Get the free EQUIPMENT INSURANCE APPLICATION

Show details

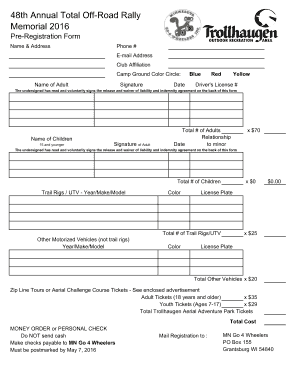

EQUIPMENT INSURANCE APPLICATION FOR NONPROFIT SPORT ORGANIZATIONS Carrier: A+ rated by AM Best Company IMPORTANT: All questions MUST BE ANSWERED / FILL IN BOXES BELOW Please Print or Type Use Black

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign equipment insurance application

Edit your equipment insurance application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your equipment insurance application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing equipment insurance application online

To use the services of a skilled PDF editor, follow these steps below:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit equipment insurance application. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out equipment insurance application

How to fill out equipment insurance application

01

Step 1: Start by gathering all the necessary information about the equipment you need to insure. This may include the make, model, serial number, and value of each item.

02

Step 2: Contact an insurance provider that offers equipment insurance. You can do this by searching online or asking for recommendations.

03

Step 3: Request an equipment insurance application form from the insurance provider. They may provide it in physical or digital format.

04

Step 4: Carefully read the instructions and requirements mentioned in the application form. Ensure that you understand all the terms and conditions.

05

Step 5: Fill in your personal details such as name, address, contact information, and any other information requested in the application form.

06

Step 6: Provide accurate and detailed information about the equipment you want to insure. This may include the type of equipment, its usage, value, and any additional coverage required.

07

Step 7: Attach any supporting documents that may be required, such as invoices, receipts, or proof of ownership.

08

Step 8: Double-check all the information you have entered for accuracy and completeness.

09

Step 9: Review the insurance application form and make sure you have answered all the necessary questions.

10

Step 10: Sign and date the application form where indicated.

11

Step 11: Submit the completed application form along with any requested documents to the insurance provider. You can do this by mail, email, or through their online portal.

12

Step 12: Wait for a response from the insurance provider. They may contact you for further information or clarification if needed.

13

Step 13: Once approved, review the insurance policy and understand the coverage and any associated costs.

14

Step 14: Pay the insurance premium as instructed by the insurance provider to activate the coverage for your equipment.

15

Step 15: Keep a copy of the filled-out application form and the insurance policy for your records.

Who needs equipment insurance application?

01

Anyone who owns valuable equipment that they want to protect from potential risks or damages.

02

Small business owners who rely on equipment for their daily operations.

03

Freelancers or contractors who use specialized equipment for their work.

04

Individuals who rent or lease equipment and need to fulfill insurance requirements.

05

Companies or organizations involved in industries such as construction, manufacturing, technology, or healthcare.

06

Entrepreneurs or startups who have invested in equipment for their business.

07

Photographers, videographers, musicians, or artists who own expensive equipment.

08

Event planners or organizers who need coverage for equipment used during events.

09

Professionals in the medical field who own medical equipment.

10

Homeowners who want to insure valuable home appliances.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit equipment insurance application from Google Drive?

By integrating pdfFiller with Google Docs, you can streamline your document workflows and produce fillable forms that can be stored directly in Google Drive. Using the connection, you will be able to create, change, and eSign documents, including equipment insurance application, all without having to leave Google Drive. Add pdfFiller's features to Google Drive and you'll be able to handle your documents more effectively from any device with an internet connection.

How do I make changes in equipment insurance application?

With pdfFiller, the editing process is straightforward. Open your equipment insurance application in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

Can I sign the equipment insurance application electronically in Chrome?

You can. With pdfFiller, you get a strong e-signature solution built right into your Chrome browser. Using our addon, you may produce a legally enforceable eSignature by typing, sketching, or photographing it. Choose your preferred method and eSign in minutes.

What is equipment insurance application?

An equipment insurance application is a formal request submitted by a business or individual to obtain insurance coverage for various types of equipment, protecting against losses due to damage, theft, or other risks.

Who is required to file equipment insurance application?

Individuals or businesses that own valuable equipment and wish to protect it through insurance coverage are generally required to file an equipment insurance application.

How to fill out equipment insurance application?

To fill out an equipment insurance application, one needs to provide personal or business information, details about the equipment being insured, its value, location, and any previous claims history, along with signing the application.

What is the purpose of equipment insurance application?

The purpose of the equipment insurance application is to assess the risk associated with insuring the equipment and to provide coverage options to protect against potential losses.

What information must be reported on equipment insurance application?

Information that must be reported includes the type of equipment, its value, location, use, ownership details, and any relevant safety measures or previous claims.

Fill out your equipment insurance application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Equipment Insurance Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.