NY NYCERS F302 2020-2025 free printable template

Show details

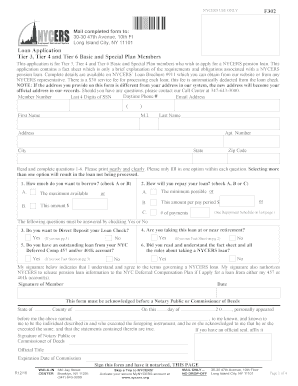

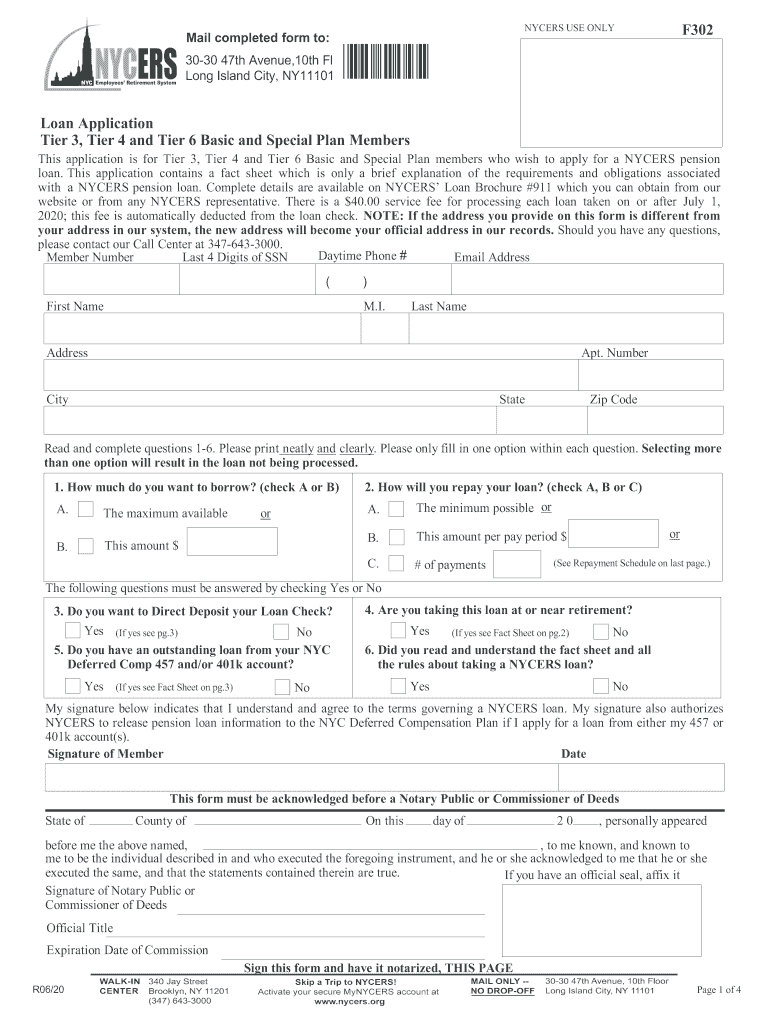

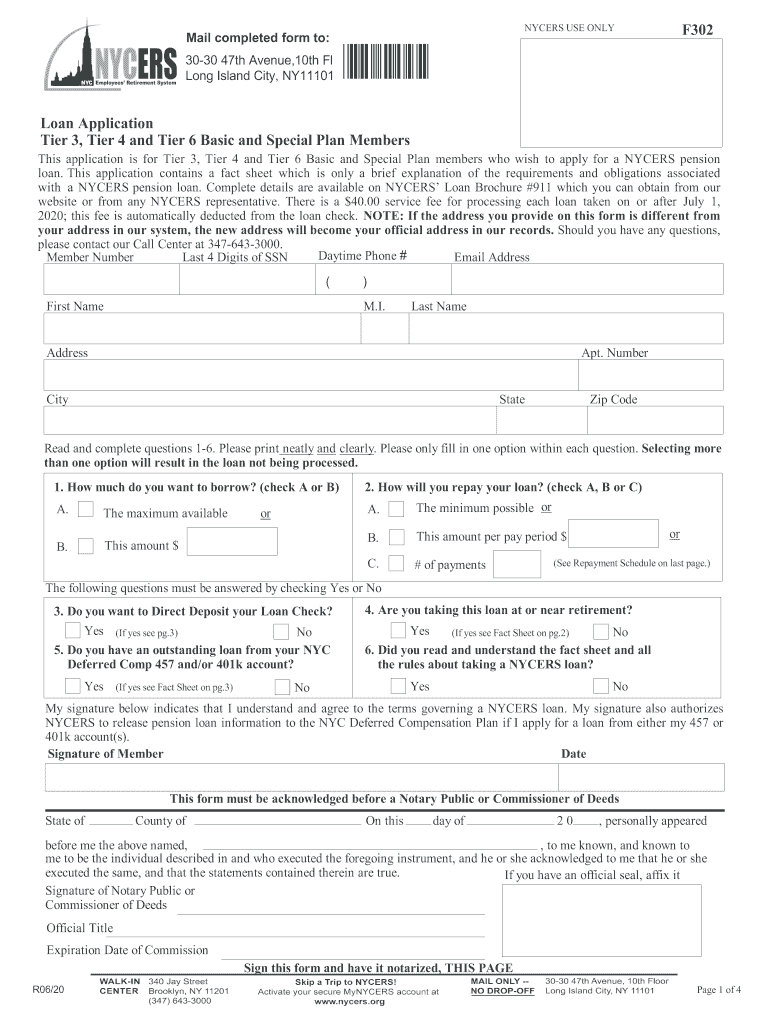

This application is for Tier 3, Tier 4 and Tier 6 Basic and Special Plan members who wish to apply for a NYCERS pension loan, detailing requirements, loan terms, and repayment options.

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign nycers loan fillable form

Edit your nycers loan application printable form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your nycers loan application 4 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing nycers f302 loan blank online

Follow the guidelines below to benefit from a competent PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit nycers f302 loan blank. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NY NYCERS F302 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out nycers f302 loan blank

How to fill out NY NYCERS F302

01

Obtain the NY NYCERS F302 form from the NYCERS website or your local NYCERS office.

02

Read the instructions carefully before filling out the form to understand all requirements.

03

Fill in your personal information at the top of the form, including your name, address, and member number.

04

Complete the employment section by providing details about your job position and the agency you work for.

05

Attach any necessary documentation to support your application, if required.

06

Review your entries for accuracy and completeness before submitting.

07

Sign and date the form at the bottom.

08

Submit the completed form to the designated address listed in the instructions.

Who needs NY NYCERS F302?

01

Employees of New York City who are members of the NYCERS pension system.

02

Individuals applying for retirement benefits or those seeking to make updates to their retirement accounts.

