IRS 990 - Schedule I 2020 free printable template

Show details

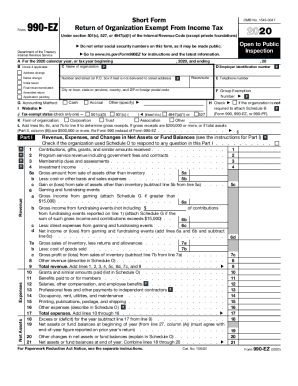

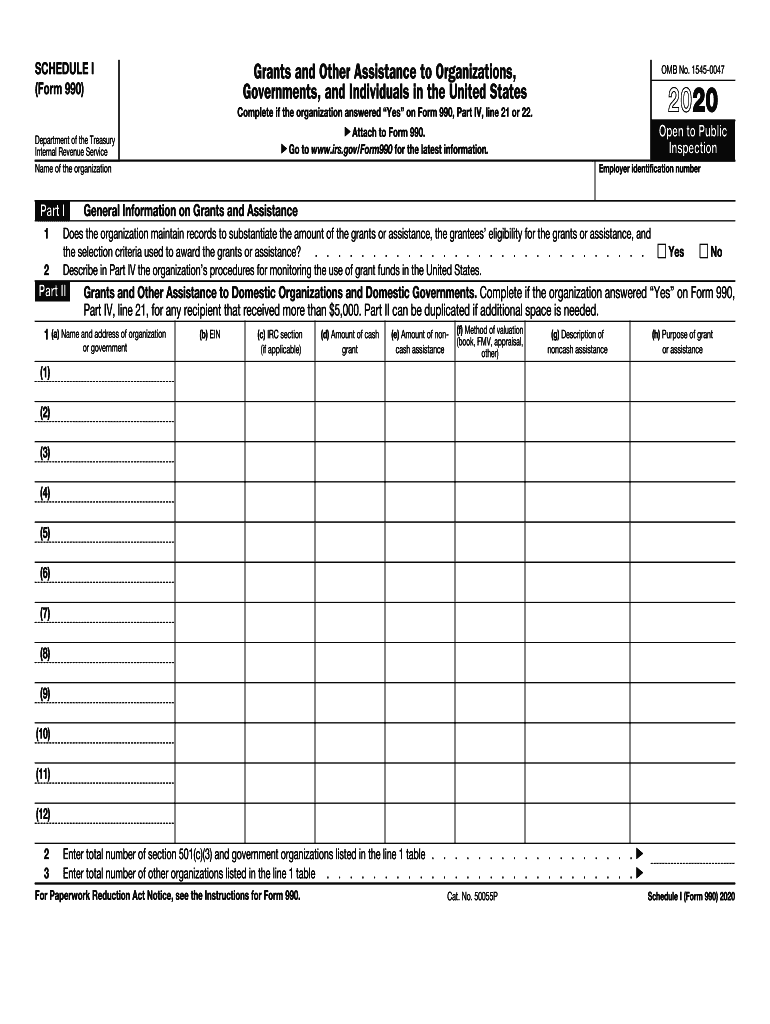

SCHEDULE I (Form 990)Grants and Other Assistance to Organizations, Governments, and Individuals in the United States1 22020Complete if the organization answered Yes on Form 990, Part IV, line 21 or

pdfFiller is not affiliated with IRS

Instructions and Help about IRS 990 - Schedule I

How to edit IRS 990 - Schedule I

How to fill out IRS 990 - Schedule I

Instructions and Help about IRS 990 - Schedule I

How to edit IRS 990 - Schedule I

To edit IRS 990 - Schedule I, use a PDF editing tool like pdfFiller. Start by uploading the form to the platform. You can then make necessary changes, such as updating financial information, correcting typos, or adding additional details. Ensure that all entries comply with IRS regulations to maintain accuracy before submission.

