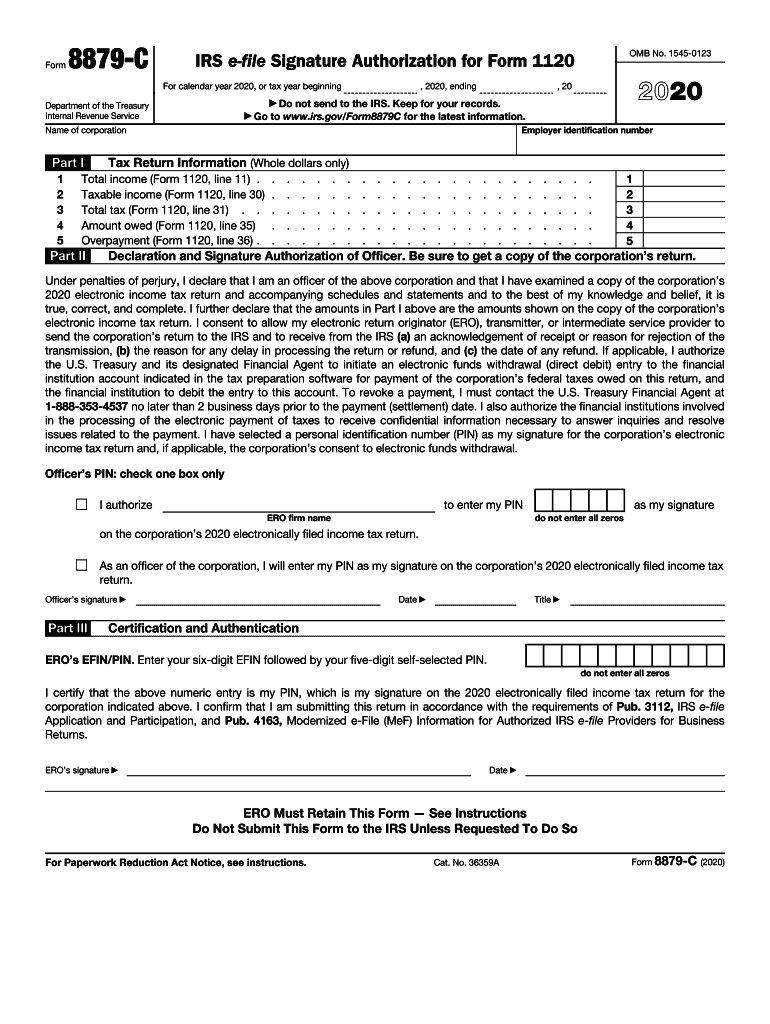

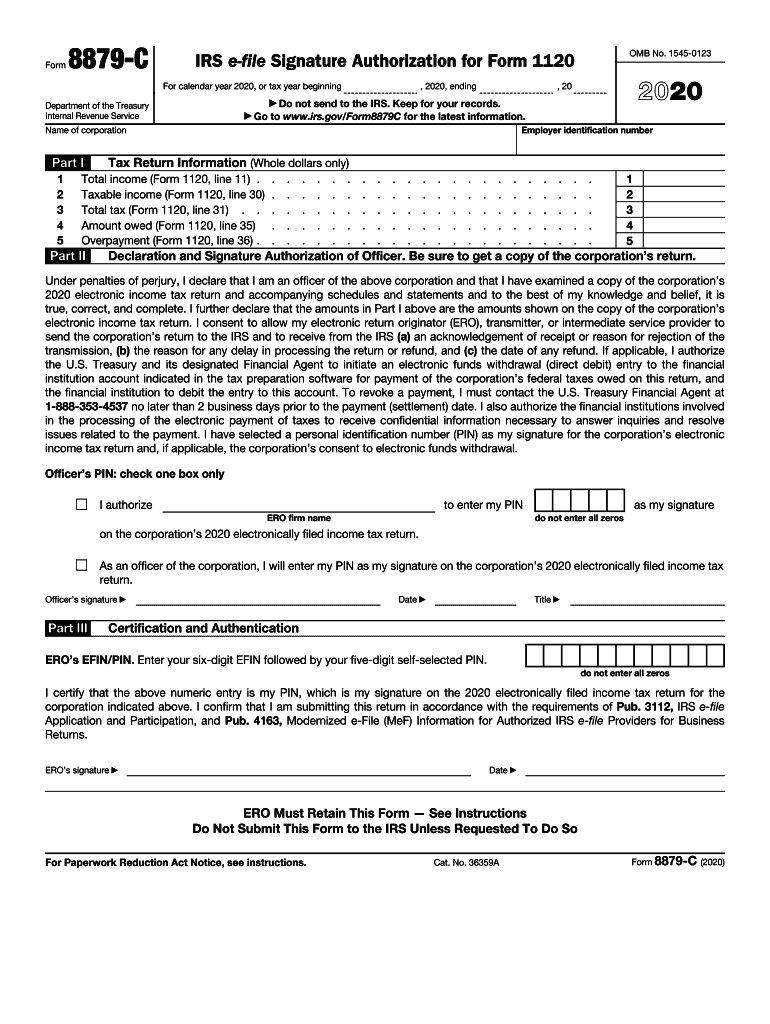

IRS 8879-C 2020 free printable template

Get, Create, Make and Sign IRS 8879-C

How to edit IRS 8879-C online

Uncompromising security for your PDF editing and eSignature needs

IRS 8879-C Form Versions

How to fill out IRS 8879-C

How to fill out IRS 8879-C

Who needs IRS 8879-C?

Instructions and Help about IRS 8879-C

Anthony were here today to talk about how to file an f bar you want to file an f bar to report your highest balance on foreign financial accounts you have a signatory interest on and what you're going to do is walk a step-by-step through the actual instructions that's right so and its also signatory authority or financial interest in, and you can have either one or both so where were going to want to go to show you the first place where you're going to go with that you'd be in the wrong place ok if you're getting a screen like this the BSA e-filing system and where it says welcome to the BSA e-filing system where ask for your user ID and enter your password that's in the wrong place your that is for were professionals like use of like us log into to access a file parser clients if you're an individual looking to file one yourself this is the page you're going to want to be on you're going to see the BSA e-filing system will have this link for you, so that's were going to want to see you're going to see two selections you can see which way you want to do it now what happens as most people go into the online form because there are some reasons why, but we recommend that you use a PDF form because you can save this PDF if you never need to make changes later on so its something we recommend now what happens a lot of times and this is very common with a lot of forms is your web browser will try to open up this PDF form in a browser, and you're going to get something that's going to frustrate you a little, and it's going to look like where is it here it's gonna look this is going to say please wait this message was eventually replaced by the proper contents of the document anyway here's the thing you need to open it an adobe reader ok that's the important thing however you get