Get the free Ethanol Infrastructure Incentive Program Reimbursement Request – FY 2012

Show details

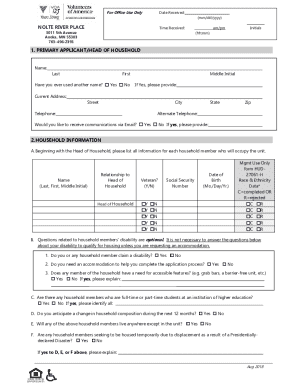

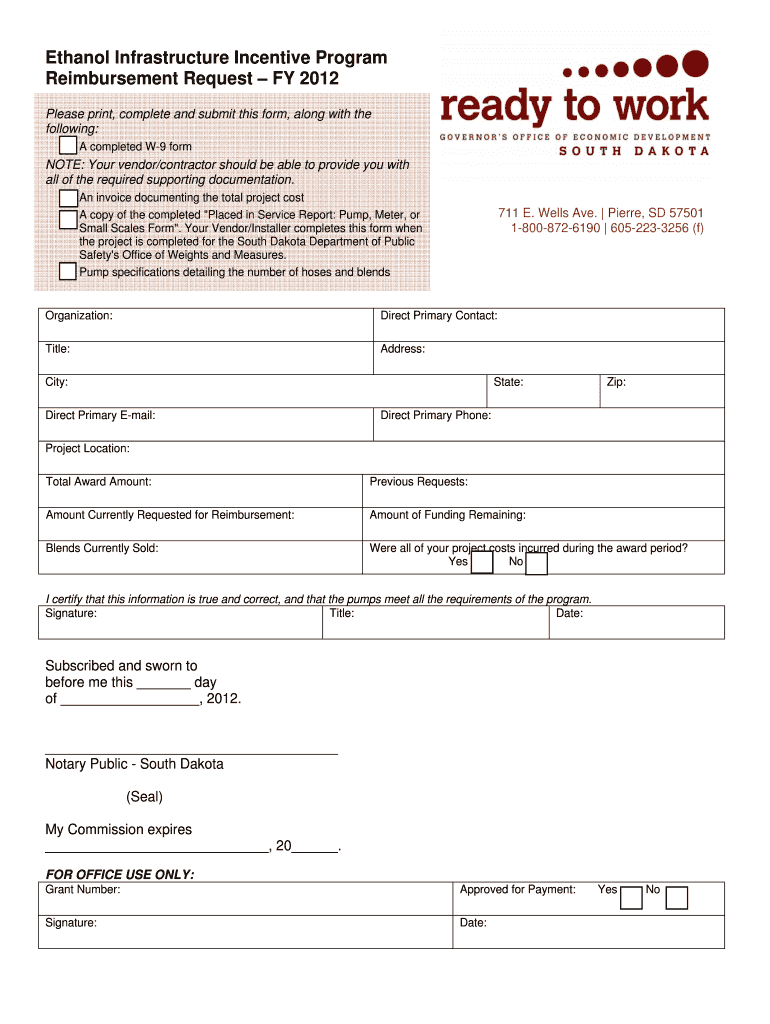

This form is used to request reimbursement for costs associated with the Ethanol Infrastructure Incentive Program. Applicants must submit a completed W-9 form, an invoice, a Placed in Service Report,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign ethanol infrastructure incentive program

Edit your ethanol infrastructure incentive program form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ethanol infrastructure incentive program form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing ethanol infrastructure incentive program online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit ethanol infrastructure incentive program. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out ethanol infrastructure incentive program

How to fill out Ethanol Infrastructure Incentive Program Reimbursement Request – FY 2012

01

Gather all necessary documentation, including invoices and proof of payment for eligible expenses related to ethanol infrastructure.

02

Download the Ethanol Infrastructure Incentive Program Reimbursement Request form from the official website.

03

Fill out the form with accurate information, including your contact details, project information, and total eligible expenses.

04

Attach all required documentation to support your reimbursement request.

05

Review the completed request for accuracy and completeness.

06

Submit the request form and attached documents by the specified deadline to the designated agency or department.

Who needs Ethanol Infrastructure Incentive Program Reimbursement Request – FY 2012?

01

This reimbursement request is intended for individuals and businesses that have invested in eligible ethanol infrastructure projects in FY 2012.

Fill

form

: Try Risk Free

People Also Ask about

What is the biofuel incentive program?

Advanced Biofuel Feedstock Incentives The matching payments are $1 for each $1 per dry ton paid by a qualified advanced biofuel production facility, up to $20 per dry ton. This program's funding is subject to congressional appropriations. For more information, see the USDA Biomass Crop Assistance Program website.

How much does the US government subsidize ethanol?

The subsidy provided in the Energy Policy Act of 1978 (10.6 cents per liter, or 40 cents per gallon) launched the industry. Between 1978 and today, the ethanol subsidy has ranged between 10.6 and 15.9 cents per liter (40 and 60 cents per gallon).

What is the tax on ethanol?

Pure ethyl alcohol for industrial use, may be purchased as tax-paid alcohol. Tax paid industrial alcohol may be purchased for non-beverage use without a federal permit or bond, by payment of the federal tax of $13.34 per proof gallon (PG).

What is the tax credit for ethanol?

Credit amounts vary by year and blend level and apply to gallons sold in the previous calendar year. Beginning 2024, blends of 15% ethanol (E15) are eligible for $0.08 per gallon and blends of 25% ethanol (E25) and higher are eligible for $0.08 per gallon. Additional conditions apply.

What is the tax incentive for ethanol?

Qualified ethanol producers are eligible for an income tax credit of $1.00 per gallon of corn- or cellulosic-based ethanol that meets ASTM Standard D4806. The total credit amount available for producers is $5 million for each fuel type in each taxable year.

What is the 30% federal tax incentive?

The Residential Clean Energy Credit equals 30% of the costs of new, qualified clean energy property for your home installed anytime from 2022 through 2032.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Ethanol Infrastructure Incentive Program Reimbursement Request – FY 2012?

The Ethanol Infrastructure Incentive Program Reimbursement Request – FY 2012 is a program designed to provide financial assistance to businesses that invest in infrastructure to support the distribution and sale of ethanol fuels in the United States.

Who is required to file Ethanol Infrastructure Incentive Program Reimbursement Request – FY 2012?

Businesses that have made qualifying investments in ethanol infrastructure and wish to receive reimbursement for those expenses are required to file the Ethanol Infrastructure Incentive Program Reimbursement Request – FY 2012.

How to fill out Ethanol Infrastructure Incentive Program Reimbursement Request – FY 2012?

To fill out the Ethanol Infrastructure Incentive Program Reimbursement Request – FY 2012, applicants should complete the provided form by accurately entering details about their qualifying expenses, along with required documentation such as receipts and proof of installation.

What is the purpose of Ethanol Infrastructure Incentive Program Reimbursement Request – FY 2012?

The purpose of the Ethanol Infrastructure Incentive Program Reimbursement Request – FY 2012 is to promote the use of renewable fuels by providing financial support to businesses that develop the necessary infrastructure for distributing and selling ethanol.

What information must be reported on Ethanol Infrastructure Incentive Program Reimbursement Request – FY 2012?

Applicants must report specific information such as the total amount of qualifying expenses, the type of infrastructure installed, the location of the investment, and any applicable receipts or invoices that verify the expenses incurred.

Fill out your ethanol infrastructure incentive program online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Ethanol Infrastructure Incentive Program is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.