NY DTF-716 2011 free printable template

Show details

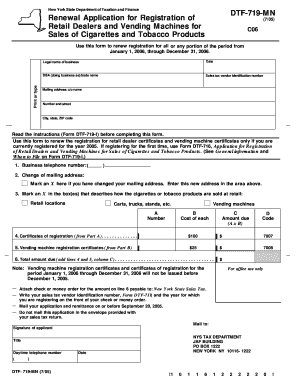

New York State Department of Taxation and Finance Application for Registration of Retail Dealers and Vending Machines for Sales of Cigarettes and Tobacco Products DTF-716 (4/11) C11 Note: To receive

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NY DTF-716

Edit your NY DTF-716 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NY DTF-716 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit NY DTF-716 online

To use the services of a skilled PDF editor, follow these steps below:

1

Log in to your account. Click on Start Free Trial and register a profile if you don't have one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit NY DTF-716. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NY DTF-716 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NY DTF-716

How to fill out NY DTF-716

01

Obtain a copy of the NY DTF-716 form from the New York State Department of Taxation and Finance website.

02

Read the instructions provided on the form carefully.

03

Fill in your personal information in the designated fields, including your name, address, and taxpayer identification number.

04

Complete the income section by reporting all relevant income sources as required.

05

Enter any deductions or credits you are eligible for according to the guidelines.

06

Double-check all entries for accuracy before submitting the form.

07

Sign and date the form in the appropriate section.

08

Submit the form either electronically or via mail to the address specified on the form.

Who needs NY DTF-716?

01

Any individual or business entity that has to report New York State withholding tax for the year.

02

Taxpayers who have had their income taxes withheld and need to claim a refund.

03

Employers who are required to report tax withheld from employee wages.

Fill

form

: Try Risk Free

People Also Ask about

What is the tobacco product tax in NY?

“We have a 75% tax from New York state that we have on our cigar tax. It affects, obviously, the buyer the most. Once again it's just a trickle-down effect where it just affects the customer,” she said. The New York Association of Convenience Stores is also opposed to the tax increase and proposed ban.

How much is tobacco products in New York?

Most Expensive Cigarettes by State The states that have the most expensive cigarette prices are New York, Connecticut, Rhode Island, Massachusetts, Alaska, Hawaii, Minnesota, Illinois, Vermont, and Washington. New York has the most expensive cigarettes in the country, at $10.53 per pack.

What state has the highest tax on cigarettes?

The highest combined state-local tax rate is $7.16 in Chicago, IL, with Evanston, IL second at $6.48 per pack. Other high state-local rates include New York City at $5.85 and Juneau, AK at $5.00 per pack.

Which state has the highest tobacco tax?

The highest combined state-local tax rate is $7.16 in Chicago, IL, with Evanston, IL second at $6.48 per pack. Other high state-local rates include New York City at $5.85 and Juneau, AK at $5.00 per pack.

What is the OTP tax rate in NY?

The New York State use tax rate on tobacco products (other than snuff and little cigars) is 75% (. 75) of the wholesale price. See Definitions for Wholesale price. The New York State excise tax rate on snuff is $2.00 per ounce, and a proportionate rate on any fractional parts of an ounce.

What state has lowest tobacco tax?

Through December 31, 2022, the state excise tax on cigarettes ranges from $0.170 per pack in Missouri, to $4.350 per pack in Connecticut and New York. The federal tax remains at $1.010 per pack.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete NY DTF-716 on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. If you have a subscription to the service, create an account or log in to an existing one. After completing the registration process, upload your NY DTF-716. You may now use pdfFiller's advanced features, such as adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

Can I edit NY DTF-716 on an Android device?

With the pdfFiller Android app, you can edit, sign, and share NY DTF-716 on your mobile device from any place. All you need is an internet connection to do this. Keep your documents in order from anywhere with the help of the app!

How do I fill out NY DTF-716 on an Android device?

Complete your NY DTF-716 and other papers on your Android device by using the pdfFiller mobile app. The program includes all of the necessary document management tools, such as editing content, eSigning, annotating, sharing files, and so on. You will be able to view your papers at any time as long as you have an internet connection.

What is NY DTF-716?

NY DTF-716 is a tax form used by individuals or entities in New York State to report and calculate certain types of income and taxes owed, typically related to New York State personal income tax.

Who is required to file NY DTF-716?

Individuals or entities who have received certain types of income, such as lottery winnings or gambling winnings, that require specific reporting to the New York State Department of Taxation and Finance are required to file NY DTF-716.

How to fill out NY DTF-716?

To fill out NY DTF-716, taxpayers need to provide their personal information, details about the income being reported, and any applicable exemptions or deductions. It is important to follow the instructions provided with the form for accurate completion.

What is the purpose of NY DTF-716?

The purpose of NY DTF-716 is to provide the New York State Department of Taxation and Finance with the necessary information to assess taxes on specific types of income that are subject to state tax obligations.

What information must be reported on NY DTF-716?

NY DTF-716 requires taxpayers to report their identification details, the type and amount of income received, the source of that income, and any other relevant information necessary for tax assessment.

Fill out your NY DTF-716 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NY DTF-716 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.