Get the free Sending the Super Choice form as an inclusion

Show details

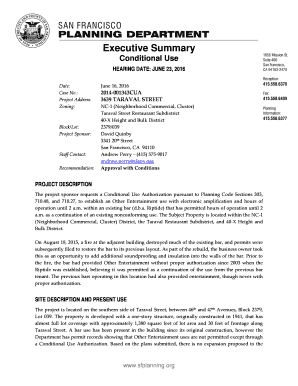

This tutorial provides guidance on how to send the Standard Choice form as an inclusion with employee pay advices in the Attaché Payroll system. It outlines the steps required to download, complete,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign sending the super choice

Edit your sending the super choice form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your sending the super choice form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit sending the super choice online

Follow the guidelines below to use a professional PDF editor:

1

Log in to account. Start Free Trial and sign up a profile if you don't have one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit sending the super choice. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out sending the super choice

How to fill out Sending the Super Choice form as an inclusion

01

Download the Super Choice form from the official website or obtain a physical copy.

02

Fill in your personal details, including your name, address, and contact information.

03

Provide your Australian Tax File Number (TFN) in the designated section.

04

Select the superannuation fund you wish to send your contributions to by providing its details.

05

Review and ensure all information is accurate and complete.

06

Sign and date the form to authorize your choice of super fund.

07

Submit the completed form to your employer or the relevant authority, either electronically or in hard copy.

Who needs Sending the Super Choice form as an inclusion?

01

Employees who want to choose their own superannuation fund instead of the default fund set by their employer.

02

Individuals starting a new job and need to indicate where their super contributions should be directed.

03

Self-employed individuals who wish to choose a super fund for their voluntary contributions.

Fill

form

: Try Risk Free

People Also Ask about

What is sgc forms?

If you've not paid an employee's super on time, in full and to the right fund, you'll need to submit a SGC statement form to the ATO. They will then calculate the SGC amount you have to pay based on the information you've given. If you fail to submit and pay the SGC on time, the nominal interest will continue to grow.

What is a superannuation choice?

Most people can choose which super fund they'd like their super contributions paid into. You can ask your employer for a 'standard choice form'. This sets out your options. You can go with your existing fund, your employer's fund, or choose a different fund.

How to get a super choice form?

Employees can access and complete the form, by: Logging into ATO online services via myGov. Downloading the Superannuation standard choice form (NAT 13080 PDF 422KB) Their employer's employee commencement-enabled payroll software, if available.

How does superchoice work?

Super choice - short for 'superannuation standard choice form' is a form that advises employers of the employee's choice of super fund. Super funds or superannuation funds are what employers put money into throughout an employee's working life so that they have sufficient funds to live off in their retirement.

What is a superannuation nomination form?

A binding beneficiary nomination is a formal written direction from you to legalsuper to tell us who you want your super paid to if you pass away. It is a legally binding document, and the Trustee is required to follow a valid binding nomination made by you.

What is the difference between MySuper and choice Super?

Choice super You actively make a choice about where your super is invested, rather than going with the default MySuper option. For help choosing investments in your super, see super investment options.

What is a super choice form?

This form advises employers of the employee's choice of fund. Employers can use it to nominate their default super fund.

What is the main purpose of the superannuation guarantee?

Super is money you pay for your workers to provide for their retirements. If you have employees, you generally need to pay super guarantee contributions to your employees regardless of how much they are paid. All employees are covered by the superannuation guarantee.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Sending the Super Choice form as an inclusion?

Sending the Super Choice form as an inclusion refers to the process by which an employee elects their preferred superannuation fund for their super contributions, ensuring that their funds are directed to the chosen account.

Who is required to file Sending the Super Choice form as an inclusion?

Employers are required to file the Sending the Super Choice form when they engage new employees or when existing employees wish to change their superannuation fund.

How to fill out Sending the Super Choice form as an inclusion?

To fill out the Sending the Super Choice form, the employee must provide personal details such as name, address, date of birth, and their chosen superannuation fund details including fund name, fund ABN, and member number.

What is the purpose of Sending the Super Choice form as an inclusion?

The purpose of the Sending the Super Choice form is to give employees the right to choose their superannuation fund and to ensure that super contributions are directed according to their preferences.

What information must be reported on Sending the Super Choice form as an inclusion?

The form must report the employee's personal details, chosen superannuation fund information, and a declaration that the information provided is true and correct.

Fill out your sending the super choice online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Sending The Super Choice is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.