Get the free RETIREMENT PRODUCTS

Show details

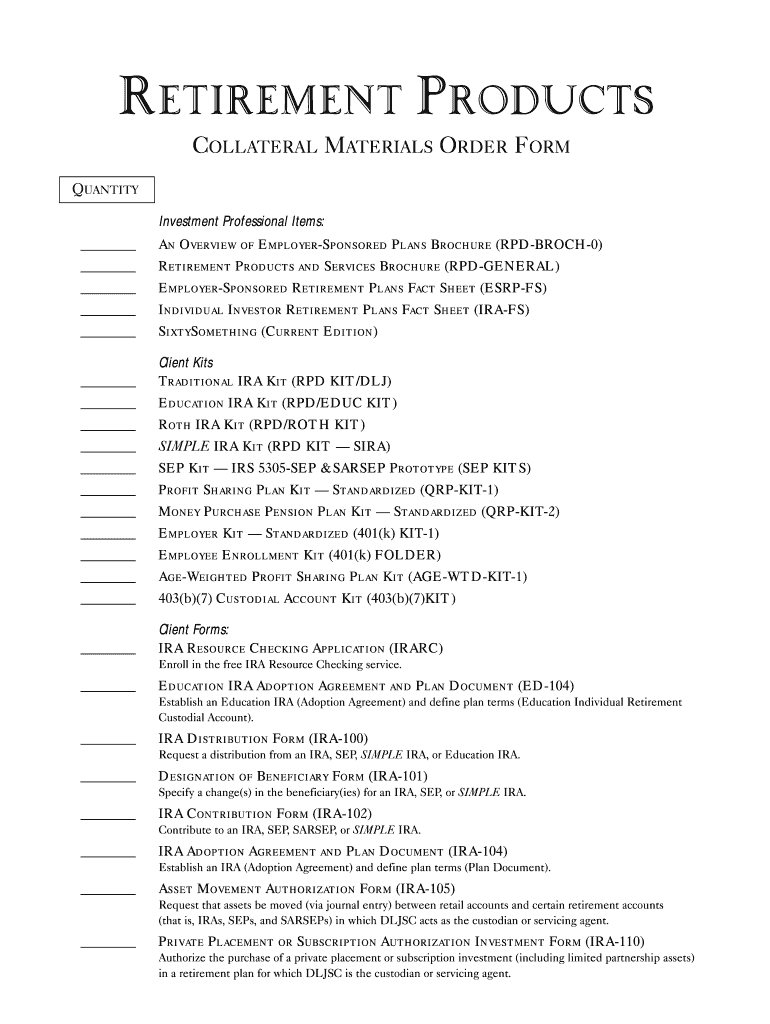

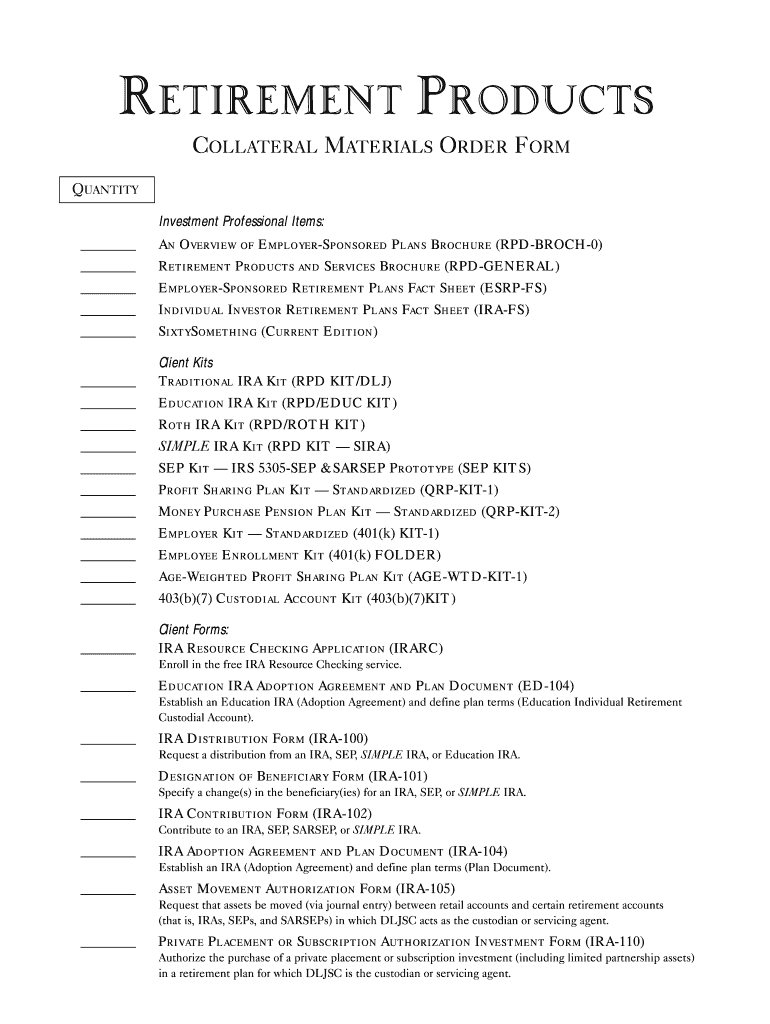

RETIREMENT PRODUCTS COLLATERAL MATERIALS ORDER FORM QUANTITY Investment Professional Items: An Overview of Employer-Sponsored Plans Brochure (RPD-BROCH-0) Retirement Products and Services Brochure

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign retirement products

Edit your retirement products form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your retirement products form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing retirement products online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit retirement products. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out retirement products

How to fill out retirement products:

01

Gather necessary information: Start by collecting all the relevant information such as personal identification details, employment history, and current financial situation. This will help you accurately fill out the retirement product application form.

02

Determine your retirement objectives: Before filling out the retirement product application, it is important to have a clear understanding of your retirement goals. Consider factors such as desired retirement age, lifestyle expectations, and financial targets. This will guide you in selecting the appropriate retirement product that aligns with your objectives.

03

Research retirement products: Familiarize yourself with different retirement products available in the market. Study their features, benefits, and restrictions. This will help you make an informed decision regarding which retirement product best suits your needs. Consider options such as 401(k) plans, individual retirement accounts (IRAs), annuities, or pension plans.

04

Seek professional advice: If you find the retirement product landscape overwhelming, consider consulting a financial advisor or retirement planner. They can provide personalized guidance based on your specific situation and goals. Their expertise can help ensure that you understand the implications and potential risks associated with the retirement product you choose.

05

Fill out the application accurately: Once you have chosen the retirement product that suits your needs, carefully complete the application form. Double-check all the information you provide to ensure accuracy. Any mistakes or omissions could lead to delays or potential issues in the future.

Who needs retirement products:

01

Individuals nearing retirement age: Retirement products are particularly beneficial for individuals who are approaching their retirement age and want to secure their financial future. These products provide a way to accumulate and grow funds over time, ensuring a steady income during retirement.

02

Young professionals: Even if retirement seems far away, it is never too early to start planning for it. By investing in retirement products at a young age, individuals can take advantage of compounding returns and long-term growth potential. Starting early allows for a larger nest egg and a more comfortable retirement.

03

