AU NSW A12-T2 2020 free printable template

Show details

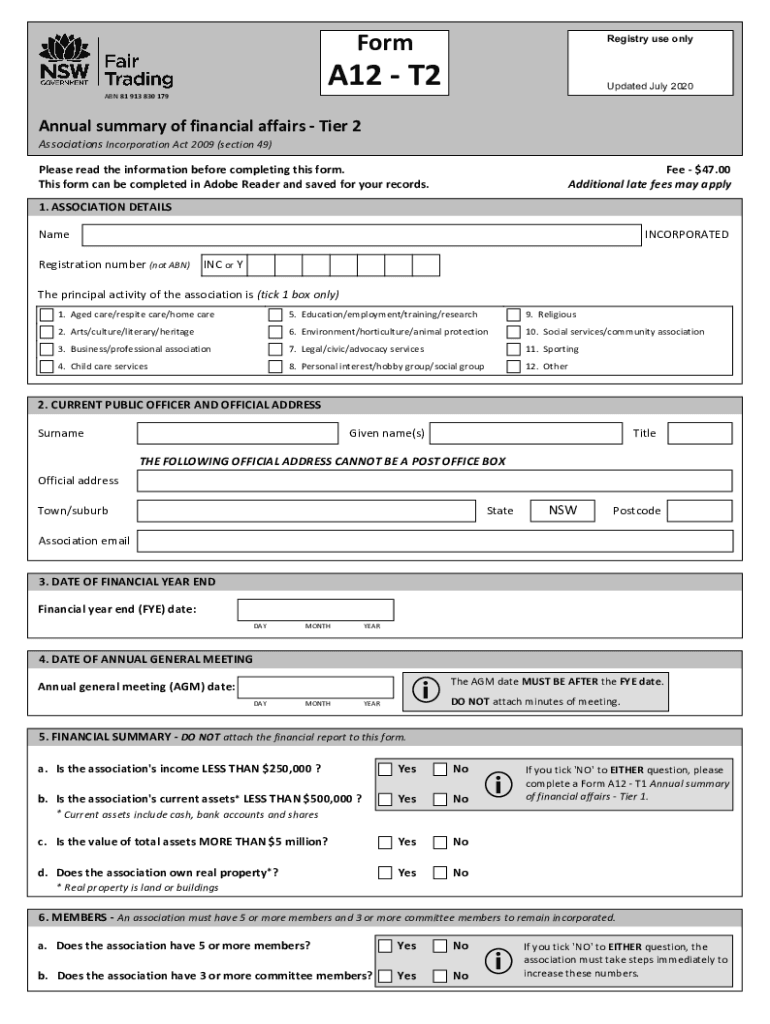

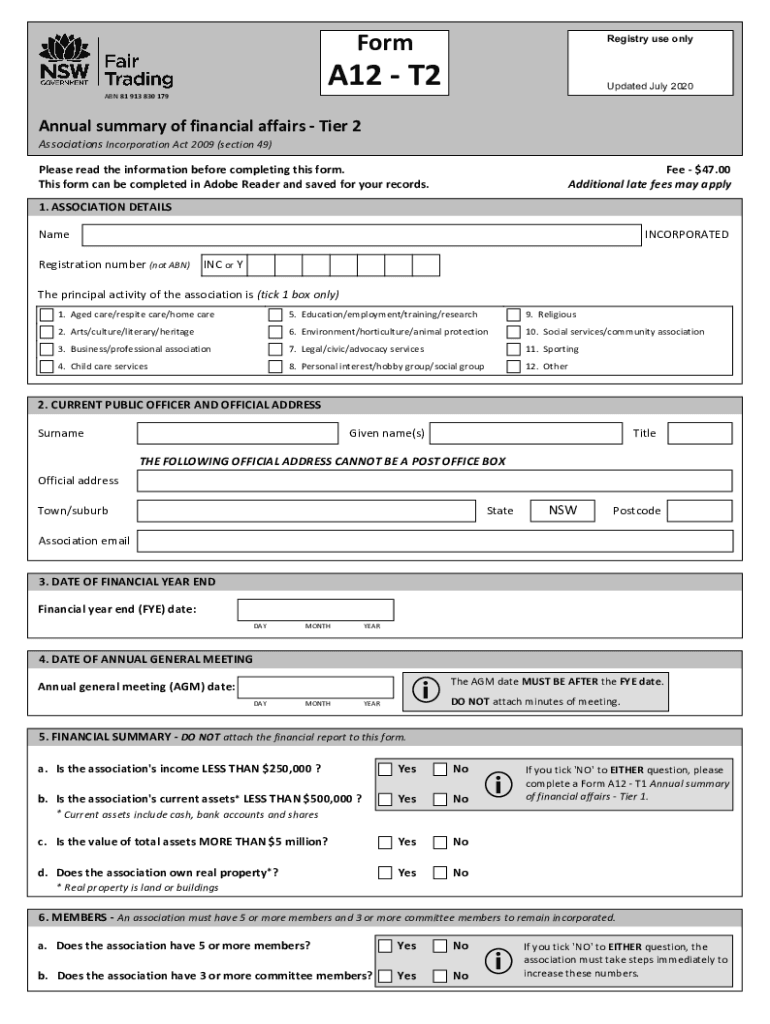

Annual summary of financial affairs Tier 2 Associations Incorporation Act 2009 (section 49)ABN 81 913 830 179Form A12 T2Updated July 2020Please read this information before completing this form. This

