Get the free Fixed Rate Residential Mortgage Application - First Federal Savings ...

Show details

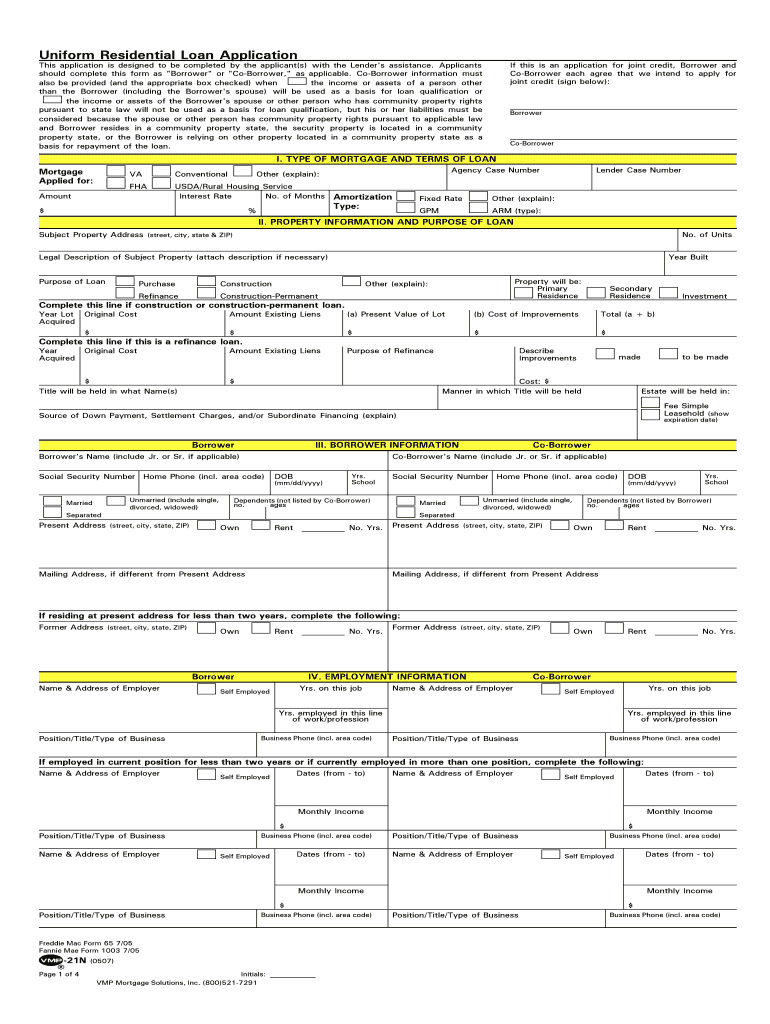

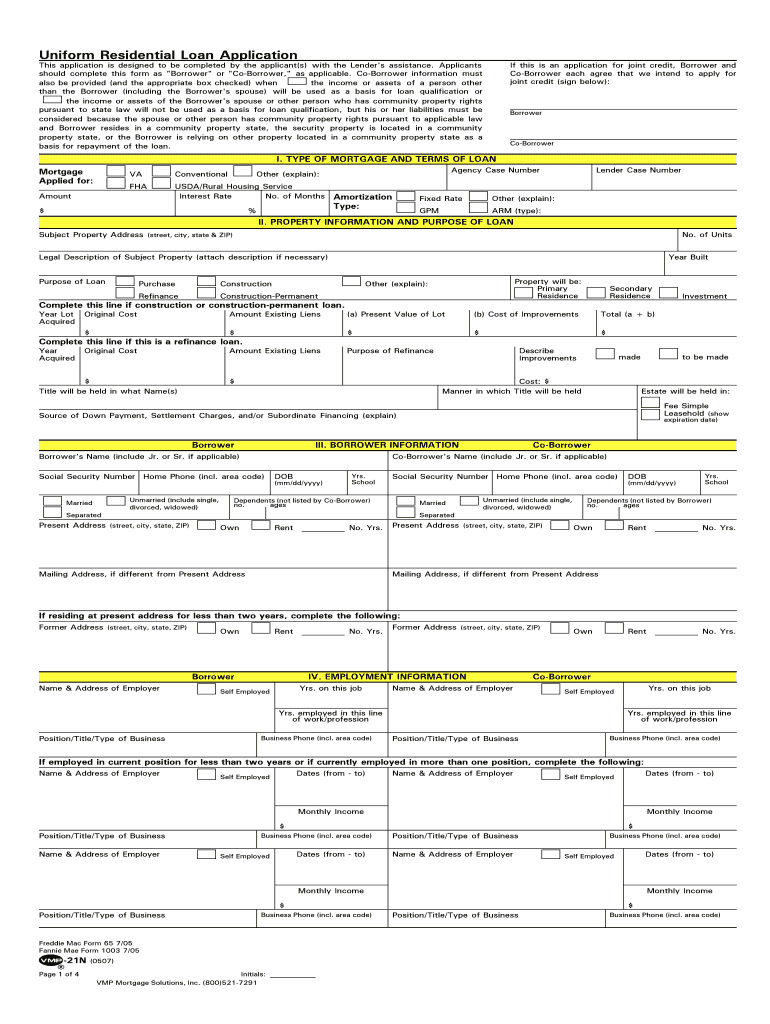

About Printing Requirements Reset Show Field Borders Uniform Residential Loan Application This application is designed to be completed by the applicant(s) with the Lender's assistance. Applicants

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign fixed rate residential mortgage

Edit your fixed rate residential mortgage form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your fixed rate residential mortgage form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit fixed rate residential mortgage online

To use the professional PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit fixed rate residential mortgage. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out fixed rate residential mortgage

How to fill out a fixed rate residential mortgage:

01

Gather all necessary documents: Before starting the application process for a fixed rate residential mortgage, make sure you have all the required documents such as proof of identity, proof of income, employment history, bank statements, and any other relevant financial records.

02

Research and compare lenders: Take the time to research and compare different lenders offering fixed rate residential mortgages. Look for reputable institutions with competitive interest rates and favorable terms. Consider consulting a mortgage broker who can provide expert advice and help you find the best options available.

03

Understand the terms and conditions: Carefully review the terms and conditions of the fixed rate residential mortgage you are applying for. Understand the interest rate, repayment schedule, penalties for early repayment, and any other clauses that may affect your financial situation. Make sure you are comfortable with the terms before proceeding.

04

Complete the application form: Fill out the application form provided by the lender accurately and completely. Provide all the required information, including personal details, employment information, financial information, and details about the property you intend to purchase.

05

Submit supporting documents: Along with the application form, you will need to submit supporting documents as per the lender's requirements. These may include income verification, bank statements, tax returns, asset documentation, and any other relevant paperwork. Ensure that all documents are organized and legible.

06

Consult a mortgage advisor or loan officer: If you have any questions or concerns during the application process, it is advisable to consult a mortgage advisor or loan officer. They can provide guidance and help ensure that you are providing all the required information accurately to improve your chances of approval.

Who needs a fixed rate residential mortgage?

01

Homebuyers: Individuals or families looking to purchase a residential property may need a fixed rate residential mortgage to finance their purchase. This type of mortgage offers stability and predictability in terms of monthly payments over the loan term.

