Get the free SECTION D FISCAL MANAGEMENT - Todd County School District - tcsdk12

Show details

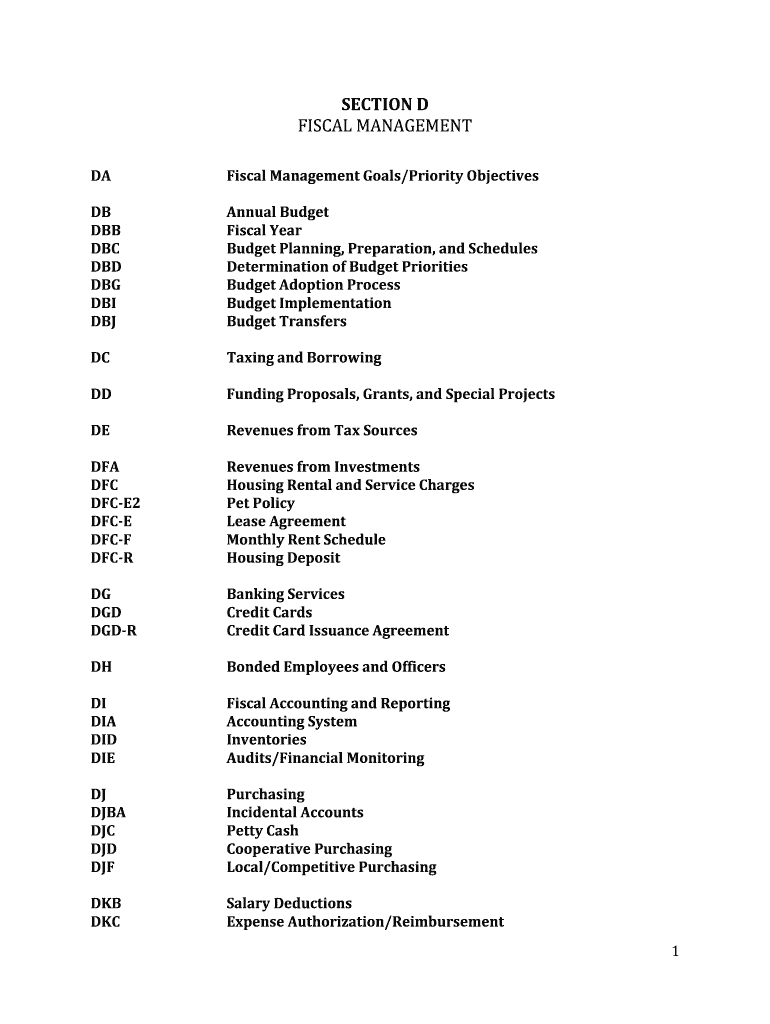

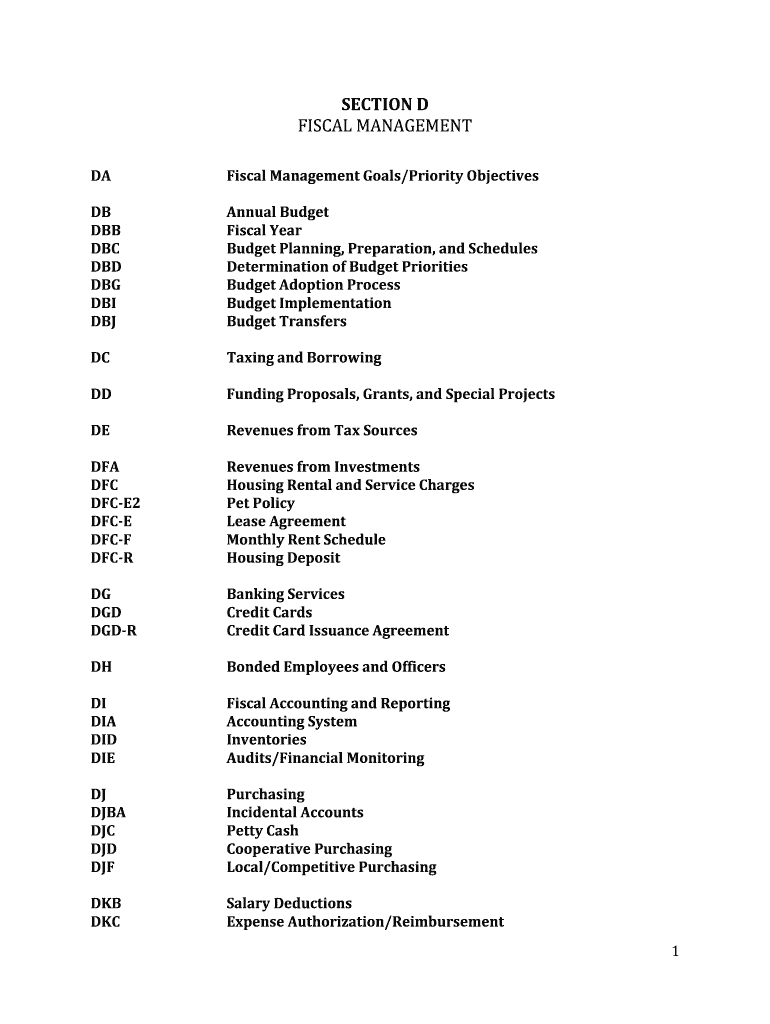

SECTION D FISCAL MANAGEMENT DA Fiscal Management Goals/Priority Objectives DB DBB DBC DBD DOG FBI dB Annual Budget Fiscal Year Budget Planning, Preparation, and Schedules Determination of Budget Priorities

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign section d fiscal management

Edit your section d fiscal management form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your section d fiscal management form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit section d fiscal management online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit section d fiscal management. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out section d fiscal management

How to fill out section d fiscal management:

01

Start by gathering all relevant financial information, such as income, expenses, and assets. This will help provide a comprehensive overview of your fiscal management.

02

Clearly identify and describe your financial goals and objectives. This could include long-term financial planning, budgeting, or investment strategies.

03

Explain how you will manage and allocate resources effectively to achieve your financial goals. This may involve detailing your budgeting process, financial controls, and monitoring mechanisms.

04

Provide a breakdown of your income sources, such as salaries, grants, or investments. Include any additional information on projected income or funding sources.

05

Discuss your strategies for managing expenses, including cost-cutting measures or efficiency improvements. This could involve outlining your approach to procurement, vendor management, or optimizing resources.

06

Outline any financial risks or challenges that may impact your fiscal management. This could include potential cash flow issues, debt management concerns, or economic uncertainties.

07

Mention any financial safeguards or controls you have in place to ensure transparency and accountability. This could involve describing internal audit procedures, financial reporting mechanisms, or compliance measures.

08

Consider including any additional financial information that may be necessary for a thorough understanding of your fiscal management. This could include financial statements, balance sheets, or cash flow projections.

Who needs section d fiscal management:

01

Organizations or businesses: Section D fiscal management is crucial for organizations or businesses of any size to maintain financial health. It helps ensure proper allocation of resources, effective budgeting, and risk management.

02

Non-profit organizations: Non-profit organizations rely on fiscal management to demonstrate responsible stewardship of resources and financial sustainability. It also helps to maintain transparency and accountability to donors and stakeholders.