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign AU NSW A12-T2

Edit your AU NSW A12-T2 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your AU NSW A12-T2 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing AU NSW A12-T2 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit AU NSW A12-T2. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

The use of pdfFiller makes dealing with documents straightforward. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

AU NSW A12-T2 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out AU NSW A12-T2

How to fill out AU NSW A12-T2

01

Obtain the AU NSW A12-T2 form from the relevant authority or website.

02

Read the instructions carefully before starting to fill out the form.

03

Provide your personal details such as name, address, and contact information in the designated sections.

04

Fill in any required identification numbers, such as your driver's license or tax file number, as specified in the form.

05

Answer all relevant questions truthfully and thoroughly, following the prompts provided.

06

Include any necessary supporting documents as indicated in the form's instructions.

07

Review your completed form for accuracy and completeness before submission.

08

Submit the form through the appropriate method (online, by mail, or in person) as outlined in the guidelines.

Who needs AU NSW A12-T2?

01

Individuals who are applying for permits or licenses regulated by the NSW government.

02

Businesses or entities seeking to comply with NSW regulations.

03

Residents who need to report specific activities or changes in status to the government.

Fill

form

: Try Risk Free

People Also Ask about

How do I contact fair trading rental NSW?

Call 13 32 20 (8.30am to 5pm, Mon - Fri) From overseas, call +61 2 9895 0111 during the office hours above (GMT + 10 hours).

What does NSW Fair Trading do for consumers?

NSW Fair Trading is the state government agency responsible for protecting consumers' rights. We provide free assistance and information on shopping and renting rights. We can provide information to consumers about options to resolve disputes with traders and in some cases our staff can attempt to negotiate a solution.

What is the role of the office of Fair Trading in relation to real estate legislation in NSW?

Fair Trading's role in compliance NSW Fair Trading promotes a fair marketplace for consumers and traders by maximising traders' compliance with regulatory requirements. We safeguard consumer rights and investigate alleged breaches of the legislation we administer.

What are the three steps that the NSW Fair Trading recommends in resolving a consumer issue?

If you have a problem with a business, trader, landlord or tenant, these three steps may help you resolve it. Talk it over. Speak or write to your supplier and explain how you want the situation resolved. Find out more information. Make a complaint.

What role does NSW Fair Trading play in regulating the property industry?

Fair Trading's role in compliance NSW Fair Trading promotes a fair marketplace for consumers and traders by maximising traders' compliance with regulatory requirements. We safeguard consumer rights and investigate alleged breaches of the legislation we administer.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get AU NSW A12-T2?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the AU NSW A12-T2. Open it immediately and start altering it with sophisticated capabilities.

How do I edit AU NSW A12-T2 on an iOS device?

Use the pdfFiller mobile app to create, edit, and share AU NSW A12-T2 from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

How do I complete AU NSW A12-T2 on an Android device?

On an Android device, use the pdfFiller mobile app to finish your AU NSW A12-T2. The program allows you to execute all necessary document management operations, such as adding, editing, and removing text, signing, annotating, and more. You only need a smartphone and an internet connection.

What is AU NSW A12-T2?

AU NSW A12-T2 is a specific form used in New South Wales, Australia, for reporting certain financial or tax-related information required by the state's revenue department.

Who is required to file AU NSW A12-T2?

Businesses and individuals who meet certain criteria set by the New South Wales revenue authorities, usually pertaining to their income or financial transactions, are required to file AU NSW A12-T2.

How to fill out AU NSW A12-T2?

To fill out AU NSW A12-T2, you need to provide accurate financial details as per the instructions on the form, including your personal or business information, income details, and other relevant financial data.

What is the purpose of AU NSW A12-T2?

The purpose of AU NSW A12-T2 is to ensure that the New South Wales revenue authorities receive accurate information to assess tax obligations and compliance of the individuals or businesses filing the form.

What information must be reported on AU NSW A12-T2?

The information that must be reported on AU NSW A12-T2 typically includes income details, deductions, business expenses, and any other financial data required by the form's guidelines.

Fill out your AU NSW A12-T2 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

AU NSW a12-t2 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.