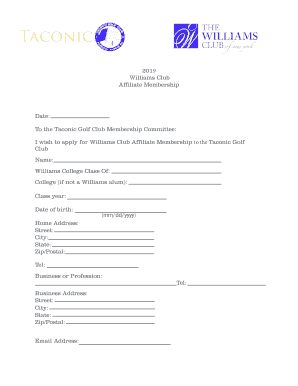

Get the free FORM #17 Irrevocable Trust. Code Section 2503(c) Trust ... - ALI CLE

Show details

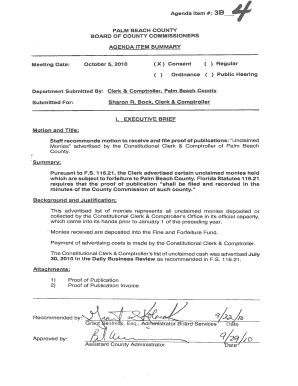

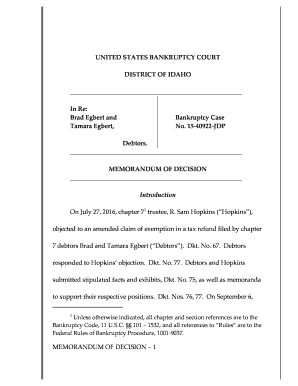

FORM #17 Irrevocable Trust. Code Section 2503 Trust. This trust is an example of the specimen that is described at 9A.02(a). IRREVOCABLE TRUST AGREEMENT Made February 1, 2010. ARTICLE I Purpose I,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form 17 irrevocable trust

Edit your form 17 irrevocable trust form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 17 irrevocable trust form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing form 17 irrevocable trust online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit form 17 irrevocable trust. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Dealing with documents is always simple with pdfFiller. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form 17 irrevocable trust

How to fill out form 17 irrevocable trust:

01

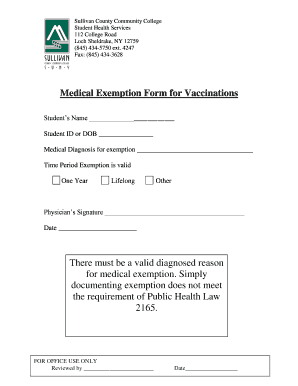

Gather all necessary information: Before starting the form, make sure you have all the required information handy. This may include details about the trust, the grantor, the trustee, and the beneficiaries involved.

02

Begin with basic information: Start by providing the basic details such as the name of the trust, the date it was created, and the jurisdiction under which it was formed. This information is typically found in the first section of the form.

03

Specify the trust terms: In the next section, you will need to outline the terms and conditions of the trust. This includes specifying whether it is a grantor trust, a charitable trust, or any other type of irrevocable trust. Clearly state the purpose and goals of the trust as well.

04

Identify the grantor: The grantor is the person who establishes the trust. You will need to provide their full legal name, address, and taxpayer identification number (TIN) in the designated section. If the trust has multiple grantors, provide the necessary details for each.

05

Designate the trustee: The trustee is responsible for managing the assets and administering the trust. Include the name, address, and TIN of the trustee in the provided space. If there are multiple trustees, provide the details for each.

06

List the beneficiaries: Specify the beneficiaries of the trust and include their names and addresses. You may also need to mention their relationship to the grantor or any additional relevant details.

07

Provide financial information: In this section, you will need to disclose the financial details of the trust. This includes the initial funding of the trust, any additional contributions, and investment details. Be sure to include accurate and up-to-date information.

08

Sign and date the form: Once you have completed all the necessary sections, carefully review the form for any errors or omissions. After verifying its accuracy, sign and date the form to certify its validity.

Who needs form 17 irrevocable trust?

01

Individuals planning for estate or asset protection: Form 17 irrevocable trust may be needed by individuals who wish to establish a legal arrangement for protecting their assets and ensuring their efficient distribution upon their passing.

02

Family members or beneficiaries: Those who expect to receive assets or financial benefits from an irrevocable trust, such as children, spouses, or other named beneficiaries, may need form 17 irrevocable trust to properly claim and manage their entitlements.

03

Legal professionals: Lawyers specializing in estate planning, trust administration, or tax law may require form 17 irrevocable trust to assist their clients in properly setting up or managing irrevocable trusts in accordance with applicable laws and regulations.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is form 17 irrevocable trust?

Form 17 irrevocable trust is a tax form used to report information about an irrevocable trust to the Internal Revenue Service (IRS).

Who is required to file form 17 irrevocable trust?

Any taxpayer who is the grantor, trustee, or beneficiary of an irrevocable trust is required to file form 17 irrevocable trust.

How to fill out form 17 irrevocable trust?

To fill out form 17 irrevocable trust, you will need to provide detailed information about the trust, its income, beneficiaries, and any distributions made.

What is the purpose of form 17 irrevocable trust?

The purpose of form 17 irrevocable trust is to ensure that the IRS has accurate information about the trust's income and beneficiaries for tax reporting purposes.

What information must be reported on form 17 irrevocable trust?

Information required to be reported on form 17 irrevocable trust includes the trust's name, EIN, income, deductions, and distributions.

Can I sign the form 17 irrevocable trust electronically in Chrome?

As a PDF editor and form builder, pdfFiller has a lot of features. It also has a powerful e-signature tool that you can add to your Chrome browser. With our extension, you can type, draw, or take a picture of your signature with your webcam to make your legally-binding eSignature. Choose how you want to sign your form 17 irrevocable trust and you'll be done in minutes.

Can I create an electronic signature for signing my form 17 irrevocable trust in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your form 17 irrevocable trust and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

How do I fill out the form 17 irrevocable trust form on my smartphone?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign form 17 irrevocable trust and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

Fill out your form 17 irrevocable trust online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form 17 Irrevocable Trust is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.