Get the free SEP IRAs, SIMPLE IRAs, Roth IRAs, and Education IRAs

Show details

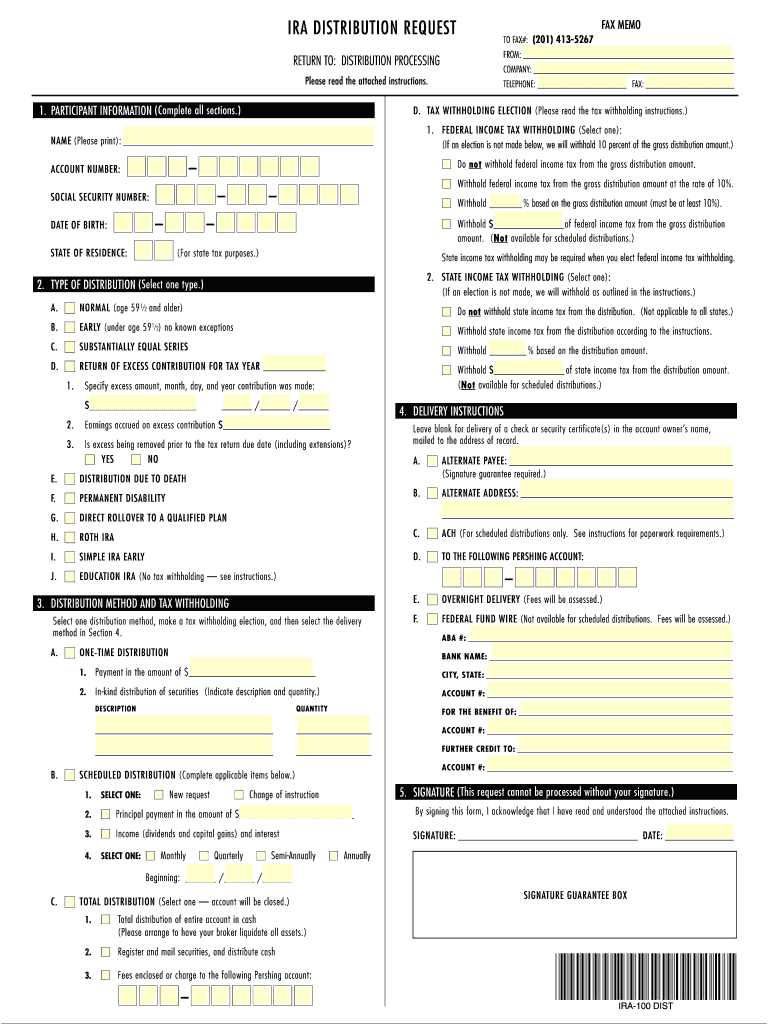

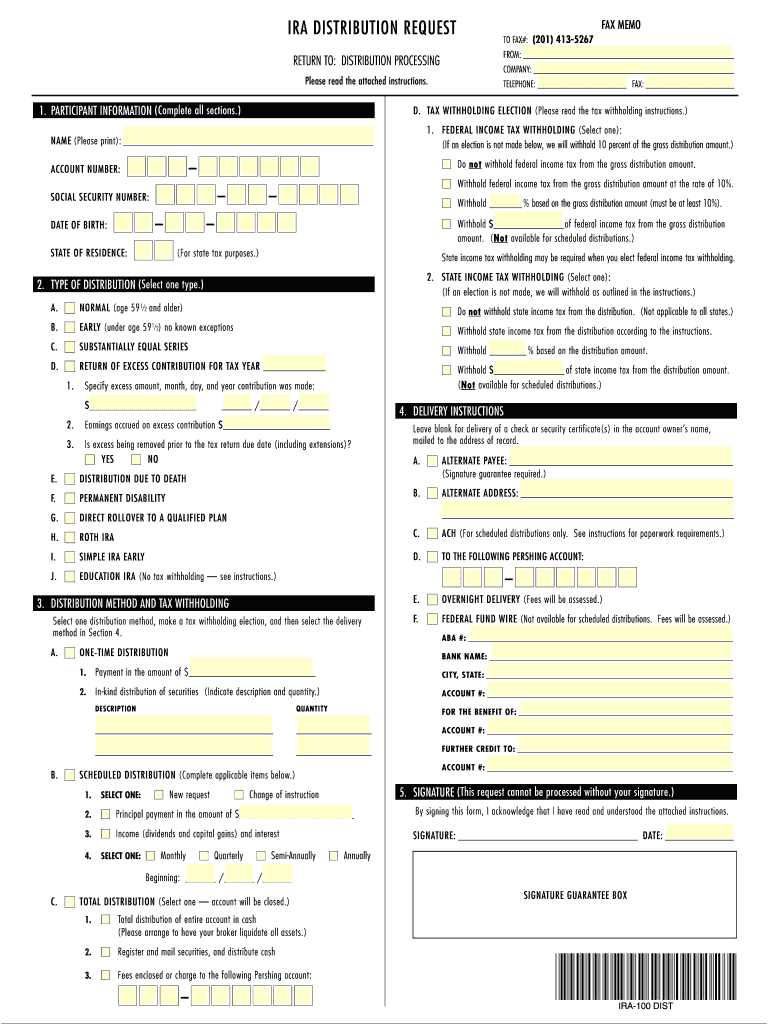

IRA DISTRIBUTION REQUEST Use this form to request a distribution of assets from Traditional IRAs, SEP IRAs, SIMPLE IRAs, Roth IRAs, and Education IRAs PLEASE BE AWARE OF THE FOLLOWING WHEN COMPLETING

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign sep iras simple iras

Edit your sep iras simple iras form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your sep iras simple iras form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit sep iras simple iras online

Follow the guidelines below to benefit from a competent PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit sep iras simple iras. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out sep iras simple iras

How to fill out SEP IRAs and Simple IRAs:

01

Determine eligibility: Before filling out SEP IRAs or Simple IRAs, it's important to check if you are eligible to make contributions to these retirement plans. SEP IRAs are available for self-employed individuals or small business owners, while Simple IRAs are typically offered by employers with 100 or fewer employees.

02

Gather necessary information: Collect all the required information and documents that will be needed to fill out the application or enrollment forms. This may include personal details, employment information, tax identification numbers, and financial information.

03

Select a financial institution: Decide on a financial institution or provider where you want to open your SEP IRA or Simple IRA. Research different options and compare fees, investment options, and customer reviews to ensure you choose a reputable and suitable provider.

04

Complete application/enrollment forms: Fill out the application or enrollment forms provided by the chosen financial institution. Provide accurate and up-to-date information to avoid any delays or issues in the process.

05

Determine contribution amount: Determine the amount you wish to contribute to your SEP IRA or Simple IRA. For SEP IRAs, self-employed individuals can contribute up to 25% of their net earnings from self-employment, while for Simple IRAs, employees can contribute up to $13,500 (2021 limit) or $16,500 for those aged 50 or older.

06

Review and submit: Review all the information provided in the application or enrollment forms, ensuring its accuracy and completeness. Double-check all the necessary details before submitting the forms to avoid any potential errors or oversights.

Who needs SEP IRAs and Simple IRAs:

01

Self-employed individuals: SEP IRAs are particularly beneficial for self-employed individuals who want to save for retirement while enjoying potential tax advantages. It provides flexibility in contribution amounts and allows them to contribute as both an employer and employee.