Self-employed individuals: For self-employed individuals, retirement products offer a way to save and invest for retirement since they do not have access to employer-sponsored retirement plans. They provide an avenue for self-employed individuals to build a retirement fund and enjoy the same benefits as those with traditional employment.

04

Employees with employer-sponsored plans: While some employees may have access to employer-sponsored retirement plans such as 401(k)s or pensions, it is still important to evaluate additional retirement product options. These additional products can serve as supplemental savings to further bolster your retirement nest egg.

In summary, filling out retirement products involves gathering necessary information, clarifying retirement objectives, researching different options, seeking professional advice if needed, and accurately completing the application form. Retirement products are beneficial for individuals nearing retirement age, young professionals, self-employed individuals, and even those with access to employer-sponsored plans.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send retirement products to be eSigned by others?

retirement products is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

How can I fill out retirement products on an iOS device?

Make sure you get and install the pdfFiller iOS app. Next, open the app and log in or set up an account to use all of the solution's editing tools. If you want to open your retirement products, you can upload it from your device or cloud storage, or you can type the document's URL into the box on the right. After you fill in all of the required fields in the document and eSign it, if that is required, you can save or share it with other people.

How do I fill out retirement products on an Android device?

Use the pdfFiller Android app to finish your retirement products and other documents on your Android phone. The app has all the features you need to manage your documents, like editing content, eSigning, annotating, sharing files, and more. At any time, as long as there is an internet connection.

What is retirement products?

Retirement products are financial products designed to help individuals save and invest for their retirement.

Who is required to file retirement products?

Employers and financial institutions are required to file retirement products on behalf of their employees or customers.

How to fill out retirement products?

Retirement products can be filled out electronically or on paper, following the instructions provided by the relevant authority.

What is the purpose of retirement products?

The purpose of retirement products is to help individuals save and invest for their retirement in order to have financial security in their later years.

What information must be reported on retirement products?

Retirement products must include information such as contributions, earnings, withdrawals, and other relevant financial details.

Fill out your retirement products online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Retirement Products is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.