Get the free Credit Analysis Advancedpmd - North Dakota Bankers Association

Show details

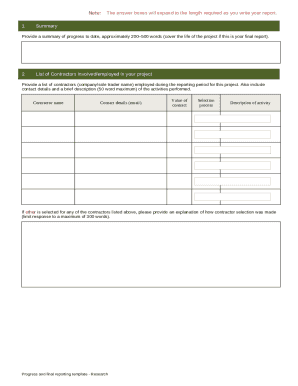

Advanced Credit Analysis and Business Financing November 1617, 2010 Radisson Hotel, Bismarck ND About the Program Highlights This program has been designed to provide credit analysts and business

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign credit analysis advancedpmd

Edit your credit analysis advancedpmd form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your credit analysis advancedpmd form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit credit analysis advancedpmd online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit credit analysis advancedpmd. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out credit analysis advancedpmd

How to fill out credit analysis advancedpmd?

01

Start by gathering all the necessary financial information and documentation required for a credit analysis. This may include income statements, balance sheets, cash flow statements, and other relevant financial documents.

02

Assess the creditworthiness of the borrower by analyzing their financial statements and identifying any red flags or areas of concern. Look for factors such as debt levels, profitability, liquidity, and cash flow stability.

03

Evaluate the borrower's repayment capacity by analyzing their ability to generate sufficient cash flow to meet their debt obligations. Consider factors such as operating cash flow, debt service coverage ratio, and interest coverage ratio.

04

Assess the borrower's collateral and security position. Evaluate the value and quality of the collateral offered to secure the credit. Consider factors such as loan-to-value ratio and any existing liens or encumbrances on the collateral.

05

Analyze the borrower's industry and market conditions. Assess the industry's growth prospects, competitive landscape, and potential risks that may impact the borrower's ability to repay the credit.

06

Evaluate the borrower's management and governance structure. Look for experienced management with a track record of successfully managing financial obligations.

07

Conduct a thorough risk assessment of the borrower, taking into account any external factors such as regulatory changes, economic conditions, or geopolitical risks that may impact the borrower's creditworthiness.

08

Summarize your findings and make a credit recommendation based on your analysis. Provide details on the borrower's creditworthiness, repayment capacity, collateral quality, industry risks, and any mitigating factors.

09

Communicate your credit analysis report to the relevant stakeholders, such as senior management, credit committees, and any other parties involved in the decision-making process.

10

Regularly review and update your credit analysis as new information becomes available or circumstances change.

Who needs credit analysis advancedpmd?

01

Financial institutions such as banks and credit unions need credit analysis to assess the creditworthiness of borrowers and make informed lending decisions.

02

Corporate finance departments may require credit analysis to evaluate the creditworthiness of potential business partners, suppliers, or customers.

03

Investors and asset managers may use credit analysis to assess the credit risk of potential investments and determine appropriate investment strategies.

04

Credit rating agencies rely on credit analysis to assign credit ratings to issuers of debt securities, providing investors with an unbiased assessment of credit risk.

05

Regulatory authorities use credit analysis to monitor and evaluate the financial stability and solvency of financial institutions within their jurisdiction.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the credit analysis advancedpmd in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your credit analysis advancedpmd.

Can I edit credit analysis advancedpmd on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign credit analysis advancedpmd on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

How do I fill out credit analysis advancedpmd on an Android device?

On an Android device, use the pdfFiller mobile app to finish your credit analysis advancedpmd. The program allows you to execute all necessary document management operations, such as adding, editing, and removing text, signing, annotating, and more. You only need a smartphone and an internet connection.

What is credit analysis advancedpmd?

Credit analysis advancedpmd is a detailed assessment of a company's financial health, creditworthiness, and ability to repay loans.

Who is required to file credit analysis advancedpmd?

Financial institutions, lenders, and credit agencies are required to file credit analysis advancedpmd.

How to fill out credit analysis advancedpmd?

Credit analysis advancedpmd can be filled out by providing detailed financial information, credit history, and analysis of the company's financial statements.

What is the purpose of credit analysis advancedpmd?

The purpose of credit analysis advancedpmd is to evaluate the risk of lending money to a company, determine credit terms, and assist in making informed lending decisions.

What information must be reported on credit analysis advancedpmd?

Information such as company financial statements, credit history, debt levels, cash flow projections, and industry trends must be reported on credit analysis advancedpmd.

Fill out your credit analysis advancedpmd online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Credit Analysis Advancedpmd is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.