Get the free Enhanced Due Diligence Procedures for High-Risk Customers

Show details

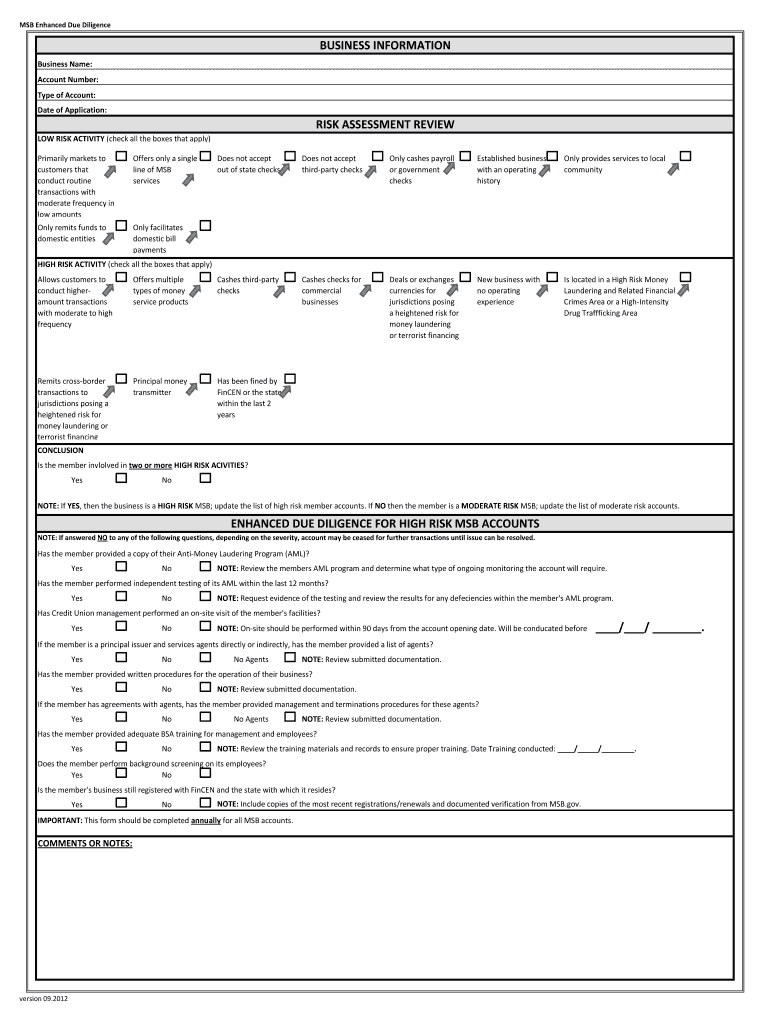

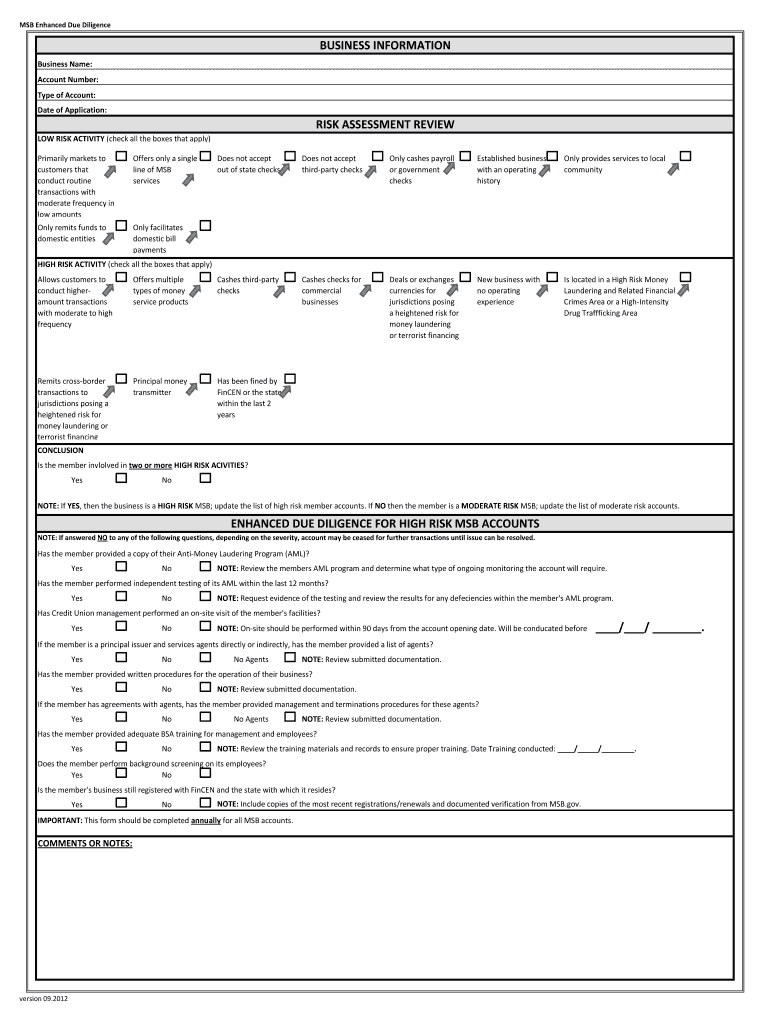

MSB Enhanced Due DiligenceBUSINESS INFORMATION

Business Name:

Account Number:

Type of Account:

Date of Application:RISK ASSESSMENT REVIEW

LOW RISK ACTIVITY (check all the boxes that apply)

Primarily

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign enhanced due diligence procedures

Edit your enhanced due diligence procedures form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your enhanced due diligence procedures form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit enhanced due diligence procedures online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit enhanced due diligence procedures. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out enhanced due diligence procedures

How to fill out enhanced due diligence procedures

01

Gather all the necessary information about the client, including their identity, address, and contact details.

02

Conduct a risk assessment to determine the level of due diligence required. This may involve considering factors such as the client's country of residence, profession, and business activities.

03

Verify the client's identity using reliable and independent sources, such as government-issued identification documents or trusted databases.

04

Obtain additional documentation to support the client's identity, such as proof of address or business registration certificates.

05

Conduct background checks on the client to assess their reputation and potential involvement in money laundering or terrorist financing.

06

Continuously monitor the client's activities and update the due diligence information as required.

07

Document all the steps taken during the enhanced due diligence process for future reference and compliance purposes.

Who needs enhanced due diligence procedures?

01

Enhanced due diligence procedures are typically required for high-risk clients or those engaged in high-risk activities.

02

Financial institutions, such as banks, investment firms, and money service businesses, are often required to perform enhanced due diligence.

03

Other businesses or individuals involved in sensitive industries, such as casinos, real estate agencies, or art dealers, may also need to implement enhanced due diligence measures.

04

Regulatory bodies or authorities may specifically mandate enhanced due diligence for certain types of transactions or customers.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my enhanced due diligence procedures directly from Gmail?

Using pdfFiller's Gmail add-on, you can edit, fill out, and sign your enhanced due diligence procedures and other papers directly in your email. You may get it through Google Workspace Marketplace. Make better use of your time by handling your papers and eSignatures.

