to file Payments to Individuals Who are Non‐Employees of NSHE?

Any department or unit within the Nevada System of Higher Education that engages and compensates individuals who are classified as non-employees must file Payments to Individuals Who are Non‐Employees of NSHE.

How to fill out Payments to Individuals Who are Non‐Employees of NSHE?

To fill out Payments to Individuals Who are Non‐Employees of NSHE, one should gather the necessary information about the individual including their name, contact details, and the nature of services provided. The form should clearly specify the amount paid, the payment method, and any relevant tax information.

What is the purpose of Payments to Individuals Who are Non‐Employees of NSHE?

The purpose of Payments to Individuals Who are Non‐Employees of NSHE is to ensure proper documentation and compliance with tax laws regarding compensation for services rendered by individuals who are not official employees of the institution.

What information must be reported on Payments to Individuals Who are Non‐Employees of NSHE?

The report must include the individual's full name, Social Security number or Tax Identification number, address, type of service provided, amount paid, and any taxes withheld. Additionally, the payer's details and the payment date should also be included.

Fill out your payments to individuals who online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Payments To Individuals Who is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.