03

Government agencies: Government agencies utilize section D fiscal management to uphold financial integrity and public trust. It helps them effectively manage public funds, budgeting processes, and compliance with financial regulations.

04

Individuals or households: Section D fiscal management can apply to individuals or households as well. It involves budgeting, managing expenses, saving for the future, and making sound financial decisions.

In conclusion, section D fiscal management is essential for various entities, including organizations, non-profits, government agencies, and individuals, to effectively manage finances, achieve financial goals, and ensure transparency and accountability.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete section d fiscal management online?

Easy online section d fiscal management completion using pdfFiller. Also, it allows you to legally eSign your form and change original PDF material. Create a free account and manage documents online.

How do I edit section d fiscal management straight from my smartphone?

The pdfFiller mobile applications for iOS and Android are the easiest way to edit documents on the go. You may get them from the Apple Store and Google Play. More info about the applications here. Install and log in to edit section d fiscal management.

How do I fill out the section d fiscal management form on my smartphone?

Use the pdfFiller mobile app to complete and sign section d fiscal management on your mobile device. Visit our web page (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, the capabilities you’ll have access to, and the steps to take to get up and running.

What is section d fiscal management?

Section D fiscal management refers to the portion of a financial document or report that outlines the budgeting and spending practices of an organization.

Who is required to file section d fiscal management?

Non-profit organizations and government agencies are typically required to file section D fiscal management as part of their financial reporting requirements.

How to fill out section d fiscal management?

Section D fiscal management should be filled out by providing detailed information on the organization's income, expenses, and budgeting practices.

What is the purpose of section d fiscal management?

The purpose of section D fiscal management is to provide transparency and accountability regarding an organization's financial practices.

What information must be reported on section d fiscal management?

Information that must be reported on section D fiscal management includes income sources, expenses, budget allocations, and financial goals.

Fill out your section d fiscal management online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Section D Fiscal Management is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.