Get the free asset declaration bihar govt employee pdf download

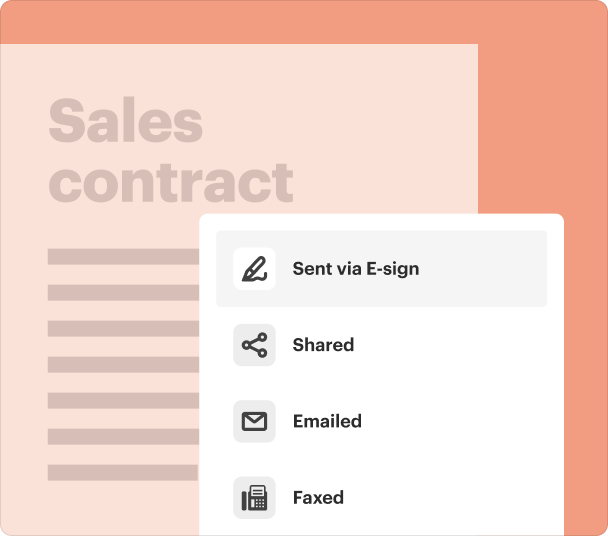

Fill out, sign, and share forms from a single PDF platform

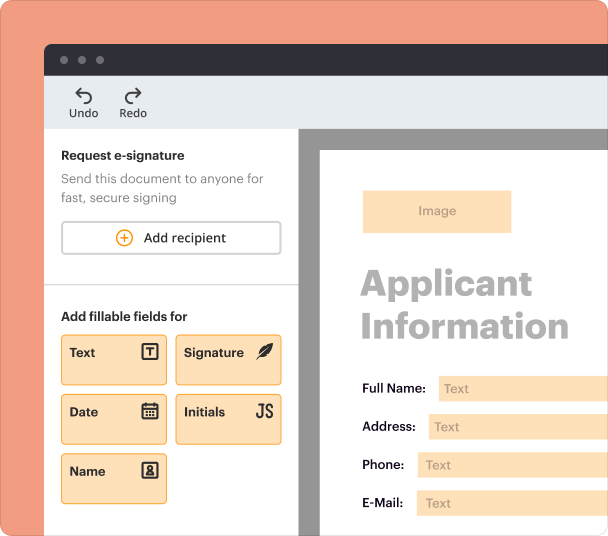

Edit and sign in one place

Create professional forms

Simplify data collection

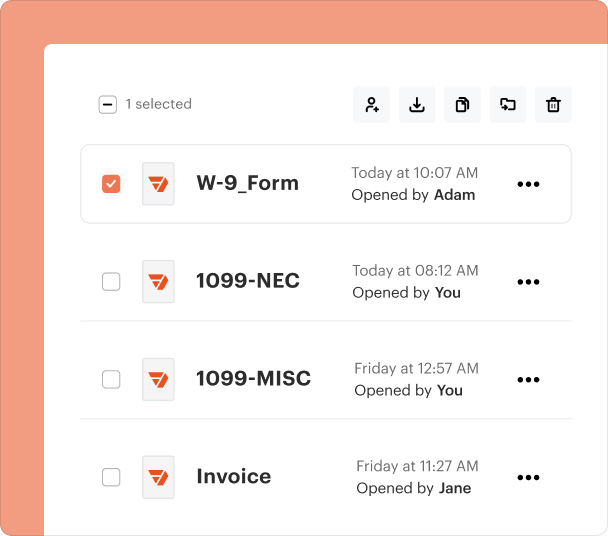

Manage forms centrally

Why pdfFiller is the best tool for your documents and forms

End-to-end document management

Accessible from anywhere

Secure and compliant

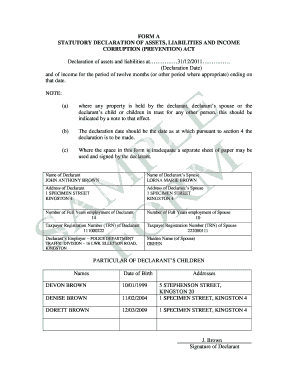

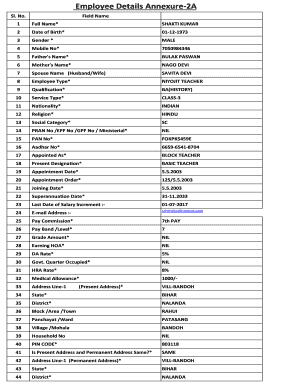

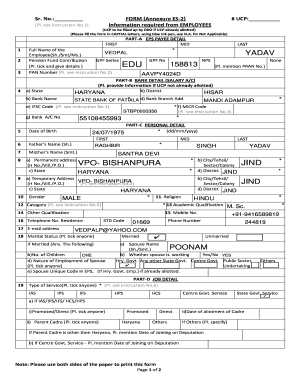

Detailed Guide on Asset Declaration Form for Bihar Government

The asset declaration Bihar govt form form is essential for government employees in Bihar to disclose their assets and liabilities. This submission plays a critical role in promoting transparency and integrity within the government sector.

When filling out this form, it's vital to adhere to guidelines and ensure accuracy to avoid legal repercussions. Understanding the nuances of the process will help streamline your submission.

What is the purpose of the asset declaration form?

The Asset Declaration Form in Bihar serves to collect information regarding the assets owned by government employees. Its main goal is to ensure accountability and prevent corruption by monitoring the wealth accumulation of public officials over time.

-

It encourages transparency within government ranks by having employees disclose all assets.

-

The initiative aims to deter corrupt practices by monitoring asset growth.

-

This practice builds public trust in the integrity of government operations.

Legally, every government employee must submit this form as part of their duties under the Bihar Government’s regulations.

Who needs to submit the asset declaration form?

