Get the free SYSTEMATIC TRANSFER PLAN STP - GR Portfolio Services

Show details

Systematic transfer plan (STP)/ Systematic withdrawal Plan (SVP) form Please read instructions overleaf before filling the Form I/We hereby apply to the Trustees of Relegate UNESCO Mutual Fund for

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign systematic transfer plan stp

Edit your systematic transfer plan stp form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your systematic transfer plan stp form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing systematic transfer plan stp online

To use the services of a skilled PDF editor, follow these steps:

1

Check your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit systematic transfer plan stp. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out systematic transfer plan stp

How to fill out a systematic transfer plan (STP):

01

Understand the concept: Firstly, familiarize yourself with what a systematic transfer plan (STP) is. It is an investment strategy where an investor transfers a fixed amount of money from one fund to another fund at regular intervals. This allows for gradual and systematic movement of funds between different investment options.

02

Select the funds: Decide on the mutual funds you want to use for the STP. Typically, you will have a source fund (the one from which you transfer money) and a target fund (the one receiving the money). Consider your investment goals, risk tolerance, and time horizon when selecting these funds.

03

Determine the transfer amount and frequency: Calculate the amount of money you want to transfer at each interval. This can be a fixed amount or a percentage of the source fund's value. Also, determine the frequency of transfers, such as monthly, quarterly, or annually, based on your financial planning needs.

04

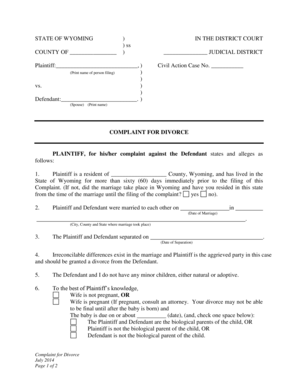

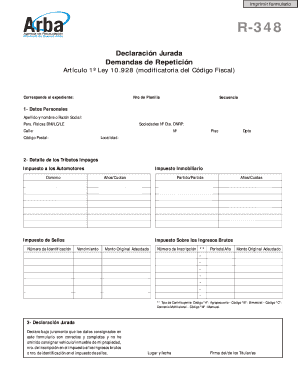

Complete the STP form: Contact the mutual fund company or fund house where you hold your investments to request an STP form. Fill out the form with accurate and up-to-date information, including your personal details, folio number, source fund details, target fund details, transfer amount, and frequency.

05

Attach supporting documents: Check if any supporting documents are required, such as a canceled cheque or bank mandate, and ensure that you have all the necessary paperwork ready. These documents may vary depending on the mutual fund company's requirements.

06

Submit the form: Once you have filled out the STP form and gathered the supporting documents, submit them to the respective mutual fund company either physically or electronically, as per their instructions. Ensure that you retain a copy of the form for your records.

07

Monitor and review: After initiating the STP, monitor the progress of your transfers and review the performance of the funds involved. Stay updated with any changes in the market conditions, fund performance, or your financial goals, and make adjustments to your STP if necessary.

Who needs a systematic transfer plan (STP):

01

Investors with lump sum amounts: If you have a significant amount of money available for investment and want to prevent investing it all at once, STP allows for a gradual transfer from a source fund to a target fund, reducing the risk associated with timing the market.

02

Risk-averse investors: STP can be beneficial for those who prefer smooth and controlled investment entry. It helps mitigate the impact of market volatility by systematically shifting funds, potentially leading to better averaging of investment costs.

03

Long-term investors: Investors with long investment horizons can utilize STP to diversify their portfolio and explore different investment options. By regularly moving funds between funds with varying risk levels or objectives, investors can adapt their investment strategy to changing market conditions.

04

Individuals seeking regular income: STP can also be used to generate a regular income stream. By transferring a fixed amount from an equity fund to a debt fund, investors can potentially benefit from higher returns in equities while securing a stable income from debt instruments.

Remember to consult a financial advisor or seek professional guidance to understand your specific investment needs and whether STP aligns with your financial goals.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is systematic transfer plan stp?

A systematic transfer plan (STP) is an investment strategy that allows an investor to systematically transfer a fixed amount from one investment to another.

Who is required to file systematic transfer plan stp?

Individuals or entities who want to implement a systematic transfer plan for their investments are required to file STP.

How to fill out systematic transfer plan stp?

To fill out a systematic transfer plan, the investor needs to specify the amount to be transferred, the frequency of transfers, and the investments involved.

What is the purpose of systematic transfer plan stp?

The purpose of a systematic transfer plan is to automate the process of moving funds between investments, thereby reducing the impact of market fluctuations.

What information must be reported on systematic transfer plan stp?

The systematic transfer plan must include details such as the source and destination investments, the transfer amount, and the transfer frequency.

How can I manage my systematic transfer plan stp directly from Gmail?

In your inbox, you may use pdfFiller's add-on for Gmail to generate, modify, fill out, and eSign your systematic transfer plan stp and any other papers you receive, all without leaving the program. Install pdfFiller for Gmail from the Google Workspace Marketplace by visiting this link. Take away the need for time-consuming procedures and handle your papers and eSignatures with ease.

How can I send systematic transfer plan stp to be eSigned by others?

When your systematic transfer plan stp is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

Where do I find systematic transfer plan stp?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific systematic transfer plan stp and other forms. Find the template you need and change it using powerful tools.

Fill out your systematic transfer plan stp online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Systematic Transfer Plan Stp is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.