Get the free Annual Reconciliation - gbfb

Show details

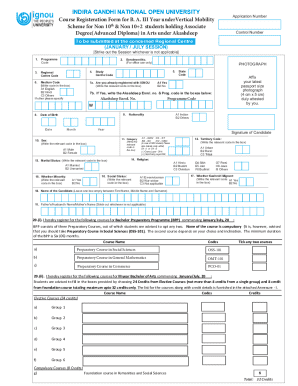

This document is designed for the annual reconciliation of receipts, distribution, and inventory. It includes sections for reporting periods, inventory details, and signatures from authorized representatives.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign annual reconciliation - gbfb

Edit your annual reconciliation - gbfb form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your annual reconciliation - gbfb form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing annual reconciliation - gbfb online

Follow the steps down below to take advantage of the professional PDF editor:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit annual reconciliation - gbfb. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out annual reconciliation - gbfb

How to fill out Annual Reconciliation

01

Gather all necessary financial documents, including income statements, expense reports, and tax documents.

02

Review your accounting records for accuracy and completeness.

03

Compile a list of all income earned and expenses incurred during the year.

04

Calculate the total income and total expenses for the year.

05

Determine the net income by subtracting total expenses from total income.

06

Fill out the Annual Reconciliation form with the gathered information.

07

Double-check all entries for accuracy.

08

Submit the Annual Reconciliation to the appropriate authorities by the deadline.

Who needs Annual Reconciliation?

01

Individuals who are self-employed or running a business.

02

Businesses of all sizes, including sole proprietorships, partnerships, and corporations.

03

Organizations that need to reconcile their financial activities with the tax authorities.

Fill

form

: Try Risk Free

People Also Ask about

What is reconciliation in English literature?

Reconciliation refers to the process of restoring friendly relations and resolving conflicts, often emphasizing forgiveness and understanding.

Is there an annual reconciliation for Form 941?

In the end, the information on your quarterly 941s must match your submitted Form W-2s. By reconciling your 941 forms with your payroll, you can verify the accuracy of these filings. For best results, reconciliation should be done on a quarterly and a year-end basis.

What is annual withholding reconciliation?

California. No annual reconciliation exists, as quarterly DE-9 filings serve that purpose. However, understanding quarterly obligations and potential local-level withholdings is essential, especially in multi-city operations.

What is bank reconciliation in simple words?

Bank reconciliation is an accounting process in which a company's records are reconciled with its bank statements to make sure that the balances match. It entails tallying the transactions recorded in the company's books (deposits, withdrawals, payments, etc.) with those listed on the bank statement.

What is the main purpose of reconciliation?

Purpose: The process of reconciliation ensures the accuracy and validity of financial information. Also, a proper reconciliation process ensures that unauthorized changes have not occurred to transactions during processing.

What is bank reconciliation in English?

In bookkeeping, bank reconciliation is the process by which the bank account balance in an entity's books of account is reconciled to the balance reported by the financial institution in the most recent bank statement. Any difference between the two figures needs to be examined and, if appropriate, rectified.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Annual Reconciliation?

Annual Reconciliation is a process where businesses compare their financial records against statements from various sources, ensuring that all income and expenses are accounted for accurately for the fiscal year.

Who is required to file Annual Reconciliation?

Typically, all businesses and self-employed individuals who meet certain income thresholds and are subject to tax requirements are required to file Annual Reconciliation.

How to fill out Annual Reconciliation?

To fill out Annual Reconciliation, gather all relevant financial documents, complete the designated forms accurately with your total income, expenses, and any adjustments, and submit them to the appropriate tax authority by the deadline.

What is the purpose of Annual Reconciliation?

The purpose of Annual Reconciliation is to ensure that all financial records are accurate, to identify any discrepancies in income or expenses, and to fulfill tax obligations efficiently.

What information must be reported on Annual Reconciliation?

Annual Reconciliation must report total income, total expenses, deductions, tax credits, and any other relevant financial information as required by the tax authorities.

Fill out your annual reconciliation - gbfb online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Annual Reconciliation - Gbfb is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.