TN HS-2997 2009 free printable template

Get, Create, Make and Sign TN HS-2997

Editing TN HS-2997 online

Uncompromising security for your PDF editing and eSignature needs

TN HS-2997 Form Versions

How to fill out TN HS-2997

How to fill out TN HS-2997

Who needs TN HS-2997?

Instructions and Help about TN HS-2997

How will income be determined for purposes of setting child support in Tennessee with child support parental income can include more than just earnings from employment what steps must you take to be ensured that all income is included for the other spouse when both parents are legally responsible for supporting their children each parents income is considered when calculating child support obligations' hi I'm miles Mason, and I'm a family lawyer and the founder of the miles Mason Family Law Group we represent clients in the greater Memphis Collierville and Germantown Tennessee areas in this video I'll explain how income is determined under the child support guidelines you may want to print a copy of the Tennessee child support worksheets and guidelines and follow along you have to begin with the state of Tennessee child support worksheet your completed worksheet provide to all the financial details of judge needs to enter child support orders in your case start there look it over get a feel for the information and the other and what the other parent must disclose as well what if there was a mistake what if all the parents' income wasn't reported in the worksheet what if a parent concealed income which was later brought to light after discovered income may be grounds to seek a modification in the courts' child support order whether the court will modify the order will depend on the circumstance in every case it's always best to accurately assess income when the child support is being established be diligent to go the extra mile to get it right the first time trying to fix a child support problem later on means lawyer fees court costs possible delays and a great deal of stress step 1 calculate each parent's monthly gross income both parents most monthly gross income must be reported in part 2 of the worksheet gross income includes income from any source whether that income is earned or unearned gross income is determined before taxes and other deductions are taken out in Tennessee child support law gross income is very inclusive and broadly defined that's to ensure that the child's benefits from the parents overall financial success here's a rule of thumb that maybe if there's a present or a future financial benefit then the source of that benefit may be considered income for child support you need to be thoughtful through this process a good place to begin looking for income sources it's the previous two to five years income tax returns w-2s and supporting documents for the tax returns also try and obtain and review the current year-to-date financial information and pay stub, but income tax returns seldom provide the whole story especially for self-employed parent what was the taxable income on a federal income tax return can be different from gross income for child support calculations gross income for child support can include and often does include income or benefits that went unreported on tax returns I'm going to list some income sources to...

People Also Ask about

What is the highest child support you can pay?

How much child support do you get for one child in Tennessee?

How long does it take for child support to start in Tennessee?

What is the maximum child support in Tennessee?

How does TN calculate child support?

How do I start child support in Tennessee?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit TN HS-2997 in Chrome?

Can I sign the TN HS-2997 electronically in Chrome?

Can I edit TN HS-2997 on an iOS device?

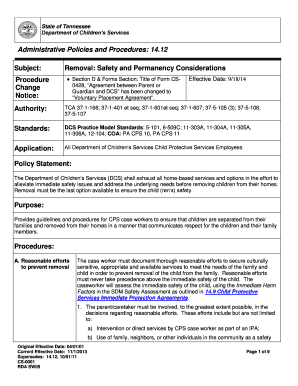

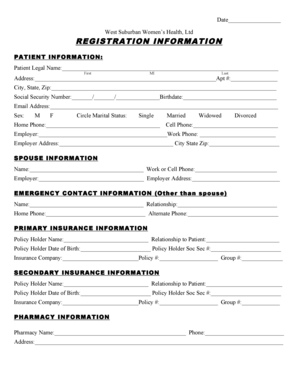

What is TN HS-2997?

Who is required to file TN HS-2997?

How to fill out TN HS-2997?

What is the purpose of TN HS-2997?

What information must be reported on TN HS-2997?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.