How do I correct a title mistake in Texas?

How do I correct a mistake on my title in Texas? Contact your DMV in writing and let them know there's an error on the title. Have the DMV issue you a duplicate title. If the previous owner is responsible for the title error, contact them and have them fill in the new vehicle title correctly.

How much does it cost to transfer a car title in Texas?

The title fee is $33, plus motor-vehicle sales tax (6.25 percent). There is also a $2.50 transfer of a current registration fee. If the license is not current, there may be a registration fee.

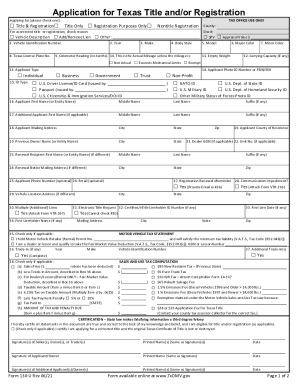

What is Form 130-U Texas?

Form 130-U The application is used by the County Tax Assessor-Collector (CTAC) and the Comptroller's office to calculate the amount of motor vehicle tax due. The application includes a motor vehicle tax statement section to document the following: the motor vehicle sales tax due on a Texas sale of a motor vehicle.

Do both parties have to be present to transfer a car title in Texas?

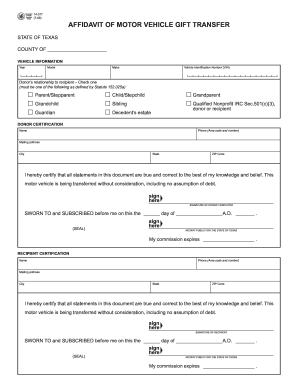

The Donor and Recipient must both sign the affidavit and title application. Either the donor or recipient must submit all forms and documents in person to the county tax office.

What is title jumping in Texas?

Title jumping is when someone purchases a car and then resells it without having titled it in their own name. Also known as floating a title, the practice is illegal. A title is a record of the vehicle's ownership history kept by the state.

How do I transfer a car title from two owners to one in Texas?

What Do I Need for a Texas Vehicle Title Transfer? A signed and completed Application for Texas Vehicle Title (Form 130-U) from the vehicle's seller. A release of lien and/or power of attorney (if applicable) Payment for the required TX fees and taxes.

Do both parties have to be present to transfer a title in Texas?

The Donor and Recipient must both sign the affidavit and title application. Either the donor or recipient must submit all forms and documents in person to the county tax office.

What forms are needed to transfer car title in Texas?

Form 130-U (Application for Texas Title and/or Registration), signed and dated by the seller(s) and buyer(s). If seller is unable to sign the Form 130-U, a Bill of Sale from the out of state seller can be provided instead. The Form 130-U can be found under the Forms tab on the TxDMV website.

What do I need to transfer a title in Texas?

What Do I Need for a Texas Vehicle Title Transfer? A signed and completed Application for Texas Vehicle Title (Form 130-U) from the vehicle's seller. A release of lien and/or power of attorney (if applicable) Payment for the required TX fees and taxes.

What forms do I need to register my car in Texas?

Visit your local county tax office. You are not required to title your vehicle in Texas, but first-time registrants must fill out and complete Application for Texas Title and/or Registration (Form 130-U).

Can I transfer title online in Texas?

1. TO COMPLETE THE TX MOTOR VEHICLE TRANSFER NOTIFICATION ONLINE: *PREFERRED METHOD* If possible, we highly recommend completing forms online instead of by mail, so you may easily save and print out a copy for your records that includes a date/timestamp.

What all do you need to transfer a title in Texas?

Original signatures from buyer or authorized agent. A completed and signed application for Texas title, 130-U. This form can be faxed on demand from 1-888-232-7033 or downloaded through the Texas Department of Motor Vehicles website. Other supporting evidence may be required on an individual basis.

How to fill out a Texas title transfer form?

1:20 4:13 Then you'll print the buyers name and complete address then fill in the odometer reading in theMoreThen you'll print the buyers name and complete address then fill in the odometer reading in the space provided enter your mileage exactly as it appears on your odometer.

Can you do a Texas title transfer online?

1. TO COMPLETE THE TX MOTOR VEHICLE TRANSFER NOTIFICATION ONLINE: *PREFERRED METHOD* If possible, we highly recommend completing forms online instead of by mail, so you may easily save and print out a copy for your records that includes a date/timestamp.

What happens if a buyer does not transfer a vehicle on its name in Texas?

Texas Sellers liability for the vehicle in the event the buyer does not transfer the title. You only have 30 days to file the Vehicle Transfer Notification to receive this state- guaranteed removal of liability.

What is a corrected title in Texas?

In some states, a corrected title will be issued for removing or adding an owner's name due to divorce, death or marriage. In other states, details about the vehicle, such as incorrect odometer readings, can result in a corrected title being issued.

What forms do I need to transfer a title in Texas?

Form 130-U (Application for Texas Title and/or Registration), signed and dated by the seller(s) and buyer(s). If seller is unable to sign the Form 130-U, a Bill of Sale from the out of state seller can be provided instead. The Form 130-U can be found under the Forms tab on the TxDMV website.

Can you use white out on a title in Texas?

VTR-42 - Error Made on the Assignment of Title When Selling Vehicle. If you made a mistake on the assignment of title when selling your vehicle, please note that using white out or making an erasure on a certificate of title when transferring ownership automatically voids the certificate.

What is the penalty for not transferring title within 30 days in Texas?

To avoid penalties, transfer title within 30 Calendar days from date of sale or entry into Texas. Sales tax penalties: After 30 Calendar days, an additional 5% of the sales tax is assessed, and increases to 10% if not transferred after an additional 30 calendar days.

How do you change a car title in Texas?

If you have bought a vehicle from a Texas dealer and you are a Texas resident, the dealership will transfer the title at the tax office on your behalf. However, if you have purchased a vehicle from an individual, the documents must be submitted to the tax office in person or by mail.