Alpha Omega Consulting Group Payday Loan Agreement 2005-2026 free printable template

Show details

This document serves as a payday loan agreement between the lender and the borrower, outlining the terms of the loan including personal information, loan details, payment schedule, and privacy notice

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign cash advance agreement template form

Edit your payday loan agreement form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your payday loan application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit payday agreement form sample online

Use the instructions below to start using our professional PDF editor:

1

Check your account. In case you're new, it's time to start your free trial.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit payday loan application form. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out payday loan website template form

How to fill out Alpha Omega Consulting Group Payday Loan Agreement

01

Begin by reading through the entire Payday Loan Agreement to understand its terms and conditions.

02

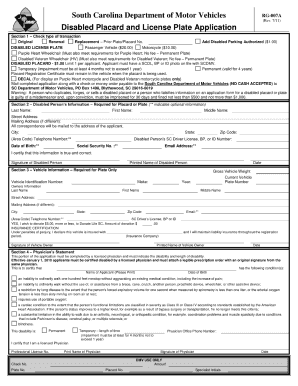

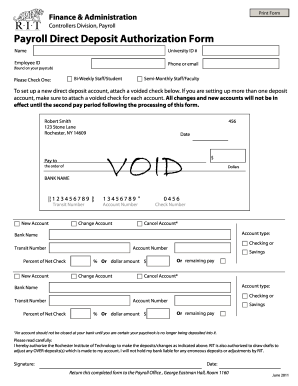

Fill in your personal information in the designated areas, including your name, address, and contact details.

03

Provide your employment information, including the name of your employer and your monthly income.

04

Specify the loan amount you wish to borrow, ensuring it falls within the allowable limits.

05

Indicate your repayment terms, including the duration of the loan and the proposed payment dates.

06

Review the fees and interest rates associated with the loan, ensuring you are clear on the total repayment amount.

07

Sign and date the agreement at the bottom to confirm your acceptance of the terms.

Who needs Alpha Omega Consulting Group Payday Loan Agreement?

01

Individuals facing unexpected expenses who need quick access to cash.

02

People with short-term financial emergencies requiring immediate funding.

03

Borrowers who may not have access to traditional loans due to credit history issues.

Fill

payday loan example

: Try Risk Free

People Also Ask about example of payday loan

How do I write a loan payment agreement?

The name, address, and contact information of the borrower. The name, address, and contact information of the lender. A plan for loan payment, such as a monthly payment plan with start dates and due dates. The maturity date or the date that the final payment is due on the loan.

Can I write my own loan agreement?

However, the do-it-yourself approach is perfectly acceptable and just as legally enforceable. Once you have both agreed on the terms, you may want to have the personal loan contract notarized or ask a third party to act as a witness during the signing.

How do I write a personal loan agreement between friends?

Get It in Writing Your name and the borrower's name. The date the loan was granted. The amount of money being lent. Minimum monthly payment. Payment due date. Interest rate, if you're charging interest. Consequences for defaulting on the loan.

How do I write a loan agreement between friends?

To draft a Loan Agreement, you should include the following: The addresses and contact information of all parties involved. The conditions of use of the loan (what the money can be used for) Any repayment options. The payment schedule. The interest rates. The length of the term. Any collateral. The cancellation policy.

How do you write a simple loan agreement?

Common items in personal loan agreements. The name, address, and contact information of the borrower. The name, address, and contact information of the lender. A plan for loan payment, such as a monthly payment plan with start dates and due dates. The maturity date or the date that the final payment is due on the loan.

How do I write a basic loan agreement?

What a personal loan agreement should include Legal names and address of both parties. Names and address of the loan cosigner (if applicable). Amount to be borrowed. Date the loan is to be provided. Repayment date. Interest rate to be charged (if applicable). Annual percentage rate (if applicable).

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find payday loans examples?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific payday loan examples and other forms. Find the template you want and tweak it with powerful editing tools.

Can I sign the payday loan terms electronically in Chrome?

You can. With pdfFiller, you get a strong e-signature solution built right into your Chrome browser. Using our addon, you may produce a legally enforceable eSignature by typing, sketching, or photographing it. Choose your preferred method and eSign in minutes.

Can I create an electronic signature for signing my payday loan contract in Gmail?

Create your eSignature using pdfFiller and then eSign your payday template immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

What is Alpha Omega Consulting Group Payday Loan Agreement?

The Alpha Omega Consulting Group Payday Loan Agreement is a legal document that outlines the terms and conditions of a payday loan provided by the Alpha Omega Consulting Group. It specifies the amount borrowed, interest rates, repayment schedule, and any associated fees.

Who is required to file Alpha Omega Consulting Group Payday Loan Agreement?

Individuals who seek to obtain a payday loan from Alpha Omega Consulting Group are required to file the Payday Loan Agreement as part of the loan application process.

How to fill out Alpha Omega Consulting Group Payday Loan Agreement?

To fill out the Alpha Omega Consulting Group Payday Loan Agreement, borrowers must provide their personal information, including name, address, social security number, employment details, the loan amount requested, and consent to the terms and conditions set forth in the agreement.

What is the purpose of Alpha Omega Consulting Group Payday Loan Agreement?

The purpose of the Alpha Omega Consulting Group Payday Loan Agreement is to formalize the loan transaction between the lender and the borrower, ensuring that both parties understand their rights, responsibilities, and the terms under which the loan is provided.

What information must be reported on Alpha Omega Consulting Group Payday Loan Agreement?

The information that must be reported on the Alpha Omega Consulting Group Payday Loan Agreement includes the borrower's personal details, loan amount, interest rate, repayment terms, fees, and any other conditions related to the loan.

Fill out your Alpha Omega Consulting Group Payday Loan online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Spotloan Loan Agreement is not the form you're looking for?Search for another form here.

Keywords relevant to printable loan agreement form

Related to printable loan agreement

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.