Get the free Transition to retirement income

Show details

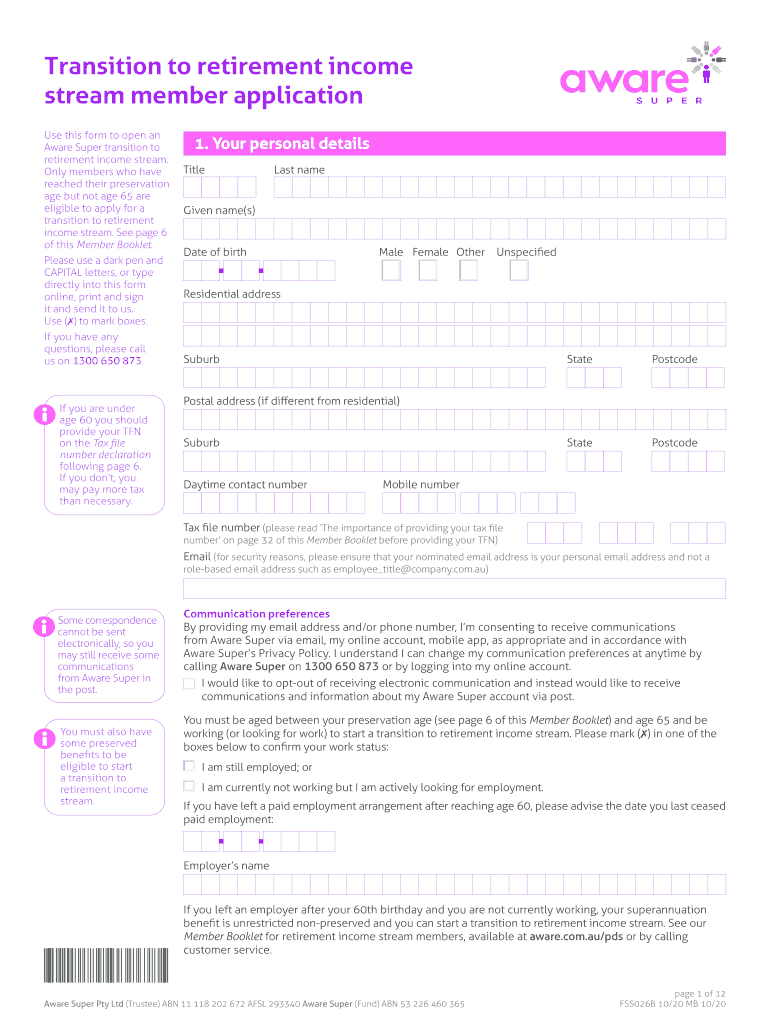

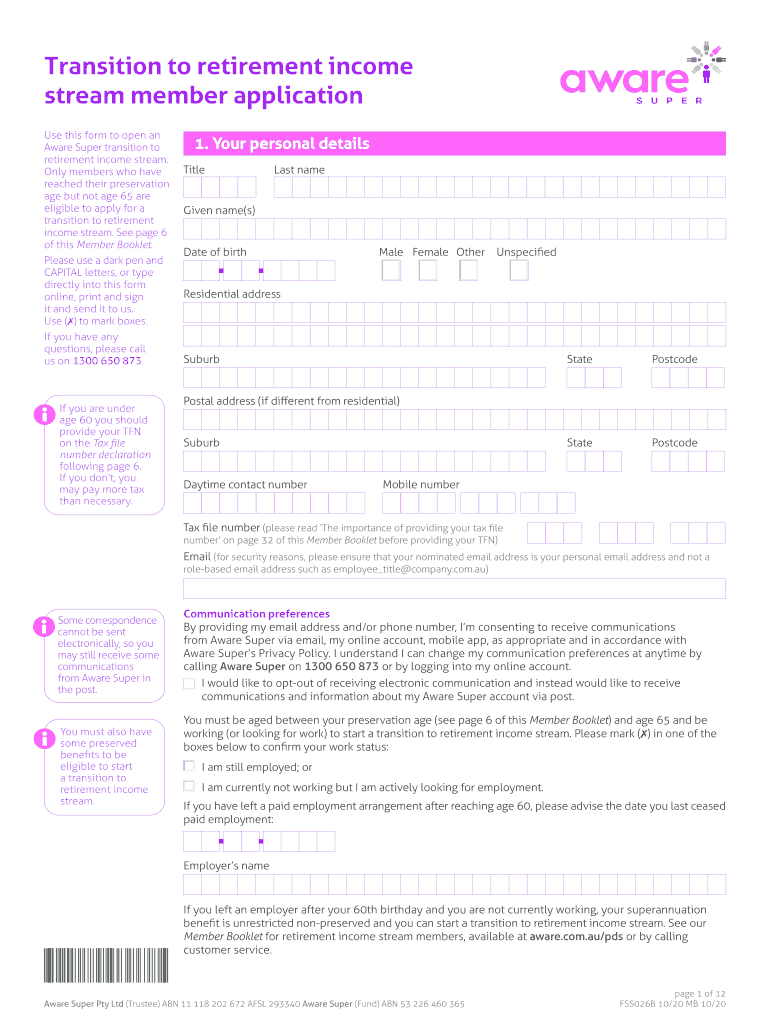

Transition to retirement income

stream member application

Use this form to open an

Aware Super transition to

retirement income stream.

Only members who have

reached their preservation

age but not

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign transition to retirement income

Edit your transition to retirement income form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your transition to retirement income form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing transition to retirement income online

Follow the guidelines below to use a professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit transition to retirement income. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out transition to retirement income

How to fill out transition to retirement income

01

Determine the eligibility criteria: To be eligible for a transition to retirement income, you need to be at preservation age (which varies depending on your date of birth) and have reached your superannuation preservation age.

02

Understand the purpose: The purpose of a transition to retirement income is to provide individuals with the flexibility to reduce their working hours while supplementing their income with regular payments from their superannuation fund.

03

Consult with a financial advisor: It is recommended to seek professional financial advice to determine if a transition to retirement income strategy is suitable for your specific situation.

04

Check your superannuation fund's options: Review the options provided by your superannuation fund, as they may offer different investment and payment options for a transition to retirement income.

05

Decide on the amount and frequency of income payments: Determine how much income you would like to receive and how often you want to receive payments from your superannuation fund.

06

Complete the necessary forms: Fill out the required forms provided by your superannuation fund to initiate the transition to retirement income strategy.

07

Monitor and review your strategy: Regularly assess the performance of your transition to retirement income strategy and make adjustments if necessary to ensure it aligns with your financial goals and objectives.

Who needs transition to retirement income?

01

Individuals approaching retirement age: Transition to retirement income is beneficial for individuals who are approaching their preservation age and want to gradually reduce their working hours.

02

Those who want to supplement their income: People who are looking for additional income to support their lifestyle while still working may find a transition to retirement income strategy helpful.

03

Individuals with sufficient superannuation savings: To make use of a transition to retirement income strategy, it is important to have enough superannuation savings to support regular income payments.

04