Asset declaration submissions are mandatory for all Bihar government employees, including permanent, temporary, and contractual staff. This widespread requirement ensures that the asset disclosures are comprehensive and cover all areas associated with government service.

-

All permanent employees must declare their assets annually.

-

Even temporary or contractual employees are required to submit detailed asset reports.

-

Employees working in government-affiliated organizations also fall under this mandate.

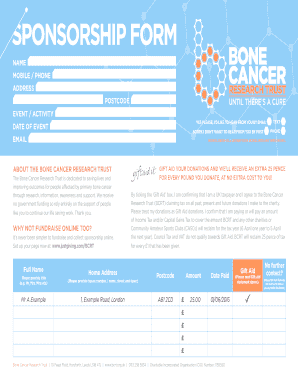

How to fill the asset declaration form correctly?

To correctly fill out the asset declaration form, follow these detailed instructions clearly. First, start with your personal details, including your designation, departmental affiliation, and identification number.

-

Double-check all entries to avoid discrepancies that could lead to penalties.

-

Detail all assets, including real estate, bank accounts, and investments.

-

Ensure you eSign the document digitally as required before submission.

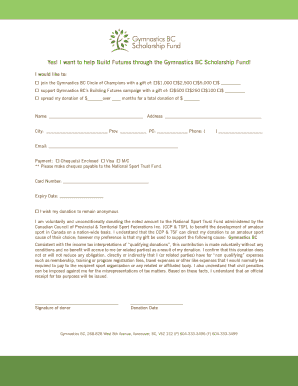

What formats are available for download?

The asset declaration form for the Bihar government is available in multiple formats, such as PDF and DOC. Each format presents unique advantages depending on user needs.

-

Ideal for preserving the original layout and preventing unauthorized edits.

-

Best for users who may want to edit the form easily before finalizing.

-

Utilize tools like pdfFiller to fill and edit forms online seamlessly.

What common challenges arise during the submission process?

Completing the asset declaration form can sometimes present various challenges for employees. Understanding these hurdles can help mitigate them effectively.

-

Omitting required details can lead to rejected applications.

-

Employees often miss deadlines due to lack of awareness or disregard.

-

Confusion can arise from unclear submission guidelines.

To counter these, always consult official channels and follow up with your department to ensure submission clarity.

What happens after you submit the asset declaration form?

Once submitted, the asset declaration form undergoes a review process within the relevant department. This typically involves verifying the information and checking compliance before acceptance.

-

Reviews may take several weeks depending on departmental workload.

-

You can check the status of your submission through official channels.

-

You will be informed of approval or required revisions.

What are the consequences of non-submission or inaccuracies?

Failure to submit the asset declaration form on time can lead to significant legal ramifications for individuals. This compliance is not merely a bureaucratic formality but an essential element of government integrity.

-

Non-compliance can incur fines or other penalties depending on the violation.

-

Discrepancies may trigger investigations by bodies such as the Lokayukta.

-

Continued failure to declare may jeopardize your position within the government.

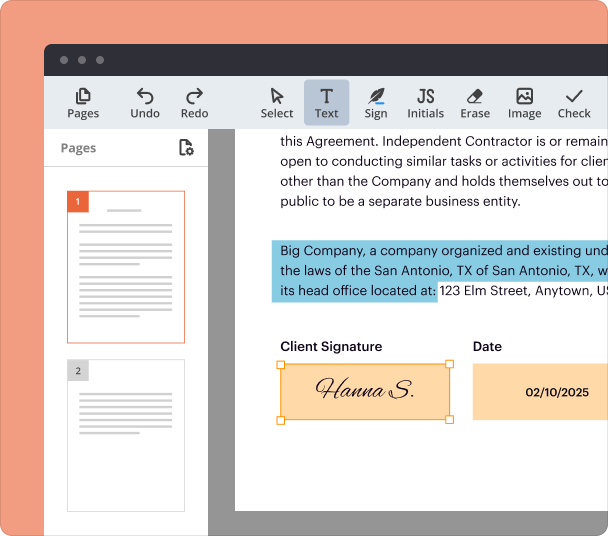

How can pdfFiller facilitate the asset declaration process?

pdfFiller offers a cloud-based platform that enhances the ease and efficiency of completing and managing documents, including the asset declaration form. This digital solution meets the growing need for accessible document management tools.

-

Users can edit forms directly in the app without needing to download them first.

-

You can eSign documents securely online, making the process faster.

-

Teams can work together on documents in real-time, streamlining the submission process.

Frequently Asked Questions about declaration of assets and liabilities bihar pdf form

What is the asset declaration form?

The asset declaration form is a document that government employees in Bihar must complete, detailing their assets and liabilities. It ensures accountability and prevents corruption within public service.

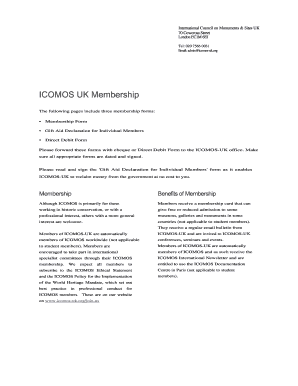

How do I download the asset declaration form?

The form is available for download in PDF and DOC formats from the official Bihar government website or specific portals like pdfFiller. Choose the format that best suits your needs.

What happens if I miss the submission deadline?

Missing the submission deadline can lead to legal penalties and potential disciplinary action. It is essential to be aware of deadlines and submit your form on time.

Can I edit the asset declaration form after filling it out?

Yes, you can edit the asset declaration form if you are using a platform like pdfFiller, which allows for seamless editing before final submission.

What do I do if I encounter issues during submission?

If you face any issues, reach out to your department’s HR or use official help lines. Having a clear understanding of submission guidelines can also help mitigate challenges.

pdfFiller scores top ratings on review platforms