How to fill out IRS 990 - Schedule I

Filling out IRS 990 - Schedule I requires accurate financial information regarding the organization’s revenue and expenses. Begin with identifying the primary activity of your organization. Then, accurately report contributions, program service revenue, and any other inflow of financial resources. Follow each section meticulously to ensure all necessary data is included.

01

Collect all relevant financial records.

02

Complete each applicable section based on your organization's activities.

03

Review for accuracy before submission.

About IRS 990 - Schedule I 2020 previous version

What is IRS 990 - Schedule I?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

Due date

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About IRS 990 - Schedule I 2020 previous version

What is IRS 990 - Schedule I?

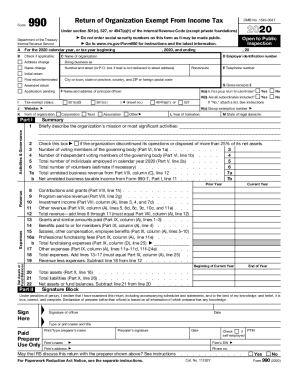

IRS 990 - Schedule I is a supplementary form used by tax-exempt organizations to provide essential information regarding their contributions, donations, and revenue streams. This form is specifically designed to assist in reporting various financial activities and ensures compliance with U.S. tax laws. Organizations must accurately report revenues to offer transparency on their funding sources.

What is the purpose of this form?

The purpose of IRS 990 - Schedule I is to capture detailed financial data that helps the IRS understand the revenue sources of tax-exempt organizations. It assists in identifying how these organizations are funded and if they operate within the limits mandated by tax law. This information is critical for maintaining tax-exempt status and ensuring proper oversight.

Who needs the form?

Organizations that are required to file Form 990 are also required to submit Schedule I. This typically includes charities, non-profits, and other tax-exempt entities. Smaller organizations with gross receipts below a certain threshold may be exempt from filing this form. However, larger organizations must ensure that they provide detailed financial information through Schedule I.

When am I exempt from filling out this form?

You may be exempt from filling out IRS 990 - Schedule I if your organization qualifies as a small tax-exempt group, typically with gross receipts below $200,000 and total assets under $500,000. Additionally, specific classifications of organizations, like churches and certain governmental entities, might not be required to complete this schedule. Always consult IRS guidelines to confirm your exemption status.

Components of the form

IRS 990 - Schedule I comprises various components, including sections for reporting contributions, program service revenue, and expenses. Each section must be filled accurately to reflect the financial activities of the organization. The detailed reporting allows for complete transparency and accountability, ensuring compliance with IRS regulations.

Due date

The due date for submitting IRS 990 - Schedule I coincides with the Form 990 deadline, which is the 15th day of the 5th month after the close of the organization’s fiscal year. This means if your organization operates on a calendar year basis, the due date would be May 15th of the following year. Organizations seeking an extension can file for Form 8868, which extends the deadline by six months.

What are the penalties for not issuing the form?

Failing to submit IRS 990 - Schedule I can result in significant penalties. The IRS imposes a penalty of $20 per day for each day the form remains unfiled, up to a maximum of $10,500. Continuing to neglect this requirement can jeopardize the organization’s tax-exempt status and lead to further scrutiny from the IRS.

What information do you need when you file the form?

When filing IRS 990 - Schedule I, you will need detailed financial information, including total contributions received, grants made, program service revenues, and any other pertinent financial activities. Additionally, ensuring that you have the organization’s Employer Identification Number (EIN) handy is vital for accurate processing. Double-check all provided figures for correctness before submitting.

Is the form accompanied by other forms?

IRS 990 - Schedule I usually accompanies Form 990. Depending on the specific circumstances of the organization, it may also be submitted alongside several other schedules, such as Schedule G or Schedule B, if applicable. Ensure all relevant forms are completed accurately to provide a full picture of the organization’s financial health.

Where do I send the form?

IRS 990 - Schedule I should be mailed to the appropriate IRS address based on your organization's location. The required mailing address can be found on the IRS website or in the instructions accompanying Form 990. Be sure to send the form to the correct address to avoid delays in processing.

See what our users say