that done that is the important thing because it's going to be very different going to look very different from what we have there now let me get into our Adobe Reader and here we go we have the adobe reader f bar form ok and so were going to put in so were going to start this is the form that we want, so it says were going to put in smith f bar 2013 were actually just 2 2015 and first thing it does is it asks us if its being filed late select the reason violate world was assuming their 2015 on time its do June thirtieth of 2016 course next year those are going to be changing to the date your tax returns to give you a few different reasons why your you didn't have your filing late forgot the file did not know I had to file that account balances below reporting threshold do not know my account qualifies as foreign account statement not received in time count statement lost late receiving missing required account information unable to obtain joints about signature and time unable to access BSA e-filing system other provide explains explanation of below now filing a missing an old FR might be a simple thing were just following it, but there could be reasons where you might want to...

People Also Ask about

Who is eligible for IRS e-file?

What is California E-file?

What is e submission BIR?

Who is eligible for E-file?

What are the qualifications for the IRS Free File option?

How do I Efile my taxes in Malaysia?

How do I submit an e file tax return?

When can California e-file taxes?

What is Efile CA?

Does California Require E filing?

How do I submit my tax to LHDN?

How do I submit my tax return online Malaysia?

Can anyone e-file taxes?

How to file BIR 1701 online?

What is the purpose of E filing?

Can I Efile my tax return myself?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my IRS 8879-C in Gmail?

How can I send IRS 8879-C for eSignature?

How do I edit IRS 8879-C straight from my smartphone?

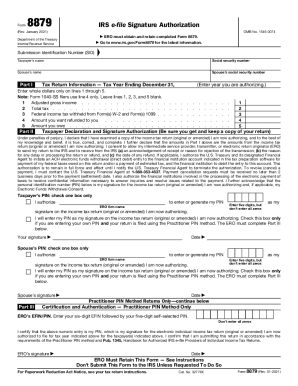

What is IRS 8879-C?

Who is required to file IRS 8879-C?

How to fill out IRS 8879-C?

What is the purpose of IRS 8879-C?

What information must be reported on IRS 8879-C?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.