WI Form 4H IC-046 2020 free printable template

Show details

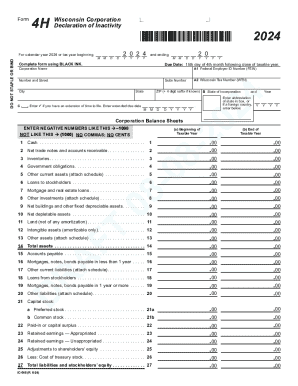

SaveInstructionsForm4HPrintWisconsin Corporation

Declaration of Inactivity2020Tab to navigate within form. Use mouse to check

applicable boxes, press space bar or press Enter. DO NOT STAPLE OR Indoor

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign WI Form 4H IC-046

Edit your WI Form 4H IC-046 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your WI Form 4H IC-046 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing WI Form 4H IC-046 online

Use the instructions below to start using our professional PDF editor:

1

Sign into your account. It's time to start your free trial.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit WI Form 4H IC-046. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to deal with documents. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

WI Form 4H IC-046 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out WI Form 4H IC-046

How to fill out WI Form 4H IC-046

01

Obtain a copy of the WI Form 4H IC-046 from the relevant authority or website.

02

Carefully read the instructions provided on the form.

03

Fill in your personal information including name, address, and contact details in the appropriate sections.

04

Provide details regarding the purpose of filling out the form as required.

05

Complete any specific sections pertaining to your situation or needs.

06

Review the form for any errors or missing information.

07

Submit the completed form as instructed, whether online or by mail.

Who needs WI Form 4H IC-046?

01

Individuals or organizations applying for specific benefits or services related to WI Form 4H IC-046.

02

People seeking assistance or information that is relevant to the form's purpose.

Fill

form

: Try Risk Free

People Also Ask about

What is a WT 7 form?

It is a secure process developed by the Department of Revenue (DOR) for employers and/or their representatives to transmit their Employers Annual Reconciliation of Wisconsin Income Tax Withheld from Wages (Form WT-7) data to DOR via an electronic file over the Internet. How do I get started?

Am I exempt from Wisconsin withholding?

Employee is a resident of a state with which Wisconsin has a reciprocity agreement. Wisconsin currently has reciprocity agreements with Illinois, Indiana, Kentucky, and Michigan. If you employ residents of those states, you are not required to withhold Wisconsin income taxes from wages paid to such employees.

What is the 804 tax form for Wisconsin?

Use Form 804 to claim a refund on behalf of a decedent (deceased taxpayer). If you are filing the decedent's income tax return, submit Form 804 with the return.

What are the exemptions for Wisconsin state income tax?

Personal exemptions are subtracted from Wisconsin AGI, along with the standard deduc- tion, to arrive at taxable income. A $700 personal exemption is provided for each taxpayer, the tax- payer's spouse, and for each individual claimed as a dependent.

How do I claim my decedent's Wisconsin income tax refund?

Use Form 804 to claim a refund on behalf of a deceased taxpayer. If you are claiming a refund on behalf of a deceased tax- payer, you may be required to file Form 804. If you are unable to cash the refund check that was sent to you, you should return it with a completed Form 804.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the WI Form 4H IC-046 electronically in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your WI Form 4H IC-046.

How do I edit WI Form 4H IC-046 straight from my smartphone?

You can do so easily with pdfFiller’s applications for iOS and Android devices, which can be found at the Apple Store and Google Play Store, respectively. Alternatively, you can get the app on our web page: https://edit-pdf-ios-android.pdffiller.com/. Install the application, log in, and start editing WI Form 4H IC-046 right away.

How do I edit WI Form 4H IC-046 on an Android device?

With the pdfFiller Android app, you can edit, sign, and share WI Form 4H IC-046 on your mobile device from any place. All you need is an internet connection to do this. Keep your documents in order from anywhere with the help of the app!

What is WI Form 4H IC-046?

WI Form 4H IC-046 is a specific form used in Wisconsin for reporting certain financial information related to agricultural activities.

Who is required to file WI Form 4H IC-046?

Individuals or entities engaged in agricultural production and who meet specific income thresholds are required to file WI Form 4H IC-046.

How to fill out WI Form 4H IC-046?

To fill out WI Form 4H IC-046, individuals should gather their financial records, follow the instructions provided on the form, and accurately report their income and expenses related to agricultural activities.

What is the purpose of WI Form 4H IC-046?

The purpose of WI Form 4H IC-046 is to collect data on agricultural income and expenses to assist in determining tax obligations and eligibility for financial programs.

What information must be reported on WI Form 4H IC-046?

The form requires reporting of total agricultural income, expenses, assets, liabilities, and any other relevant financial information related to the agricultural operations.

Fill out your WI Form 4H IC-046 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

WI Form 4h IC-046 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.