03

City workers who need to report changes in their employment status or personal information.

Video instructions and help with filling out and completing nycers f302 loan blank

Instructions and Help about nycers f302 loan blank

Fill

form

: Try Risk Free

People Also Ask about

Can you borrow money from pension fund?

Pension loans are legally allowed in many cases, but plan sponsors determine whether they're allowed. If your employer does allow loans, it will likely be limited to a percentage of the balance up to a fixed amount.

How much pension loan can I get?

Maximum Loan Amount: Age up to 70 years: Rs. 10 lakh or 18 times of Net Monthly Pension (For Defence pensioners, 20 times net monthly pension), whichever is lower. Age above 70 years and up to 75 years: Rs 7.50 lakh or 18 times their Net Monthly Pension (20 times in case of Defence Pensioners), whichever is lower.

Who is eligible for NYCERS?

Generally, NYCERS membership is open to all employees of the City of New York and Participating Employers except those who are eligible for membership in the Police or Fire Department pension fund, or the Teachers or Board of Education retirement system.

How long does it take to process a NYCERS loan?

Once you submit your application, NYCERS will process it in approximately 10 business days (or, if you are applying in advance, within 10 days after your eligibility date). If you apply online and select EFT, your loan will be processed in three (3) business days.

What type of pension is NYCERS?

NYCERS is a defined benefit retirement plan. Defined benefit retirement plans for public sector employees offer benefits which are defined in law. Generally, retirement allowances payable from such plans are based on a member's years of service, age and compensation base.

Can you borrow against your pension?

