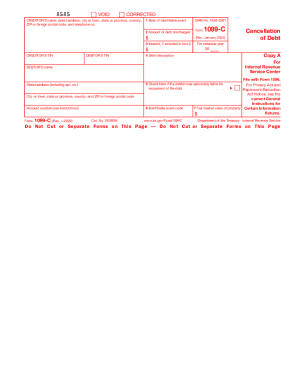

IRS 1099-C 2021 free printable template

Show details

Attention:

Copy A of this form is provided for informational purposes only. Copy A appears in red,

similar to the official IRS form. The official printed version of Copy A of this IRS form is

scalable,

pdfFiller is not affiliated with IRS

Instructions and Help about IRS 1099-C

How to edit IRS 1099-C

How to fill out IRS 1099-C

Instructions and Help about IRS 1099-C

How to edit IRS 1099-C

To edit the IRS 1099-C form, you may utilize pdfFiller's editing tools, which allow you to fill out, modify, and sign the form electronically. Access the document on pdfFiller, navigate to the editing section, and make the necessary changes. You can add or remove details, ensuring the form accurately reflects the financial information required for the tax year.

How to fill out IRS 1099-C

Filling out the IRS 1099-C form involves a few essential steps. First, gather important information such as the debtor's name, address, and the cancellation amount. Next, complete each relevant box on the form with the required details, ensuring you follow the IRS guidelines for accuracy.

01

Identify the debtor and creditor details.

02

Input the amount of debt discharged and any interest included.

03

Provide the identifiable number for the creditor.

About IRS 1099-C 2021 previous version

What is IRS 1099-C?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About IRS 1099-C 2021 previous version

What is IRS 1099-C?

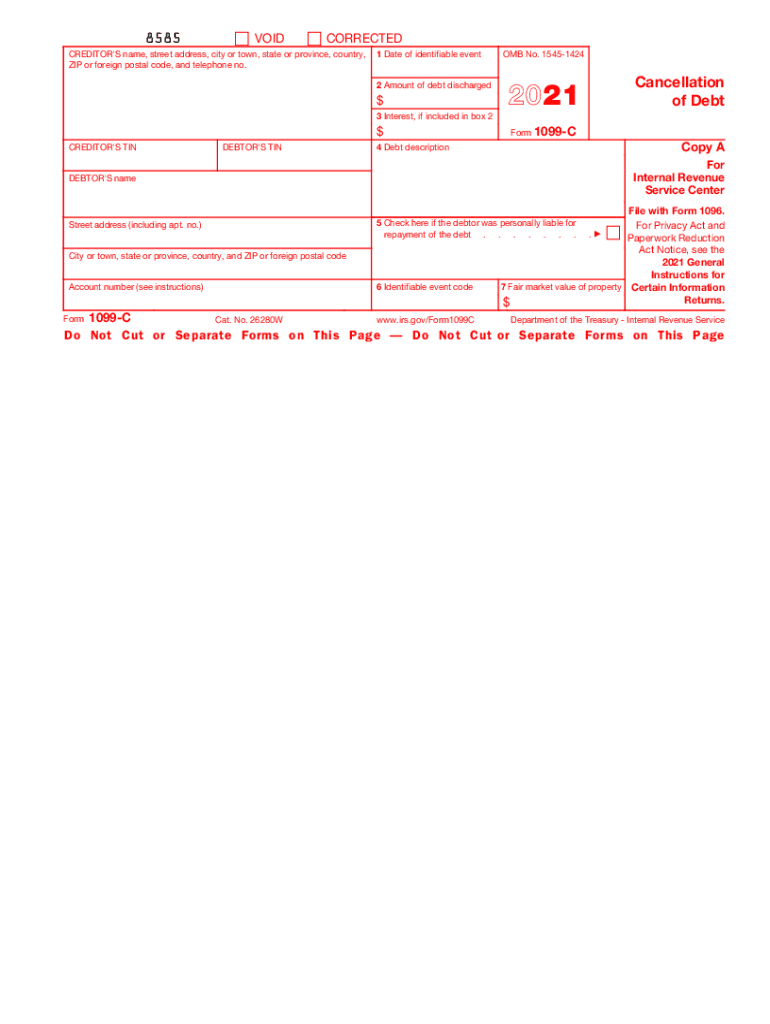

IRS 1099-C is a tax form used to report the cancellation of debt by a creditor. When a creditor discharges a debt of $600 or more, they must file this form, providing a record for the debtor and the IRS. The debtor may need to report this canceled debt as income on their tax return.

What is the purpose of this form?

The primary purpose of the IRS 1099-C form is to document the cancellation of debt, which can have significant tax implications for the debtor. This form informs the IRS that the debtor has received forgiveness for a debt, creating a basis for potential taxable income. Filers of the form must ensure that the provided information is accurate to prevent tax complications.

Who needs the form?

Creditors who cancel debts of $600 or more are required to issue the IRS 1099-C form to the debtor and file it with the IRS. This includes financial institutions, credit card companies, and other entities that forgive debt. Debtors who receive this form should keep it for their records and use it when filing their taxes.

When am I exempt from filling out this form?

You are exempt from filling out IRS 1099-C if the canceled debt is less than $600. Additionally, certain types of debt, such as qualified principal residence indebtedness, may have specific exclusions based on IRS regulations. Always check the latest IRS guidelines to determine if your situation qualifies for an exemption.

Components of the form

The IRS 1099-C form consists of several key components that need to be completed accurately. The form includes basic information like the creditor's name, address, and TIN (Taxpayer Identification Number), as well as details about the debtor, the amount of debt discharged, and the date of cancellation. Each section of the form is crucial for appropriate reporting and compliance.

What are the penalties for not issuing the form?

Failure to issue the IRS 1099-C form can result in penalties for the creditor. If they do not file the form on time, the IRS may impose a fine based on how late the form is submitted. This penalty emphasizes the importance of timely and accurate reporting in compliance with federal tax regulations.

What information do you need when you file the form?

When filing the IRS 1099-C form, you'll need specific information about the debtor and the canceled debt. This includes the debtor's name and taxpayer identification number, the amount of debt canceled, the date of cancellation, and the creditor's information. Collecting these details before completing the form ensures a smoother filing process.

Is the form accompanied by other forms?

The IRS 1099-C form typically does not need to be accompanied by additional forms. However, depending on the circumstances of the debt cancellation, the debtor may need to attach supporting documentation or additional tax forms when filing their tax return, especially if the canceled debt is subject to exceptions or exclusions.

Where do I send the form?

The IRS 1099-C form should be sent to the IRS and a copy should be provided to the debtor. The mailing address depends on the creditor's location and the specific IRS guidelines for the tax year in question. Always refer to the latest IRS instructions for details on where to send the form to ensure proper processing.

See what our users say