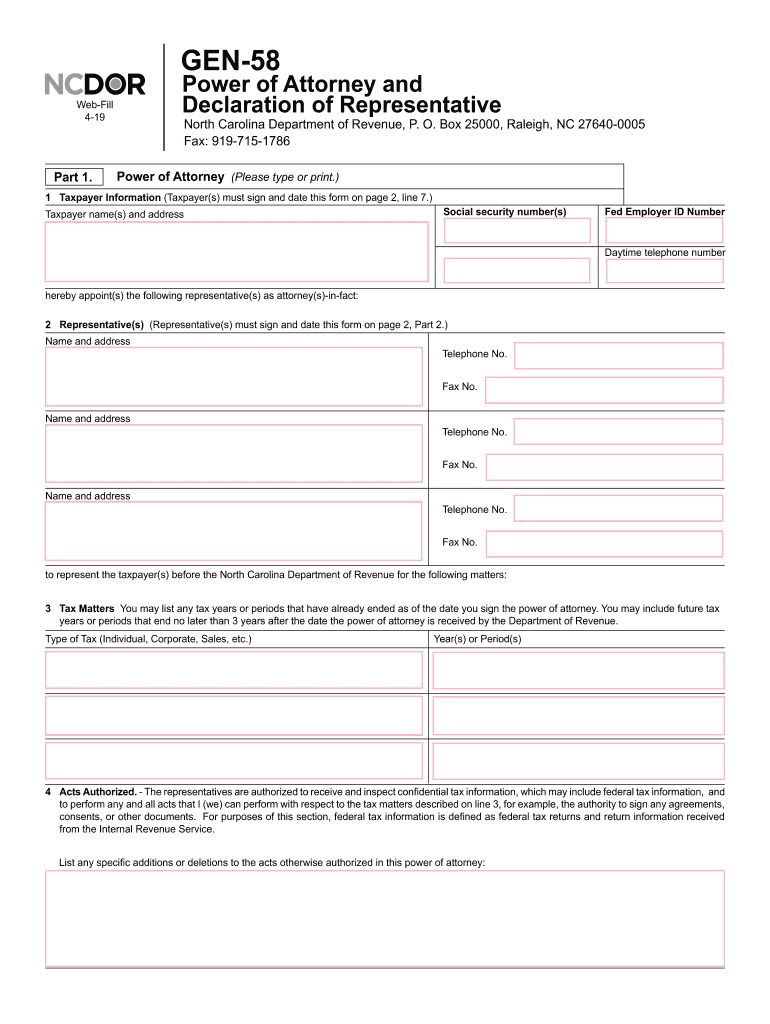

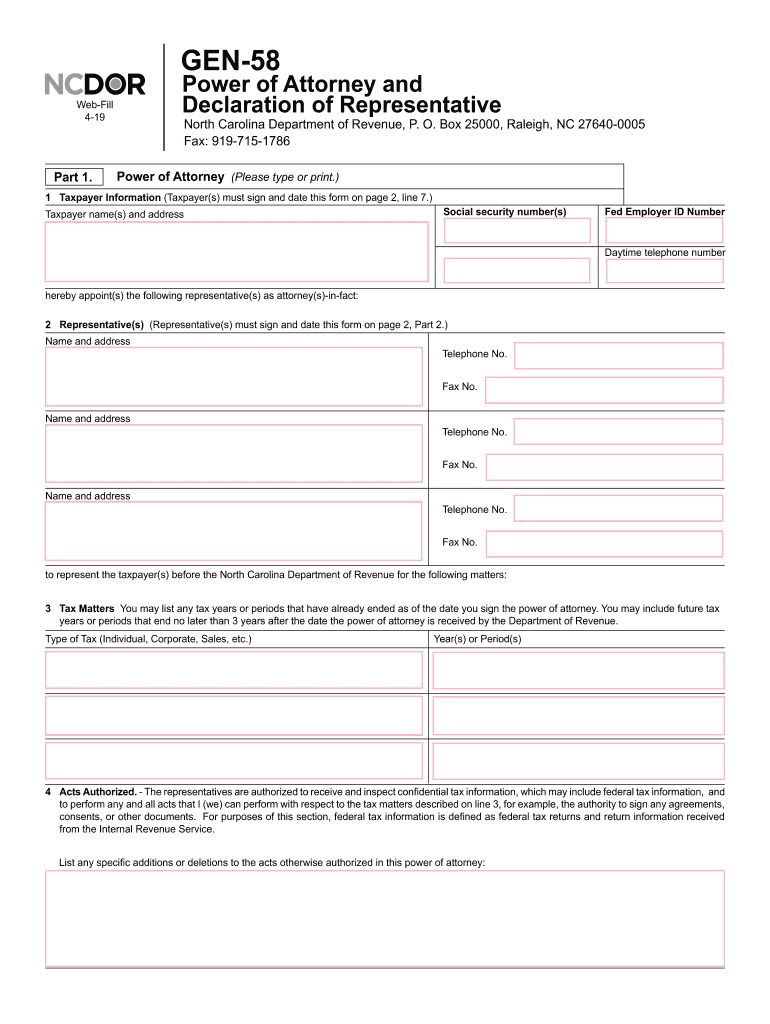

NC DoR GEN-58 2019 free printable template

Get, Create, Make and Sign gen 58 form

How to edit gen 58 pdf online

Uncompromising security for your PDF editing and eSignature needs

NC DoR GEN-58 Form Versions

How to fill out nc gen58 form

How to fill out NC DoR GEN-58

Who needs NC DoR GEN-58?

Video instructions and help with filling out and completing north carolina dor poa

Instructions and Help about gen 58 poa

Fiancée Visa Services dot contour Personal Immigration Guide Hi My name is Fred Wall I am a bonded immigration consultant with36 years of experience and a 100 success rate Today's topic is How To Bring your LaotianFiancee to the USA Your Laotian Fiancée needs permission Fromm thee US government to allow her to enter the USA This is called a K1 Fiancée visa First we work together to assemble a thick packet of forms evidences and civil documents This is required to demonstrate that you are eligible to apply and that your true agenda is a genuine life together not immigration fraud My signature philosophy is that a petition should be front loaded with high quality evidence of a bone FIDE relationship My front loaded petitions prepare the ways that your Fiancée will have an Easier interview The petition package is mailed to the United States Customs and Immigration Service USCIS takes about 4 to 5 months to review and approve When finished USCIS hands the case over tithe US State Department's National Visa Center Fiancée visa applications are held only briefly ATT NVC just long enough for NVC just long enough for NVC to