Get the free Mortgage Guaranty Insurance Corporation MGIC Indemnity Corporation P

Show details

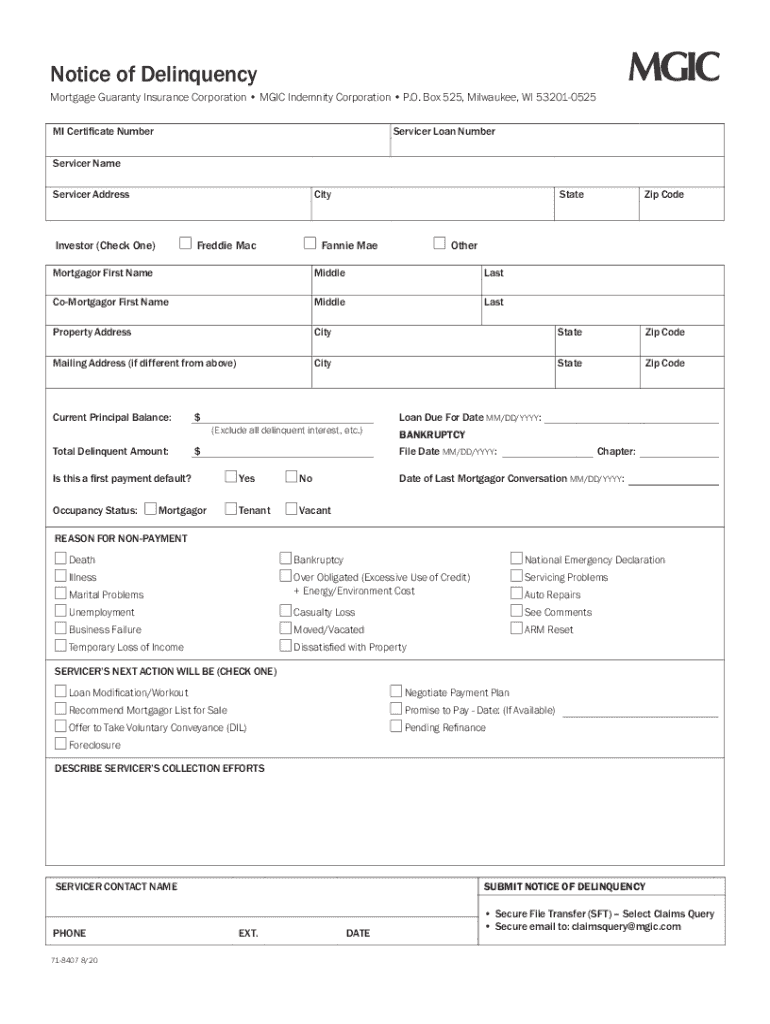

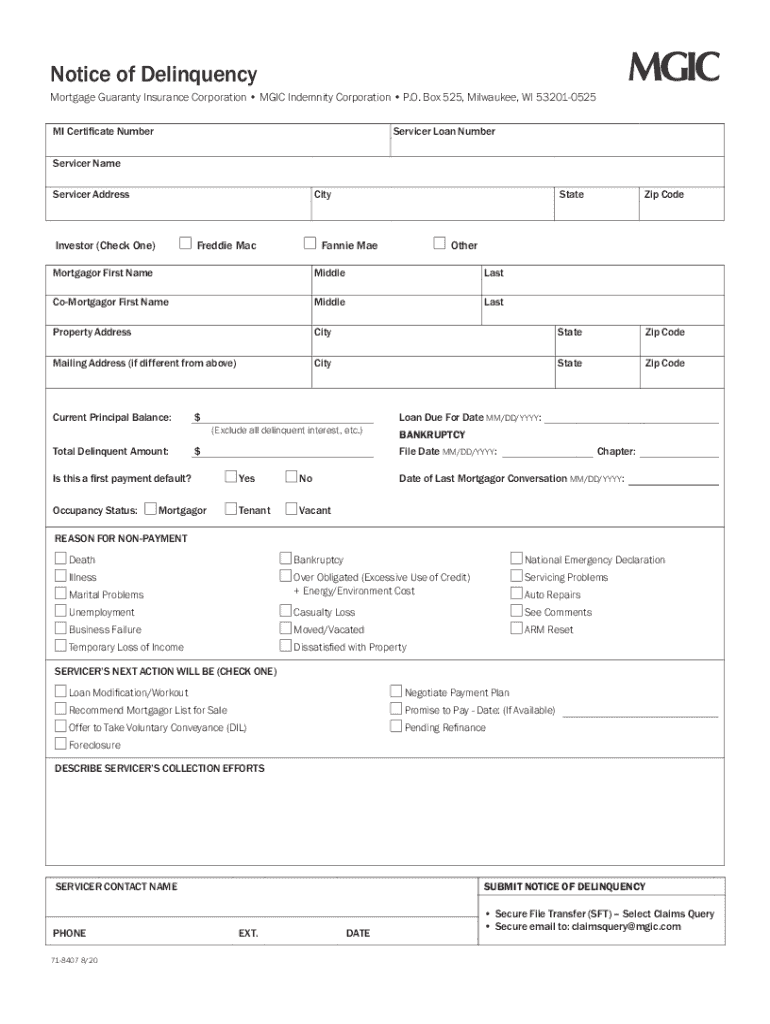

Notice of Delinquency Mortgage Guaranty Insurance Corporation MAGIC Indemnity Corporation P.O. Box 525, Milwaukee, WI 532010525 MI Certificate NumberServicer Loan NumberServicer Name Service AddressCityInvestor

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign mortgage guaranty insurance corporation

Edit your mortgage guaranty insurance corporation form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your mortgage guaranty insurance corporation form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit mortgage guaranty insurance corporation online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit mortgage guaranty insurance corporation. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out mortgage guaranty insurance corporation

How to fill out mortgage guaranty insurance corporation

01

To fill out mortgage guaranty insurance corporation, follow these steps:

02

Collect all necessary documents such as your mortgage contract, proof of income, and personal identification.

03

Complete the application form provided by the mortgage guaranty insurance corporation.

04

Provide accurate information about your mortgage, including the loan amount, interest rate, and repayment terms.

05

Submit the completed application along with the required documents to the mortgage guaranty insurance corporation.

06

Pay any applicable fees or premiums as specified by the corporation.

07

Wait for the corporation to review your application and determine if you are eligible for mortgage guaranty insurance.

08

If approved, carefully review the terms and conditions of the insurance policy provided by the corporation.

09

Sign the insurance policy agreement if you agree to the terms and conditions.

10

Keep a copy of the insurance policy for your records.

11

Make regular payments as required by the insurance policy to maintain coverage.

Who needs mortgage guaranty insurance corporation?

01

Mortgage guaranty insurance corporation is typically needed by individuals or borrowers who do not have a sufficient down payment or have a high-risk mortgage.

02

These individuals may include first-time homebuyers, individuals with low credit scores, or those with a higher debt-to-income ratio.

03

By obtaining mortgage guaranty insurance, these borrowers can reduce the risk for lenders and increase their chances of getting approved for a mortgage loan.