Individuals who want to maintain their superannuation contributions: Transition to retirement income allows individuals to continue making superannuation contributions while accessing a portion of their superannuation savings as income.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify transition to retirement income without leaving Google Drive?

By integrating pdfFiller with Google Docs, you can streamline your document workflows and produce fillable forms that can be stored directly in Google Drive. Using the connection, you will be able to create, change, and eSign documents, including transition to retirement income, all without having to leave Google Drive. Add pdfFiller's features to Google Drive and you'll be able to handle your documents more effectively from any device with an internet connection.

Can I create an electronic signature for the transition to retirement income in Chrome?

Yes. By adding the solution to your Chrome browser, you may use pdfFiller to eSign documents while also enjoying all of the PDF editor's capabilities in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a photo of your handwritten signature using the extension. Whatever option you select, you'll be able to eSign your transition to retirement income in seconds.

How do I edit transition to retirement income on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign transition to retirement income on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

What is transition to retirement income?

Transition to retirement income refers to a financial strategy that allows individuals approaching retirement age to access a portion of their superannuation savings while continuing to work part-time. It is designed to supplement their income during the transition phase to full retirement.

Who is required to file transition to retirement income?

Individuals who are accessing their superannuation under the transition to retirement provisions are required to file transition to retirement income. This usually applies to those aged 55 and over who are still employed but wish to reduce their working hours.

How to fill out transition to retirement income?

To fill out the transition to retirement income form, individuals need to provide details such as their personal information, superannuation fund details, and the amount of income they wish to withdraw from their superannuation. It is advisable to seek assistance from a financial advisor to ensure accuracy.

What is the purpose of transition to retirement income?

The purpose of transition to retirement income is to provide a flexible means for individuals nearing retirement to access their superannuation funds to supplement their income, allowing them to reduce working hours without fully retiring.

What information must be reported on transition to retirement income?

Key information that must be reported includes personal identification details, superannuation fund information, the amount of funds to be accessed, and the individual's work arrangements or intentions regarding full retirement.

Fill out your transition to retirement income online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Transition To Retirement Income is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.