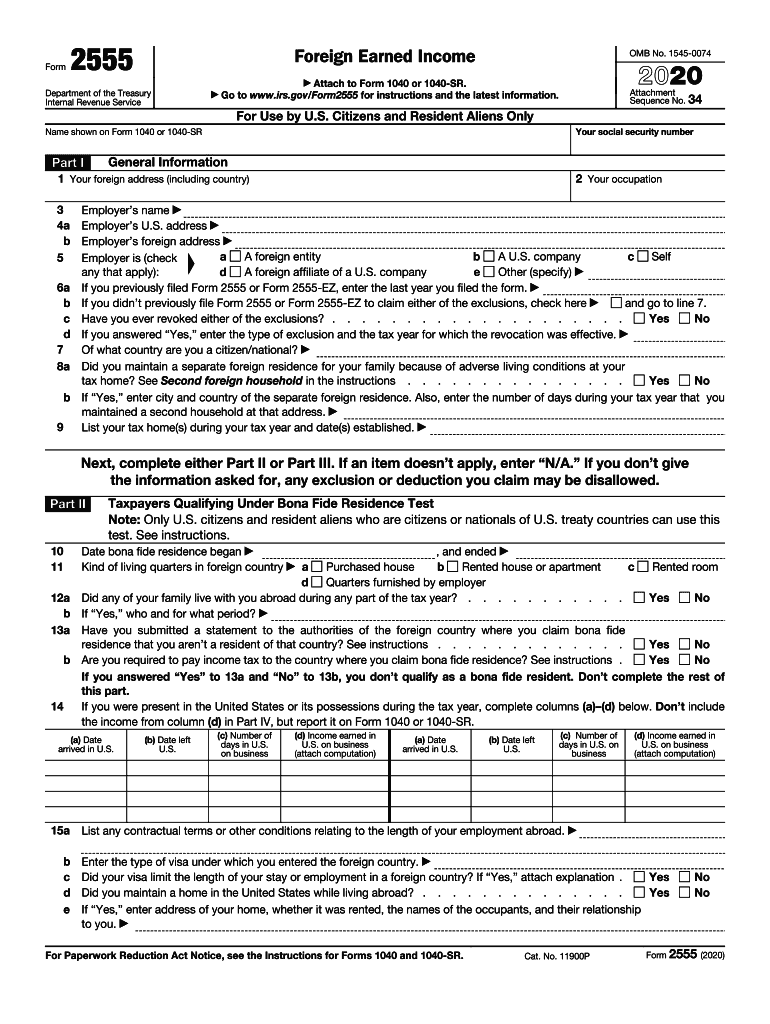

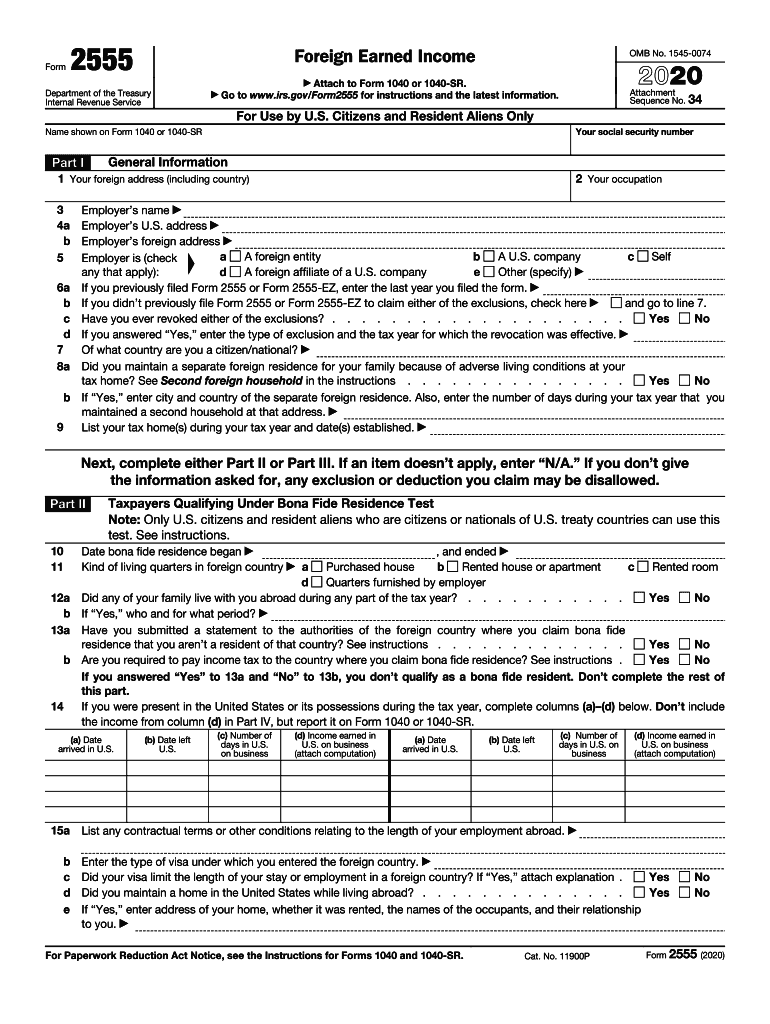

IRS 2555 2020 free printable template

Get, Create, Make and Sign IRS 2555

How to edit IRS 2555 online

Uncompromising security for your PDF editing and eSignature needs

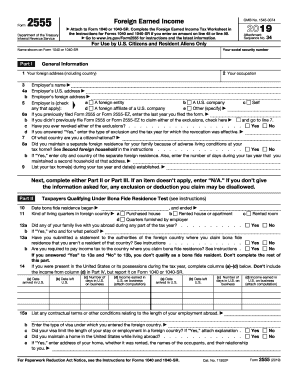

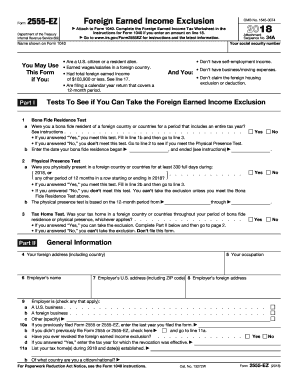

IRS 2555 Form Versions

How to fill out IRS 2555

How to fill out IRS 2555

Who needs IRS 2555?

Instructions and Help about IRS 2555

This video discusses form 2555 and the foreign earned income exclusion first we will briefly go over the requirements to claim the exclusion, and then we will review the form line by line to simplify the video we will not be going over the housing deduction which is generally applicable to self-employed individuals if you are a US citizen or an u.s. resident alien living in a foreign country you are subject to the same US income tax laws that apply to citizens and residents living in the United States however if you meet certain requirements you may be able to exclude up to a hundred and two thousand one hundred dollars of foreign earned income for 2017 you qualify for the foreign earned income exclusion if you have foreign earned income you meet the tax home test, and you meet either the bona fide residence test or the physical presence test foreign earned income generally means income you earn from services you performed in a foreign country where the employer is located and where the payment is made are not relevant to determine if the income is foreign income the term foreign country does not include u.s. possessions US...

People Also Ask about

Who qualifies for foreign earned income exclusion?

What is form 2555 EZ vs 2555?

What is form 2555-EZ?

What are forms 2555 and 2555-EZ used for?

What is form 1116 and form 2555?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit IRS 2555 from Google Drive?

How do I edit IRS 2555 online?

Can I edit IRS 2555 on an Android device?

What is IRS 2555?

Who is required to file IRS 2555?

How to fill out IRS 2555?

What is the purpose of IRS 2555?

What information must be reported on IRS 2555?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.