04

It provides an added layer of protection for the lender in case the borrower defaults on the mortgage payments.

05

Additionally, mortgage guaranty insurance may be required by lending institutions, such as banks or mortgage companies, as a condition for approving a loan.

06

Therefore, borrowers who fall into these categories or lenders who require it may need mortgage guaranty insurance corporation.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get mortgage guaranty insurance corporation?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific mortgage guaranty insurance corporation and other forms. Find the template you want and tweak it with powerful editing tools.

How can I edit mortgage guaranty insurance corporation on a smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing mortgage guaranty insurance corporation right away.

How do I fill out the mortgage guaranty insurance corporation form on my smartphone?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign mortgage guaranty insurance corporation and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

What is mortgage guaranty insurance corporation?

The Mortgage Guaranty Insurance Corporation (MGIC) is a private mortgage insurance company that provides insurance to lenders against the risk of borrower default on mortgage loans.

Who is required to file mortgage guaranty insurance corporation?

Lenders or mortgage servicers who have loans that are insured by MGIC are typically required to file information with the corporation.

How to fill out mortgage guaranty insurance corporation?

To fill out the forms required by MGIC, lenders should provide detailed information regarding the loan, borrower, and property, following the guidelines provided by the corporation.

What is the purpose of mortgage guaranty insurance corporation?

The primary purpose of MGIC is to protect lenders from financial loss due to borrower default, thereby facilitating access to mortgage financing for homebuyers.

What information must be reported on mortgage guaranty insurance corporation?

Lenders must report details including loan amount, borrower information, payment history, property details, and the reason for any default.

Fill out your mortgage guaranty insurance corporation online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Mortgage Guaranty Insurance Corporation is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.