Get the free Making the Commercial Credit Decision. Plan, Process & Execute

Show details

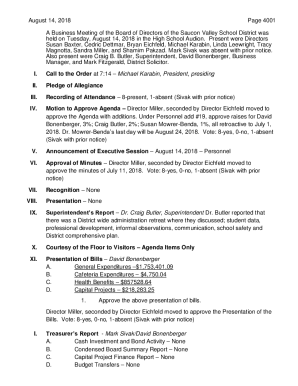

WASHINGTON BANKERS ASSOCIATIONRole of the Credit Analyst in

Commercial Banks

Credit Analyst Development Program

Jeffery W. Johnson

Bankers Insight Group, LLC jeffery.johnson@bankersinsight.com

7708464511www.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign making form commercial credit

Edit your making form commercial credit form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your making form commercial credit form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit making form commercial credit online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit making form commercial credit. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out making form commercial credit

How to fill out making form commercial credit

01

Step 1: Start by collecting all the necessary information such as business details, financial statements, and borrower credit history.

02

Step 2: Fill out the application form by providing accurate information about the borrower's business, including its legal name, address, contact details, and tax identification number.

03

Step 3: Provide detailed financial information about the business, including its annual revenue, expenses, assets, and liabilities.

04

Step 4: Include the purpose of the commercial credit, such as funding an expansion project, purchasing inventory, or refinancing existing debt.

05

Step 5: Attach any supporting documents required by the lender, such as bank statements, balance sheets, income statements, or business plans.

06

Step 6: Review the filled-out form for any mistakes or missing information before submitting it to the lender.

07

Step 7: Submit the completed form along with the supporting documents to the designated department or person responsible for processing commercial credit applications.

08

Step 8: Wait for the lender's response, which may involve further inquiries, negotiations, or a decision on whether to approve the commercial credit application.

09

Step 9: If approved, carefully review the terms and conditions of the commercial credit agreement before signing it.

10

Step 10: Fulfill any additional requirements or conditions specified by the lender, such as providing collateral, personal guarantees, or insurance coverage, if applicable.

Who needs making form commercial credit?

01

Businesses in need of financing for various purposes such as expanding operations, purchasing equipment or inventory, managing cash flow, or taking advantage of business opportunities.

02

Entrepreneurs or startups looking to fund their business ventures or launch new products or services.

03

Established companies facing temporary financial difficulties or seeking refinancing options.

04

Retailers or wholesalers needing credit to stock up on inventory for seasonal sales or promotional events.

05

Manufacturers or suppliers requiring credit to fund raw materials or manufacturing processes.

06

Real estate developers or investors seeking credit for property acquisitions or development projects.

07

Service providers or professionals needing working capital to cover operating expenses and bridge revenue gaps.

08

Any entity with a legitimate business purpose and the ability to repay the commercial credit according to the agreed-upon terms and conditions.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete making form commercial credit online?

Completing and signing making form commercial credit online is easy with pdfFiller. It enables you to edit original PDF content, highlight, blackout, erase and type text anywhere on a page, legally eSign your form, and much more. Create your free account and manage professional documents on the web.

Can I create an eSignature for the making form commercial credit in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your making form commercial credit directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

How do I complete making form commercial credit on an iOS device?

Install the pdfFiller iOS app. Log in or create an account to access the solution's editing features. Open your making form commercial credit by uploading it from your device or online storage. After filling in all relevant fields and eSigning if required, you may save or distribute the document.

What is making form commercial credit?

Making form commercial credit refers to the process of creating or applying for a type of credit intended for business purposes, which may include loans, lines of credit, or other financial products specifically designed to support commercial activities.

Who is required to file making form commercial credit?

Businesses and commercial entities that seek to obtain credit or financing are typically required to file making form commercial credit. This may include sole proprietorships, partnerships, corporations, and other organizations.

How to fill out making form commercial credit?

To fill out making form commercial credit, applicants must provide accurate business information, including financial statements, business plans, and personal information of the owners or partners. Detailed instructions should be followed according to the specific form required by the lending institution.

What is the purpose of making form commercial credit?

The purpose of making form commercial credit is to evaluate the creditworthiness of a business seeking financial assistance, ensuring that the lender can assess risks associated with extending credit.

What information must be reported on making form commercial credit?

The information that must be reported generally includes business financial statements, tax returns, ownership details, purpose of the credit, projected revenue, and any existing debts or obligations.

Fill out your making form commercial credit online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Making Form Commercial Credit is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.