02

Refinancers: Homeowners who wish to refinance their existing mortgage may opt for a fixed rate residential mortgage to lock in a stable interest rate. Refinancing can help reduce monthly payments, consolidate debts, or access equity for home improvements or other financial needs.

03

Investors: Real estate investors who plan to purchase residential properties as rental properties or for capital appreciation may utilize fixed rate residential mortgages to finance their investment. The predictable payments help ensure cash flow stability and facilitate long-term financial planning.

04

Those seeking long-term stability: Individuals who prioritize financial stability and predictability may opt for a fixed rate residential mortgage. With a fixed interest rate for the entire loan term, borrowers can have peace of mind knowing their monthly payments will not fluctuate with interest rate changes, providing greater financial security.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify fixed rate residential mortgage without leaving Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your fixed rate residential mortgage into a dynamic fillable form that you can manage and eSign from anywhere.

Where do I find fixed rate residential mortgage?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific fixed rate residential mortgage and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

Can I create an eSignature for the fixed rate residential mortgage in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your fixed rate residential mortgage and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

What is fixed rate residential mortgage?

A fixed rate residential mortgage is a type of home loan where the interest rate remains the same for the entire term of the loan.

Who is required to file fixed rate residential mortgage?

Individuals or families looking to purchase a home and finance it with a fixed rate residential mortgage are required to file.

How to fill out fixed rate residential mortgage?

To fill out a fixed rate residential mortgage, you will need to provide information about your income, assets, and credit history. You will also need to choose the loan term and interest rate that best fits your financial situation.

What is the purpose of fixed rate residential mortgage?

The purpose of a fixed rate residential mortgage is to help individuals or families purchase a home by providing them with a stable and predictable interest rate over the life of the loan.

What information must be reported on fixed rate residential mortgage?

Information such as income, assets, credit history, loan term, interest rate, and property details must be reported on a fixed rate residential mortgage.

Fill out your fixed rate residential mortgage online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Fixed Rate Residential Mortgage is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.