Can I edit enhanced due diligence procedures on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share enhanced due diligence procedures from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.

How do I complete enhanced due diligence procedures on an Android device?

On an Android device, use the pdfFiller mobile app to finish your enhanced due diligence procedures. The program allows you to execute all necessary document management operations, such as adding, editing, and removing text, signing, annotating, and more. You only need a smartphone and an internet connection.

What is enhanced due diligence procedures?

Enhanced due diligence (EDD) procedures are comprehensive and more detailed investigations and assessments conducted by financial institutions and other entities to mitigate risks associated with high-risk customers, transactions, or geographical areas. EDD is employed to gain a clearer understanding of the customer's background and to identify and manage potential risks more effectively.

Who is required to file enhanced due diligence procedures?

Financial institutions, including banks, investment firms, and insurance companies, are typically required to file enhanced due diligence procedures when dealing with high-risk customers, politically exposed persons (PEPs), and transactions that involve higher potential for money laundering or terrorist financing.

How to fill out enhanced due diligence procedures?

Filling out enhanced due diligence procedures involves gathering detailed information about the customer, such as their identity, source of funds, nature of business, and any relevant documentation that supports this information. Institutions should also assess the customer's risk profile and document the findings and measures implemented to mitigate identified risks.

What is the purpose of enhanced due diligence procedures?

The purpose of enhanced due diligence procedures is to ensure compliance with regulatory requirements, minimize the risk of financial crime, provide a thorough understanding of high-risk customers, and implement appropriate risk management strategies to protect the institution from potential liabilities.

What information must be reported on enhanced due diligence procedures?

Enhanced due diligence procedures must report information such as the customer's identity, ownership structure, source of funds or wealth, transaction patterns, and any significant adverse information concerning the customer. Institutions must document their findings and the rationale for their risk assessments.

Fill out your enhanced due diligence procedures online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Enhanced Due Diligence Procedures is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.