assign a Vientiane case number and forward your file via diplomatic pouch to Laos Once her petition arrives in Laos the consulate will contact your fiancée advising when they have scheduled her interview Two weeks before her interview date she undergoes medical exam at one of the two approved Medical clinics either in Vientiane or UdornThailand Finally she attends the visa interview at the consulate in Vientiane to demonstrate she is of good moral character and the engagements Bone FIDE A week later a courier delivers her visa, and then she can join you in the USA I make the process sound simple But it's not It is easy to make rookie mistakes that can derail the entire process If you want it done right Guaranteed I can help This is Fred Wall your Personal ImmigrationGuide For a free copy of 120 Must Have InterviewQuestions visit Fiancée Visa Services dot com forwardSlash Free

People Also Ask about nc revenue form

How much tax should I withhold in NC?

How much NC state tax should be withheld?

What percent of tax should be withheld?

How do I register for withholding tax in North Carolina?

What is the power of attorney form for NC state taxes?

How do I submit power of attorney in NC?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the gen58 in Chrome?

How do I edit nc form representative straight from my smartphone?

How do I fill out NC DoR GEN-58 using my mobile device?

What is NC DoR GEN-58?

Who is required to file NC DoR GEN-58?

How to fill out NC DoR GEN-58?

What is the purpose of NC DoR GEN-58?

What information must be reported on NC DoR GEN-58?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.