Pension loans are unregulated in the United States. Lump-sum loans as an advance on your pension may result in unfair payment plans. The Consumer Financial Protection Bureau (CFPB) warns customers of taking out loans against their pensions. Most pension plans are protected if you are forced to file for bankruptcy.

What is the maximum loanable amount for pension loan program?

The loan amount that may be availed is up to six months times his /her Basic Monthly Pension (BMP) but not more than P 500,000.00.

Can I borrow out of my pension?

Pension loans are legally allowed in many cases, but plan sponsors determine whether they're allowed. If your employer does allow loans, it will likely be limited to a percentage of the balance up to a fixed amount.

Which loan is best for pensioners?

Top Banks Offers for Personal Loan for Pensioners SBI Pension Loan. Central or State government pensioners, defence pensioners, and family pensioners upto the age of 76 years can avail of SBI personal loan to fulfil their financial needs. PNB Personal Loan Scheme for Pensioners. United Pension Loan Scheme for Pensioners.

Who does NYCERS cover?

NYCERS covers most civilian employees or employees who are not eligible to participate in retirement plans for specific uniformed agencies and educational institutions. Learn more at NYCERS.

What is the average New York City pension?

Among those “full-career” retirees: The average pension received was $57,516, compared to $53,539 for last year's retirees; Those who had been employed by the Department of Corrections (DOC) had the highest average pension (among the ten largest agencies), with 400 individuals being paid an average of $82,947.

How is NYC pension calculated?

Your pension is based on your years of credited service, your age at retirement and your final average salary (FAS). FAS is the average of the wages you earned during any 36 consecutive months of service when your earnings were highest.

What is NYC retirement plan?

The New York State Common Retirement Fund is one of the largest public pension plans in the United States, providing retirement security for over one million New York State and Local Retirement System (NYSLRS) members, retirees and beneficiaries.

How does NYCERS pension loan work?

This type of loan will not be issued until after your retirement date as NYCERS completes a review of your account. It may take up to one month to complete the review and issue your loan check. After you retire, any outstanding loan will reduce your pension unless you pay off the loan in a lump sum.

How long do you have to work for NYC to get a pension?

You will be eligible for a service retirement benefit when you reach age 55 and have five or more years of credited member service.

Can you cash out from NYCERS?

You may choose to: Terminate your membership and withdraw your accumulated contributions plus interest; or. Leave your contributions in your account and qualify for a retirement benefit when you are age 55.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the nycers f302 loan blank in Chrome?

As a PDF editor and form builder, pdfFiller has a lot of features. It also has a powerful e-signature tool that you can add to your Chrome browser. With our extension, you can type, draw, or take a picture of your signature with your webcam to make your legally-binding eSignature. Choose how you want to sign your nycers f302 loan blank and you'll be done in minutes.

Can I edit nycers f302 loan blank on an iOS device?

No, you can't. With the pdfFiller app for iOS, you can edit, share, and sign nycers f302 loan blank right away. At the Apple Store, you can buy and install it in a matter of seconds. The app is free, but you will need to set up an account if you want to buy a subscription or start a free trial.

Can I edit nycers f302 loan blank on an Android device?

You can make any changes to PDF files, such as nycers f302 loan blank, with the help of the pdfFiller mobile app for Android. Edit, sign, and send documents right from your mobile device. Install the app and streamline your document management wherever you are.

What is NY NYCERS F302?

NY NYCERS F302 is a form used by the New York City Employees' Retirement System (NYCERS) to report service credit and pension contributions for members of the system.

Who is required to file NY NYCERS F302?

Employers participating in NYCERS are required to file NY NYCERS F302 for their employees who are members of the retirement system to ensure accurate record-keeping and pension benefits.

How to fill out NY NYCERS F302?

To fill out NY NYCERS F302, employers must provide details such as employee information, contribution amounts, service dates, and any changes in employment status. It is essential to follow the guidelines provided by NYCERS for proper submission.

What is the purpose of NY NYCERS F302?

The purpose of NY NYCERS F302 is to collect and report information related to employee service credits and contributions, which are crucial for calculating retirement benefits.

What information must be reported on NY NYCERS F302?

NY NYCERS F302 must report employee name, Social Security number, job title, employment dates, contribution amounts, and any changes in service status or other relevant details.

Fill out your nycers f302 loan blank online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Nycers f302 Loan Blank is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.