02

Small business owners: SEP IRAs and Simple IRAs are popular retirement plan options for small business owners. They are relatively easy to set up and maintain, making them suitable for employers with a few employees.

03

Employees of eligible employers: Simple IRAs are specifically designed for employees working in small businesses that meet certain criteria. If you work for an employer with 100 or fewer employees and they offer a Simple IRA, you may benefit from participating in the plan to save for your retirement.

In summary, filling out SEP IRAs and Simple IRAs involves determining eligibility, gathering necessary information, selecting a financial institution, completing application/enrollment forms accurately, determining contribution amounts, reviewing the information, and submitting the forms. These retirement plan options are beneficial for self-employed individuals, small business owners, and employees working for eligible employers.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send sep iras simple iras for eSignature?

Once your sep iras simple iras is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

How do I edit sep iras simple iras online?

The editing procedure is simple with pdfFiller. Open your sep iras simple iras in the editor, which is quite user-friendly. You may use it to blackout, redact, write, and erase text, add photos, draw arrows and lines, set sticky notes and text boxes, and much more.

Can I create an eSignature for the sep iras simple iras in Gmail?

Create your eSignature using pdfFiller and then eSign your sep iras simple iras immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

What is sep iras simple iras?

SEP IRAs (Simplified Employee Pension Individual Retirement Accounts) and SIMPLE IRAs (Savings Incentive Match Plan for Employees) are retirement savings plans for small businesses and self-employed individuals.

Who is required to file sep iras simple iras?

Employers with employees who meet certain eligibility criteria must establish and contribute to SEP IRAs or SIMPLE IRAs.

How to fill out sep iras simple iras?

Employers can set up SEP IRAs and SIMPLE IRAs through financial institutions and provide necessary information to the employees to participate.

What is the purpose of sep iras simple iras?

The purpose of SEP IRAs and SIMPLE IRAs is to provide a retirement savings vehicle for employees of small businesses and self-employed individuals.

What information must be reported on sep iras simple iras?

Information such as employee contributions, employer contributions, and investment earnings must be reported on SEP IRAs and SIMPLE IRAs.

Fill out your sep iras simple iras online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Sep Iras Simple Iras is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.